Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,233 (+3)

Mark Your Calendar 📆

Next week, our analysts Dan and Dean will release a new episode of their podcast, Wealth X. 🎙️

As always, we want to hear from you. 🫵

If you have questions you’d like them to respond to, click here to submit them!

Then, remember to tune in for the all the latest on Monday, May 5, by watching on YouTube or listening on Spotify. 🎧

We hope you enjoy this episode — and learn something from it! 🎉

Paul: Being Right vs. Making Money 💸

The world shifted and turned on its axis on April 2 — Liberation Day.

A new trading order is emerging that pivots on tariffs and bilateral trade.

For the last 20 years, companies built their business on the old globalization model: Design, manufacture, and market products with no specific country in mind.

That world is now disappearing.

The Old World 🌏 Fades

The best example of this is the iPhone produced by Apple Inc. (Nasdaq: AAPL).

If you’re in India, China, or New Zealand, everyone has the same iPhone.

That’s thanks to globalized trade rules.

And over the last 20 to 30 years, every company has looked to mimic this model because it maximizes profits.

AAPL 0.00%↑ produces iPhones mostly in China.

That’s because between Chinese government subsidies, lower wages, and lax regulations, it's far cheaper to produce them there than in the U.S.

AAPL 0.00%↑ uses Ireland as a tax haven, currently paying just a fraction (⅓) of U.S. taxes.

But it isn’t alone in this strategy. Most large companies in the U.S. use globalization to optimize profits.

This isn’t illegal or shady. In fact, it was encouraged by U.S. policies for decades.

Why Globalization Is Crumbling 🍪

Now, it's beyond the scope of this Substack to detail the “how, why, and what” of the problems globalization created in the U.S.

Simply put, the U.S. gutted its production and manufacturing base.

This loss became glaringly apparent during COVID, when China withheld masks, ventilators, and other critical supplies from America, choosing to prioritize its own citizens instead.

Turns out that the globalization model was never built to withstand a pandemic.

It exposed major vulnerabilities — particularly in long supply chains across different countries — as economies opened and closed, disrupting exports and imports.

And that’s just a part of it.

Globalization has affected currency, monetary flows, asset markets, and financial systems . . . but that’s a discussion for another time.

If you’re eager to dive deeper into the full analysis, subscribe to our Purple Tier to check out the two-part special report we recently sent to our members.

Long story short, tariffs upend the entire system.

They force companies to localize or regionalize production, which leads to higher wages, redundant production across multiple countries, and increased taxes and regulatory costs.

As a result, any company using the old globalization playbook will see its profits shrink.

Tariffs Break 🚧 the Old Model

The shift to tariffs and localized/regionalized production will require a new approach to supply chains.

Businesses will need to find smaller, more profitable niches driven by local or regional demand.

Moving forward, the one-size-fits-all style is unlikely to work.

Businesses must seek specific pockets of demand and fill those customers' needs.

I imagine every company today is scrambling to figure out which products still make sense in this new, tariff-driven world.

Bottom line is this: Sudden, rapid, and unanticipated change has arrived.

World Changes = Portfolios Changes 💥

We believe companies built for the previous world will see wipeouts.

First slowly. Then suddenly.

That’s why at ATG Digital, we look forward to the new world driven by tariffs and bilateral trade.

Right now, new bull markets are forming in:

💥 Electricity

💥 Natural Gas Energy

💥 Gold

💥 Drones

💥 “Made in America” Manufacturing

We also believe that crypto and crypto-related stocks will join this group soon — along with fintech, genetics, and select biotech plays.

I’ll walk you through the logic behind each of these bull market groups in future Substacks and — if you’re an ATG Digital subscriber — during in-depth portfolio updates.

Change or Get Left Behind ⚡

I’ve read folks' complaints about taking big losses in various stocks as we shift our bets — and I get it.

But no one gets every stock right.

A good batting average is 30% to 40%. In tough markets, it might be 10% to 20%.

That means owning the big winners is critical.

Many people use subscription services like ours to buy one or two stocks.

That’s a great strategy when it works . . . but a terrible one when it doesn’t.

Look at the S&P 500. Nearly all its returns come from the top 20 to 30 stocks out of 500. That’s a hit rate of around 5%!

And the index kicks out losers and changes stocks every year.

The truth is, picking stocks is a tough game.

There will be losers, some large. Certain years will be ugly. Not every year will be a boom.

Sometimes, the investment world will do a 180-degree turn — fast.

And we’ll have to rapidly move with it, remaking our portfolios.

That’s exactly what we’re doing at ATG Digital . . .

The Big Money Is Ahead 🚀

The future’s where all the big returns are found.

We remain incredibly #BOP (bullish, optimistic, positive) on what’s unfolding — and the opportunities we see to capture massive gains in these emerging bull markets!

If you’re ready to position yourself ahead of the crowd and uncover the next big winners — in energy, crypto, fintech, biotech, and more — we’ve got you covered. 💪

Get exposure now for as little as $0.32 a day by clicking the button below!

