Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on ideas preselected by you. (Purple Tier Members)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 5,911 (+2)

Weekly 🗓️ Roundup

Here’s a roundup of all our Substack articles from the week!

If you haven’t had a chance, be sure to check them out here:

Tuesday — Up 50% on This News! 🗞️

Wednesday — Market's Down — But This Stock's Up 📈

Thursday — Please Check on Sellers of This Stock 😢

Dan: What’s Brewing ☕ in the Housing Market?

Housing prices, interest rates, homeowners staying put . . . these numbers have been soaring!

But it looks like the market is finally flattening out . . .

And many who put off buying or selling a home are ready to jump back in.

In fact, a number of states are seeing home prices fall on a year-over-year (YoY) basis as listings rise.

While home prices fall and rate cuts are inevitable, mortgage rates will begin to decline, likely leading to pent-up demand entering the market.

And in our Diamond Tier model portfolio, we have one company that will benefit as housing transactions spike . . .

The End of Real Estate as We Know It 🪦

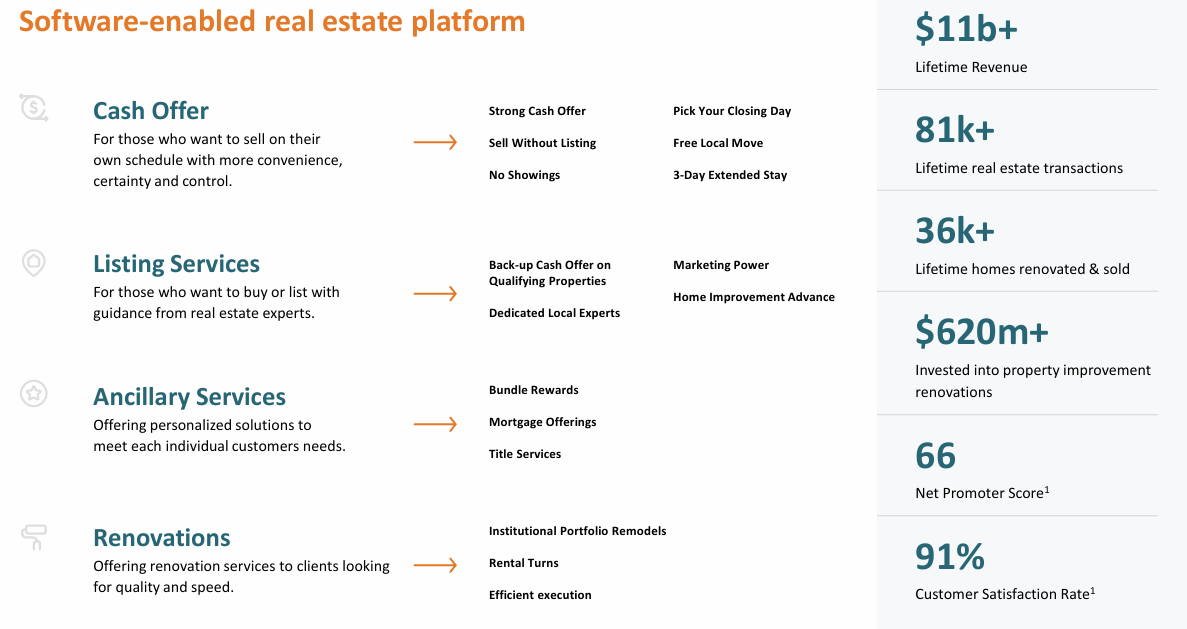

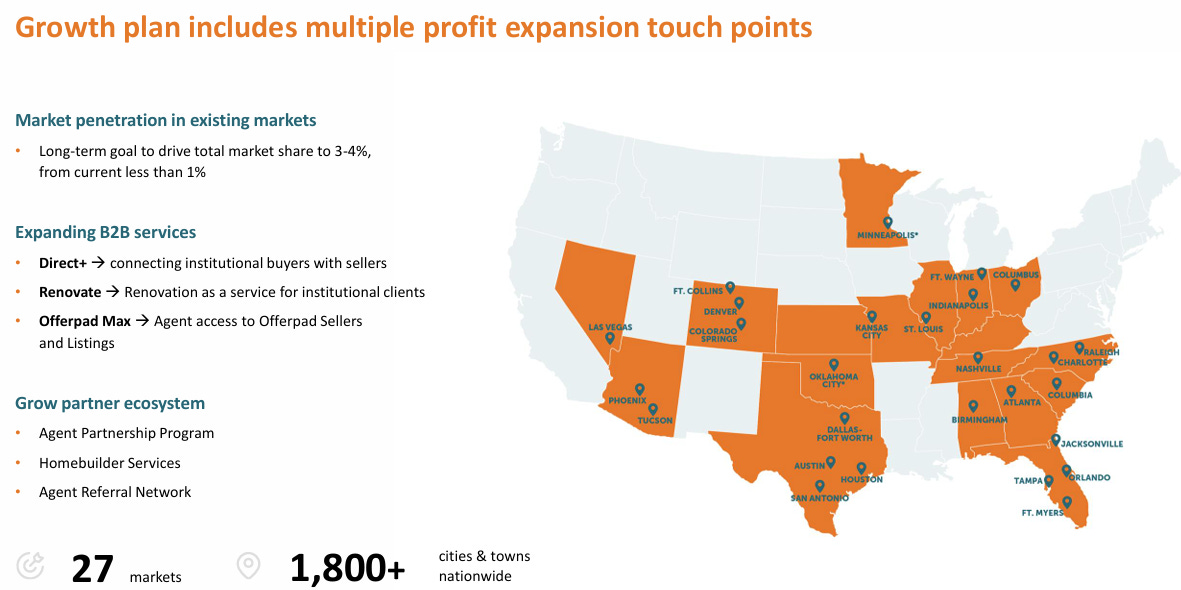

Here at ATG Digital, we’re big believers in innovation — and that’s exactly what we’re seeing from Offerpad Solutions Inc. (NYSE: OPAD).

OPAD 0.00%↑ provides a new and innovative way to buy and sell homes.

It uses technology-enabled solutions to revamp the home buying and selling experience by offering customers the convenience, control, and certainty to solve their housing needs.

