#1 Rule of Markets: Know Thyself 🧘

Are you a speculator, trader, or investor? 🧭

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company’s Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,358

Get First Dibs on Paul’s Boldest Takes 💥

One of the amazing perks of being a member of our YouTube channel?

Unlocking bonus surprise videos from Paul each month you won’t find anywhere else!

Channel members are already enjoying this one. 👇

For just $9.99/month, you can also grab first dibs on Paul’s boldest insights and weekly unfiltered takes — with new releases from the ATG Digital team — before the crowd.

Not ready to become a member?

No worries — Paul’s weekly video will be live for the public tomorrow afternoon. 🚀

But if you love being first in line for the good stuff, this is your moment.

Paul: Own the Lane You’re Built For 🚦

Before you rush into the stock market and click “buy,” pause to ask the real question: Are you here to own a piece of a company, bet on price swings, or chase quick gains?

Your answer shapes everything — from how you navigate volatility to how you handle wins and losses.

The answer to this simple question is the key to growing wealth over time.

Think about it, without these parameters, what chance do you have of hitting your target?

Today, I challenge you to spend five minutes getting real about what type of market player you are.

Business Empire or Stock Ticker? 🧭

Are you drawn to a stock’s potential to change the world, or just its green chart?

If you’re all about the business — like Warren Buffett hunting for undervalued gems — you’re investing in value.

As a value investor, you’re studying its moat, leadership, customers, and long-term vision.

You’re likely thinking in decades, not days — buying great businesses at fair prices instead of chasing quarterly earnings beats.

But if price action is your North Star, you’re either speculating or trading.

No judgment; just own it.

Price-driven traders ride momentum and hype, often entering and exiting based on headlines, estimates, or social buzz.

Many investors have made huge gains this way . . .

But let’s be honest.

That’s not value investing — it’s fast-paced risk for potentially fast reward.

What happens when the stock drops should tell you everything you need to know . . .

When Prices Plunge, What’s Your Move? 💣

Let’s say your pick drops 20% or more — What do you do?

If you’re a long-term investor, that’s a deal!

You focus on the business, turning discounts into compounding returns over time.

If you’re a trader, you likely sell fast and shift to stronger momentum.

And that’s valid too, provided you know your approach and manage risk accordingly.

That said, quick trades come with fees, taxes, and emotional whiplash.

So, if you’re wired for speed, play to that edge — just do it mindfully.

At ATG Digital, we follow a hybrid approach.

We use 52-week highs and lows as signals but override them with our judgment based on experience when needed.

Sometimes this helps us ride big winners longer — other times, it leads to losses.

Either way, it’s a process shaped by my three decades in the markets.

Here’s another element to consider. 👇

What Is Management Prioritizing? 🧠

Is the CEO running a business or chasing a stock pop?

If a company’s executives are focused on pumping share price with buybacks, hype, or midnight tweetstorms, you might be looking at a short-term sugar high.

These tactics can spike shares in the short term, but they rarely build lasting value.

So, while they may benefit momentum traders, they’re risky for investors.

The best leadership teams focus on customers, innovation, and operational excellence.

If a company’s value depends on the enterprise — not the market mood — you’re in investor territory.

If it depends on sentiment, you’re speculating.

Neither is wrong, but knowing which you’re betting on matters.

Time in Markets Beats Timing Markets ⏳

Here’s the reality: Long-haul investors and short-term traders can both win.

Day traders catch breakouts and news-based pops, while long-term holders like Buffett or Jeff Bezos compound wealth over decades.

Instead of trying to time the market, they build their value-centric portfolio over time, watching winners quietly rise to the surface.

That said, most of us don’t have 30 years or a $100 million head start.

That’s why at ATG Digital, we offer strategies to help deliver results sooner — leveraging decades of my experience working in competitive environments, like Deutsche Bank, and market wisdom won from tricky markets like the Global Financial Crisis of 2008.

Find Your Middle Path: The ATG Way 💡

You don’t need to be an overnight gambler or a forever-holder.

At ATG Digital, we’re in the Goldilocks zone investing in a sweet spot between speed and patience.

