Note: Please read our disclaimer at the bottom of the article.

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,290

🚨Upcoming Happenings 🚨

Happy Tuesday!

Dean from ATG Digital popping in to discuss upcoming happenings!

On Monday, June 30, we’ll begin our annual 2025 Midyear Review series.

In it, we’ll send you our top Substack articles from the year so far — along with commentary just for you. 🫵

Additionally, the market will be closed for Independence Day on Friday, July 4 — as will ATG Digital.

That said, we won’t have anything new to share with you that day!

Without further ado, let’s get into today’s content! 👇

Dan: Why We’re Still Holding This Rocket 🚀

At ATG Digital, we're heavily invested in biotech, crypto, gold, and electricity-related companies — and so far, we’re up big!

Other sectors are also performing well, and we’re certainly not ones to ignore an opportunity!

That’s why we’ve taken a more concentrated, strategic approach in a few other industries heating up.

With the rise of artificial intelligence (AI) and automation, fintech is one of them.

In our opinion, it's ripe for explosive growth!

During the years of record-low interest rates, many companies borrowed money to expand their businesses.

This led to massive expansion in fintech.

Now that their infrastructure is in place, some fintech companies are poised to enjoy years of growth.

And we found one that we believe is leading the charge . . .

Disrupting Insurance with AI 🤖

I’m referring to Lemonade Inc. (NYSE: LMND) — a tech-driven insurance company that’s shaking up the traditional insurance model.

Using AI and behavioral economics, it delivers renters, homeowners, pet, life, and car insurance — through a fully digital platform.

It offers faster service, lower overhead, and a customer-centric claims experience all while using data to improve underwriting accuracy.

Unlike legacy insurers, LMND 0.00%↑ takes a fixed fee and passes the savings to its customers.