#OGI100: Monday, April 28, 2025

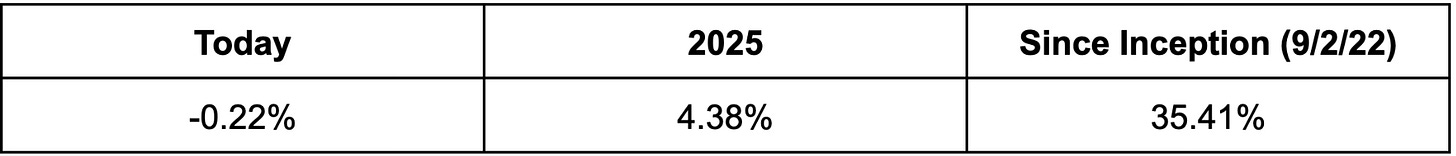

The #OGI100 is down 0.22% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Did You Catch This? 👀

Did you have a chance to check out Dean’s YouTube video last week?

In it, he pulled the lid back on the liquidity entering Bitcoin USD (BTC-USD).

For all the details, watch the video below:

To catch all our future YouTube content, be sure to subscribe by clicking here!

Tomorrow: Dan will cover a small company with big upside . . . 👀

It’s no secret . . . this is a tough market to profit from.

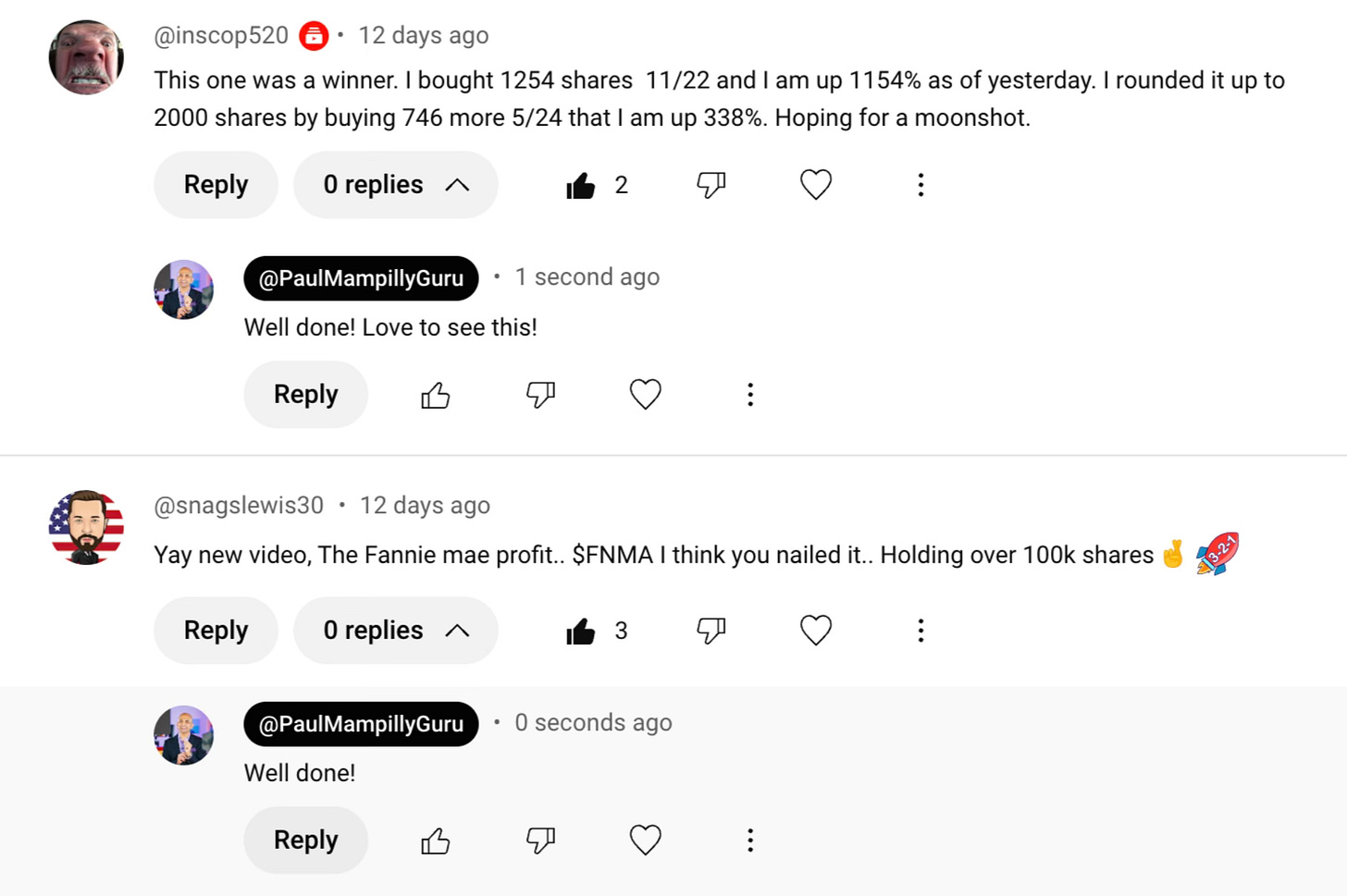

That said, it’s great to hear from ATG Digital members who are benefitting from our picks! 💪

Just take a look at the comments we received on a recent YouTube video centered on Fannie Mae and Freddie Mac:

Thank you so much for writing in! 🙌

Seeing gains like these remind us why we do what we do: to help our community profit — no matter the market conditions.

If you’re not an official ATG Digital member, consider joining today by clicking here.

On Monday, April 28, 2025, we hope to welcome you soon! 🤗

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.