Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,232

Triple-Digit Gains . . . In This Market? 👀

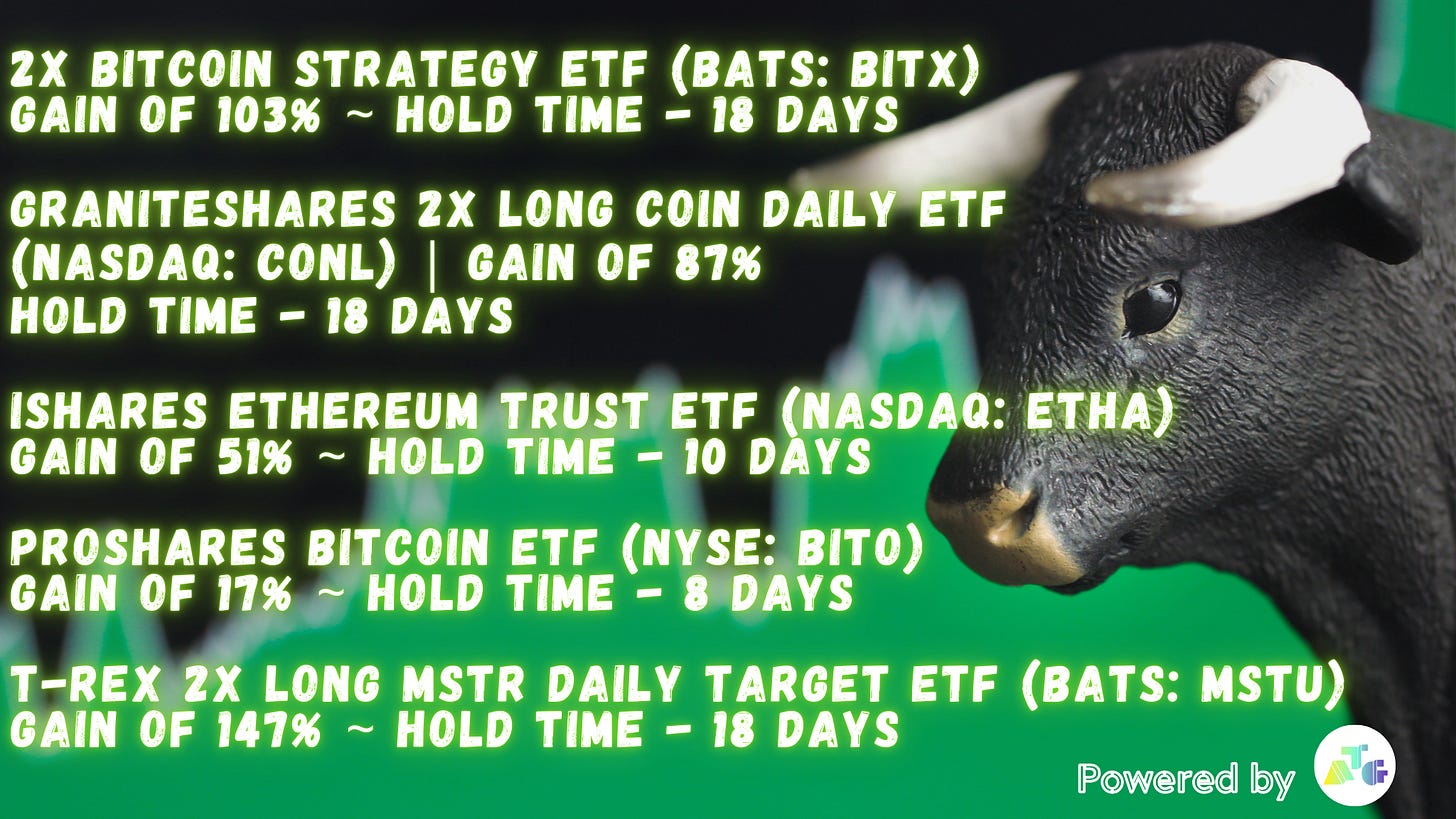

Despite today’s tough market, we’re still capturing quick profits in our Platinum Tier . . . 🔒

Check out the gains our Platinum Tier subscribers captured last week:

We’ll be the first to say we don’t always get it right . . .