Our edge lies in understanding behavioral finance — decoding investor psychology and market sentiment to uncover overlooked opportunities in stocks and crypto.

We blend value-based thinking with strategic entry points so we’re not stuck waiting decades for life-changing potential returns.

We pursue trades that could move within months or quarters, backed by data and conviction.

So, if you’re serious about building wealth on these terms — now could be the right time to join ATG Digital.

You’ll get access to our top holdings, instant trade recommendations, weekly portfolio updates, and expert insights all drawn from my 30+ years of market experience.

Click below to unlock a strategy perfect for you.

Subscriptions start at just $9.99/ month.

#OGI100: Monday, November 10, 2025

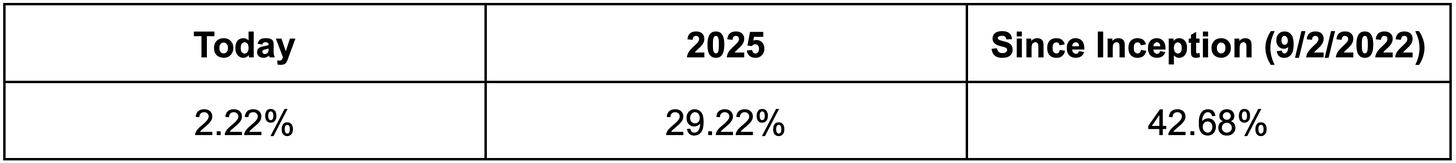

The #OGI100 is up 2.22% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan dives into a sector that could surprise investors in 2026. 👀

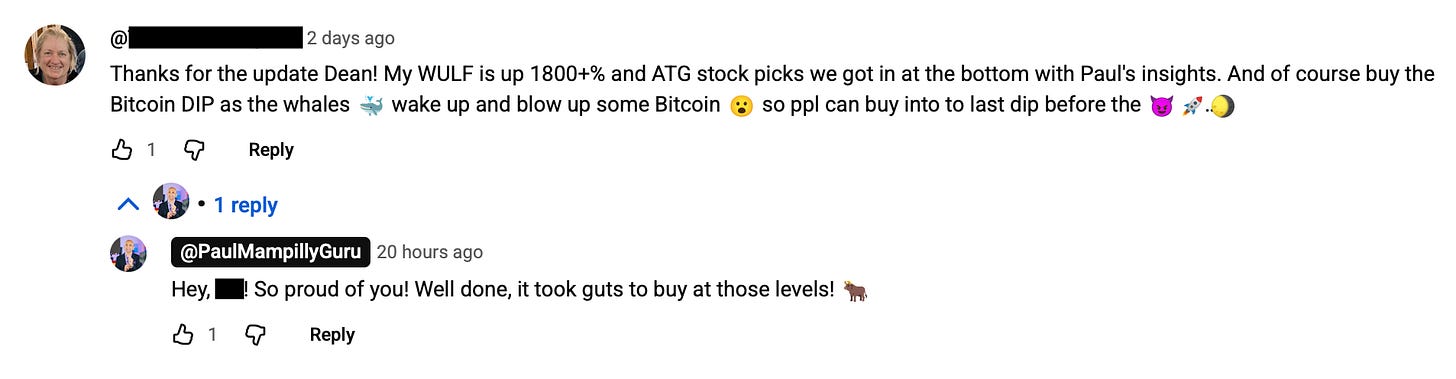

Did You Catch Dean’s Latest Video? 📺 👀

If not, you might want to grab a coffee (or tea) and hit play on this one . . . ☕

Here’s what one viewer commented:

Curious why a lesser-known AI play like TeraWulf Inc. (Nasdaq: WULF) is quietly cashing in as the AI mania unfolds?

Dean shared the latest on the AI trade, including why one famous “Big Short” legend is betting against an AI giant . . .

To a surprising corner of the market where some ATG Digital members are already seeing major gains.

Click below for the full details.

If you enjoyed the video, be sure to hit the 👍 and tell us your biggest takeaway in the comments!

On Monday, November 10, 2025, subscribe to our YouTube channel for more content from the team!

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It’s your money and your responsibility.