The company combines fundamental real estate expertise with the data-driven digital Solutions Center platform to efficiently sell and buy homes online.

It also features streamlined access to other services including mortgage, listing, renovation, and buyer representation services.

In essence, it’s a one-stop shop!

One of OPAD 0.00%↑’s newest products is an online portal for real estate agents, Powered By Offerpad (PBO).

PBO allows agents to centralize all listing activities, including viewing cash offers, accessing detailed seller and property information, and managing opportunity leads and referrals efficiently.

Agents can stay informed with the latest developments on OPAD 0.00%↑ listings and transactions, ensuring they can provide timely and accurate status updates.

Requests to utilize PBO have increased by 37% quarter over quarter.

On the Rise 📈

While navigating the housing market over the past few years, OPAD 0.00%↑ had to make some adjustments — as demonstrated by its Q2 results.

The company focused on expense management and the continued growth in asset-light platform services.

This drove improvement in gross margin and contribution margin.

Net loss and adjusted EBITDA also improved in Q2 — by 38% and 74% YoY, respectively.

OPAD 0.00%↑ also focused on wider margins per home and less on volume. This helped raise gross profit per home sold to $29.5K, up 10% from Q1 2024.

Inventory that was held for over 180 days ended Q2 at 5.1%, down from 8.5% in Q1.

And revenue for the quarter was $250.1 million, up 9% YoY.