But when we do, it’s a cause for a celebration!

Gains like these remind us why we do what we do: to help loyal readers like YOU profit in any market conditions.

To navigate the options market like a pro, consider joining the waitlist for our upcoming options course by clicking here.

If you were able to benefit from any of these trades, let us know!

And if you aren’t a member of the Platinum Tier but would like to become one for a chance at opportunities like these, click here to join today!

Paul: 3 Big Changes Driving the Next Bull Market 🔥

On April 2, 2025, President Trump’s “Liberation Day” launched a new chapter for America’s economy.

It marked a shift from global trade to an America First policy.

For 50 years, globalization — with its cheap imports and overseas factories — drove stock market gains.

But the game has changed.

Now, three massive changes are reshaping investing:

1. The end of globalization

2. The return of higher interest rates

3. The rise of everyday artificial intelligence (AI)

As an ATG Digital subscriber, knowing these shifts can help you spot new winners and avoid old traps.

Let’s dig into each game-changer . . . 👇

Goodbye Globalization 👋

The U.S. outsourced many industries like medicine, drones, and clothing.

Consider these eye-opening figures:

80% of active drug ingredients come from China and India.

70% of the global drone market is controlled by China’s DJI.

Few clothes sold in the U.S. are made domestically.

Globalization promised fair rules, but countries like China sold goods at rock-bottom prices — crushing U.S. businesses and copying American tech without permission.

Big companies gamed the system, moving factories to low-wage countries and routing profits through tax havens.

Liberation Day changed all that.

It introduces tariffs and trade deals to reshore manufacturing back to U.S. soil.

This will squeeze profits for companies relying on cheap overseas labor — think big retailers or tech giants with foreign factories.

But it’s a golden opportunity for stocks tied to American manufacturing.

That’s why at ATG Digital, we’re leaning hard into our latest “Made in America” theme — focusing on companies poised to win as supply chains shift home.

The End of Easy 💸 Money

Globalization kept interest rates low in a hidden way.

It invested much of it in the U.S. Treasury bonds, keeping rates down.

Low rates boosted stocks, especially tech, and let the government borrow heavily.

In 2025, American national debt hit $36 trillion, with a $1.9 trillion yearly deficit.

Liberation Day slows this flow of dollars.

With fewer foreign bond purchases, interest rates are rising. 30-year mortgage rates jumped from 3% in 2021 to 7.5% in 2025.

Higher rates will hurt assets across the board — but especially tech and growth stocks that benefited the most from globalization.

Bottom line is this: The boost that stocks and assets markets received from low interest rates is over.

At ATG Digital, we’re steering away from certain rate-sensitive sectors and adapting to thrive in a high-rate environment.

The New Winners of AI 🤖

AI is exploding.

But it isn’t like the internet — it won’t create just a few giant winners like Alphabet Inc. (Nasdaq: GOOG).

It’s quickly becoming an everyday tool — like electricity or running water.

In 2025, global AI spending is projected to surpass $300 billion with 75% of businesses using AI tools.

In my view, no single company or sector will dominate the AI revolution.

I believe AI’s growth drives two major impacts:

Soaking Up Investment — AI startups raised $50 billion in 2024, crowding out other new ideas.

Energy Rally — AI needs massive energy. Data centers powering AI now consume 8% of U.S. electricity — and that’s expected to double by 2030.

We believe this makes humble energy companies involved in electricity production a smart bet!

You can think of energy and infrastructure stocks as the picks and shovels of AI.

We believe these powerhouse plays are positioned to deliver bigger potential gains than the flashiest AI apps.