Strong Growth, Real Results 📊

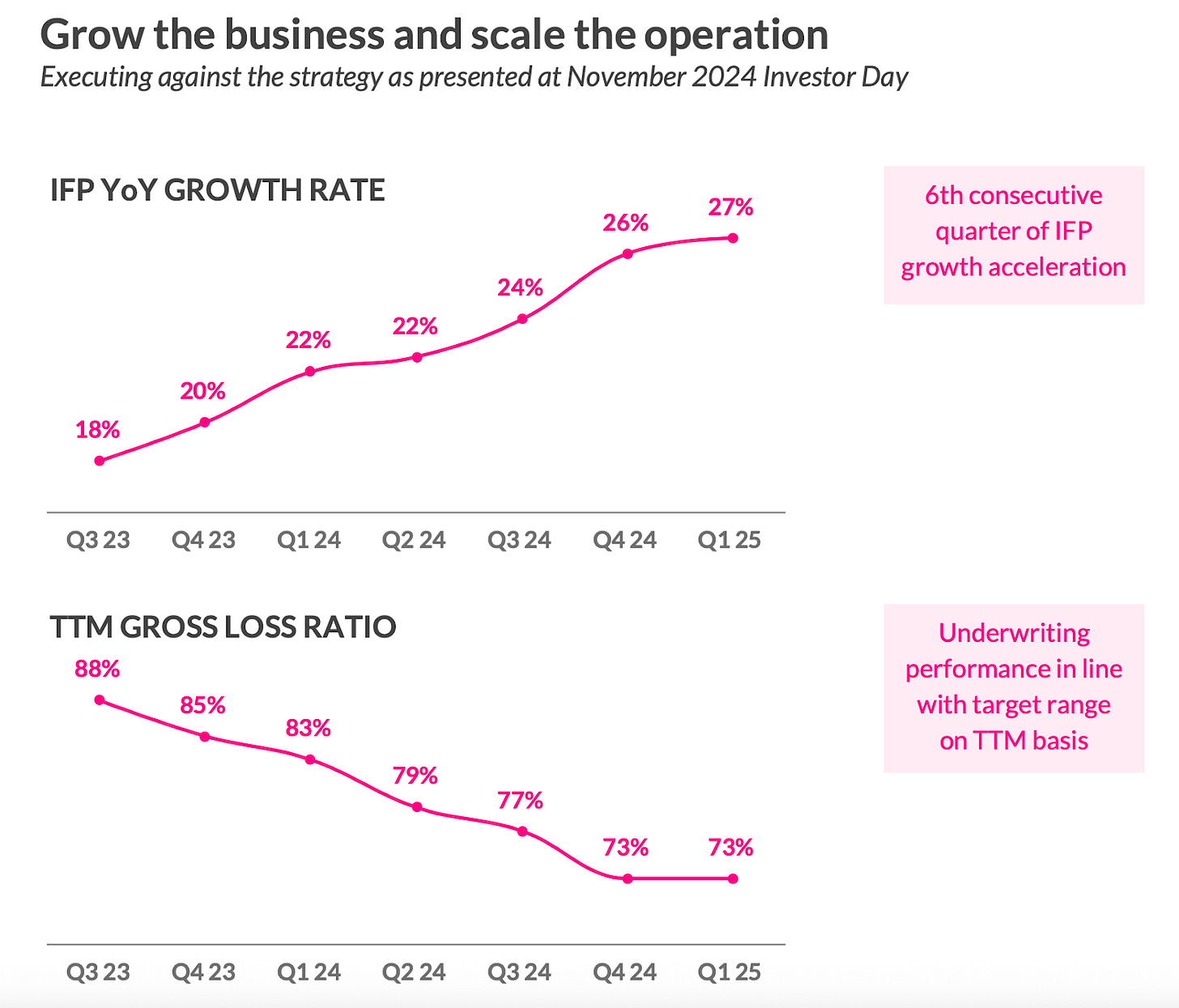

At the end of first quarter (Q1) 2025, LMND 0.00%↑ had 2.5 million customers — up 21% year over year (YoY).

Its in-force premium — the total premium income that it expects to receive this year from all policies — hit over $1 billion, up 27% YoY.

Gross profit increased 11% YoY to $39 million, even with the California Wildfire claims.

After years of volatility, LMND 0.00%↑ reported positive adjusted free cash flow at the end of 2024 and expects to continue this trajectory throughout 2025!

Sweet Gain 💸 in a Sour Market

With a market shaped by uncertainty, elevated inflation, and high interest rates, it’s a stock picker’s game.

LMND 0.00%↑ remains on the riskier side — but several factors are working in its favor:

👉 It’s moving toward profitability and free cash flow.

👉 It already has the infrastructure in place and active user base.

👉 It survived the brutal growth-stock market crash.

👉 It's benefiting from investors' appetite for AI stocks.

We’re up 158% on our position since we added it to the Gold Tier model portfolio in March 2024.

We’ll continue to hold as we believe AI-driven insurance is entering a bull phase, creating a tailwind for LMND 0.00%↑ !

When Life Gives You Lemons . . . 🤑

This is just one of our many tech-powered stocks sidestepping chaos and teeming with potential upside!

At ATG Digital, we’re spotting them early, positioning in both breakout sectors — and overlooked ones. 😎

If you’re ready to squeeze opportunity from a tough market — in fintech and beyond — click on the button below.

Come see where else we’re putting our money to work in the Gold Tier! 💪

#OGI100: Tuesday, June 24, 2025

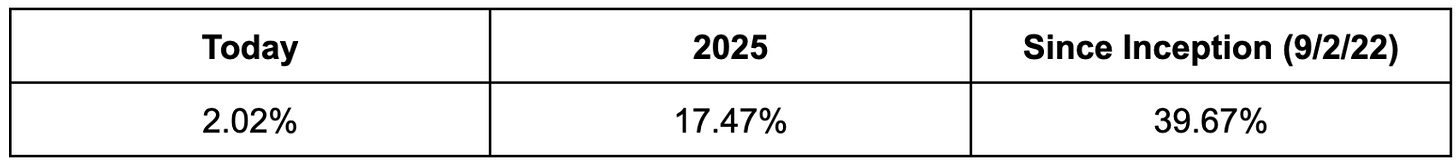

The #OGI100 is up 2.02% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dean covers a stock that’s up over 1,400%! 🚀

Prepare for Impact! ⚠️

It’s Tuesday . . .

That means Paul releases a brand-new YouTube video!

In today’s video, he explores how the national debt crisis is pushing the markets into uncharted territory.

For all the details on what to expect, including picks that could be bid up, watch the video below:

Make sure to like, comment, and subscribe to the channel!

Have you checked out Paul’s latest episode of Bald Man Speculating?

In it, he explores seismic shifts in the market that change everything.

Click here or on the image below to listen now.

Be sure to follow the podcast on Spotify by clicking here to never miss a new release!

On Tuesday, June 24, 2025, we hope you enjoyed today’s content! 🤗

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.

I started my LMND stand at the beginning 2025 it's profiting at 40% from buy price. A Sweeeeet Deal 🍋