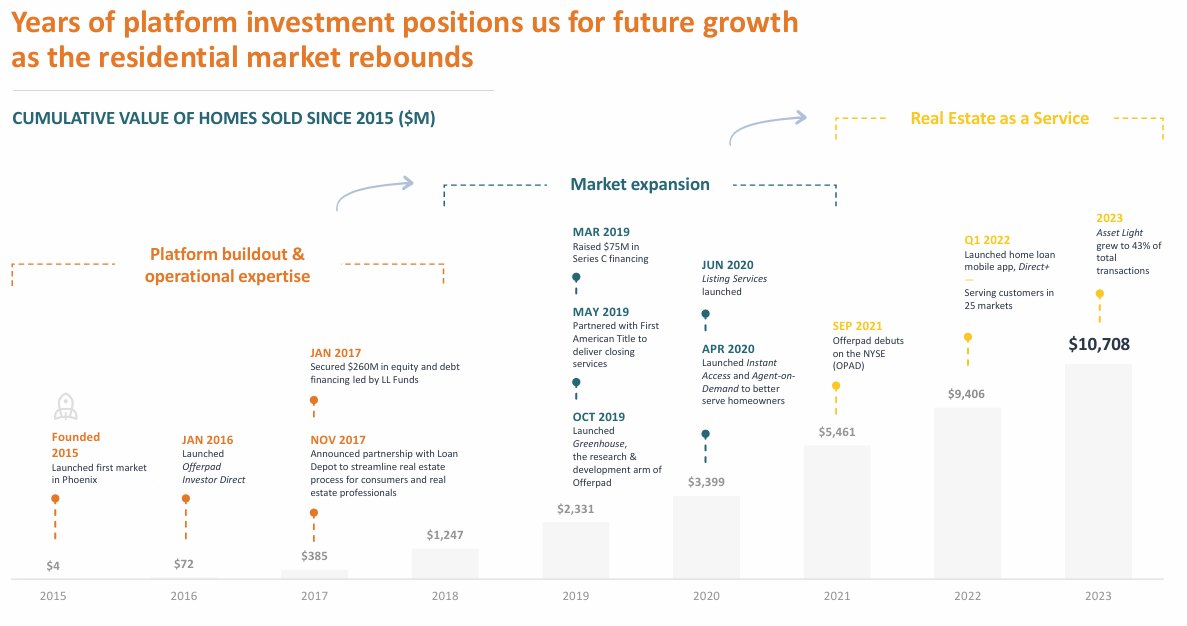

After facing years of headwinds, OPAD 0.00%↑ has invested heavily in its platform and plans for future growth!

Cheap — For Now! 🤑

Due to an extremely volatile housing market, OPAD 0.00%↑’s stock price has struggled.

With a tiny $96 million market cap, it has a price-to-sales multiple of just 0.1X.

But as we mentioned before, we believe housing will pick up as pent-up demand finally floods the market . . .

And with its innovative services and solutions, OPAD 0.00%↑ could alleviate many of the headaches associated with the real estate industry.

After surviving this downturn, OPAD 0.00%↑ trades at a very cheap valuation. It has plenty of room to run to the upside!

In our opinion, the downside is limited as sellers of the stock are limited.

We can see evidence of this as the overall market is severely in the red today — yet OPAD 0.00%↑ is currently up 3.6%!

We’ll continue to hold this stock in our Diamond Tier model portfolio and alert subscribers if anything changes.

To receive trade alerts and weekly portfolio updates on microcap stocks, like OPAD 0.00%↑, consider subscribing today by clicking here!

#GBC100: September 6, 2023

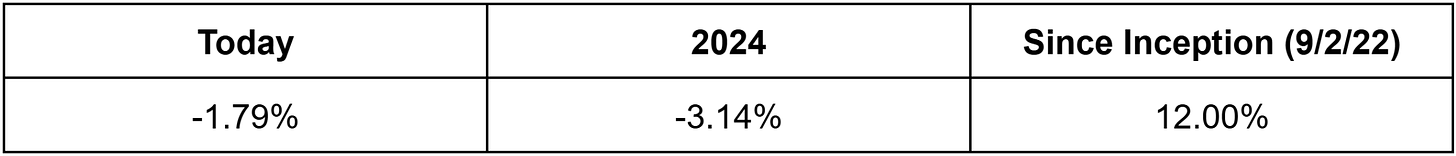

The #GBC100 is down 1.79% today.

Created on September 22, 2022, the #GBC100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #GBC100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #GBC100 into an ETF.

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Next Week: Paul will discuss two ATG Digital favorites . . . 👀 Stay tuned!

Did you catch Dan’s latest video? 📺

In it, he discusses some of our favorite new energy stocks! 💡

If you haven’t already, be sure to watch it now:

On Friday, September 6, 2024, we hope you enjoy this video — and that you subscribe to our YouTube channel for more content like it! 🙌

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.

What is your take on Liquid Piston and Energy X?