What This Means for Your Portfolio 📈

These shifts — globalization to “Made in America,” low rates to high rates, and AI’s rise demanding a new infrastructure — require a new investing playbook.

Stocks that once soared on cheap labor or low rates, such as some tech giants, will likely struggle.

We believe a wealth of high-growth new opportunities will emerge from these three shifts.

So, we’re pivoting to these sectors in our ATG Digital portfolios.

We’ve taken some short-term losses while letting go of old stocks.

But we believe that the upside from exposure to the new bull markets will more than make up for it!

These new bull markets are still undervalued — which means those who invest early could reap big potential rewards sooner rather than later.

Jump on the New Wave Now🏄🌊

Liberation Day is your signal to rethink investing . . .

And your chance to reset your trading strategy! ⚡

The old bull market — built on global trade and cheap money — is over.

A new one is here and rising, powered by American-made goods, AI’s energy boom, and homegrown production.

As an ATG Digital investor, you have the opportunity to win by investing in these growing sectors today.

But timing matters.

Click on the button below to start building your future #OGI (opportunity, growth, innovation) portfolio now!

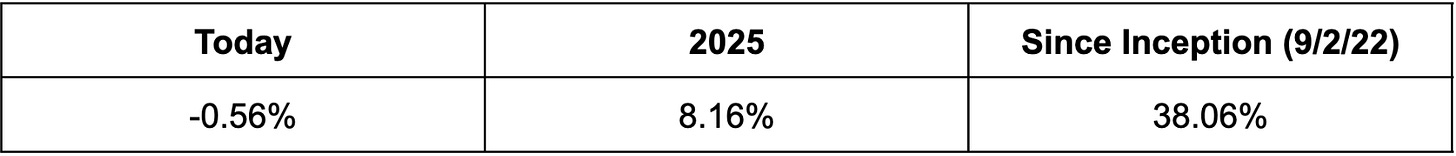

#OGI100: Monday, May 5, 2025

The #OGI100 is down 0.56% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan will cover a biotech company that’s heating up! 🔥

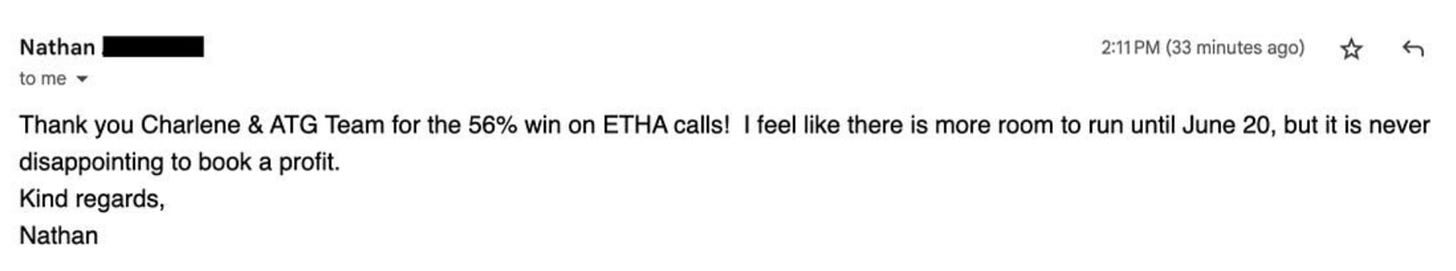

Check out what one loyal reader, Nathan, had to say:

Thanks for sharing, Nathan!

We always love seeing our community win.

So, if you’ve been able to profit from our recent options trades, feel free to share! 🫡

If you’re not an official ATG Digital member, consider joining today by clicking here.

On Monday, May 5, 2025, we hope to welcome you soon! 🤗

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.

Did Dan & Dean do episode 3 of Wealth X?? I thought it was yesterday but cannot find it on any platform 🤨

Been trading Platinum Tier Options over 3 broker platforms. Currently my most profitable trading strategy. Closed each contract times 3 for a total of 3k in profits!