Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on ideas preselected by you. (Purple Tier Members)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 5,933 (+2)

Paul: Election Results Could 30X 🤯 These Stocks

If politics aren’t your thing, you might want to skip this Substack . . .

While we don’t promote any political party or agenda here at ATG Digital, today I’ll cover a stock that could soar if former President Donald Trump wins the upcoming election.

Actually, it's not just one stock — it’s a group we refer to as the Fannie Mae/Freddie Mac stocks.

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, and the Federal Home Loan Mortgage Corporation (FMCC), known as Freddie Mac, are key players in the mortgage market.

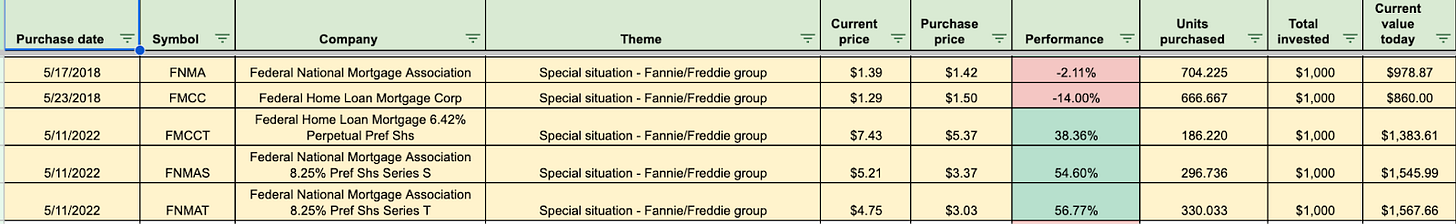

As you can see below, we added these to our Gold Tier model portfolio back in June 2018.

Then in 2022, we bought into three preferred stocks issued by these companies.

I’ve talked a good deal about this in the past, so I won’t rehash the setup here — but if you don’t already know, you can get the background information by checking out my YouTube video here:

The preferred stocks have an upside of about 7X to 10X, in my opinion.

However, here I focus specifically on the upside in FNMA and FMCC and why their stocks are potentially 30X opportunities if Trump is elected:

This trade only works if Trump is elected because he’s committed to freeing these companies from their 16-year-long conservatorship.

Freedom = 30X Upside 💸

Conservatorship is just a legal term for the government takeover of these companies during the Global Financial Crisis of 2008.

So, why is the upside 30X?

I’ll use FNMA as an example for my reasoning . . .

You see, when FNMA was put into conservatorship, it had about $10 billion in revenue. In 2024, it’s on track to generate nearly $30 billion in revenue.

Companies as big and well established as this would normally be valued based on their earnings.

After 16 years of government control, it's unclear what FNMA’s true earning power is.

However, we can see that its revenue is booming.

Compared to similar independent companies like MGIC Investment Corp (NYSE: MTG) and Radian Group Inc. (NYSE: RDN), we believe FNMA should trade for 6X to 7X sales.

Looking back at FNMA’s history, we can also see that it traded at those levels in the 1990s, which included its stable periods.

Using this assumption, we get a market capitalization somewhere between $180 billion and $210 billion.

In my opinion, this is too conservative of a valuation level.

I say this because over 16 years of conservatorship, FNMA became even more dominant and deeply entrenched as a business.

Market Domination 👑

According to the National Association of Realtors, FNMA and FMCC together control 70% of the mortgage market.

Bottom line: They completely own their markets.

In the 1990s, there was a chance that someone could compete with them.

But today, that’s not a realistic proposition as FNMA and FMCC are set to dominate their business for the foreseeable future.

Finally, keep in mind that investors look forward, not backward.

Looking ahead, with their dominant share of the mortgage market, we know FNMA and FMCC revenues will continue to grow.

This supports an even higher valuation range of 9X to 10X.

In my opinion, if Trump is elected next month, FNMA and FMCC will be set free fairly soon — either in Q2 or Q3 2025.

I believe these plans are already well advanced as they build on the groundwork laid from his first presidency.

Betting on Good Odds 🎲

Yes, there are plenty of “ifs” involved. But when I see good odds, I like to make the bet!

The polls and oddsmakers favor a Trump win.

FNMA and FMCC stocks are beginning to get bid up as investors discount these companies being released from their conservatorships.

Of course, there are no guarantees or certainty. However, we believe FNMA and FMCC could shoot 30X in the scenario I’ve laid out.

For both, that would mean a complete reversal of their crash in 2008 back to levels between $40 to $50 per share.

At their current levels of under $1.50 per share, that translates to a staggering 3,000% gain in about one year! 🤯

FNMA, FMCC, and their preferreds are in our Gold Tier model portfolio, alongside many other high-growth picks!

To get access to all these — plus updates and immediate trade notifications for our newest opportunities — click here.

#GBC100: Monday, October 21, 2024

The #GBC100 is down 1.84% today.

Created on September 22, 2022, the #GBC100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #GBC100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #GBC100 into an ETF.

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan will cover a Bitcoin USD (BTC-USD) miner! ⛏️

Have you been keeping up with our recent gains? 🤔

Just to recap, here’s what we’ve seen over the past couple weeks in our Diamond Tier:

The RealReal Inc. (Nasdaq: REAL) — 83%

Phathom Pharmaceuticals Inc. (Nasdaq: PHAT) — 159%

EVgo Inc. (Nasdaq: EVGO) — 113%

And check these Platinum Tier gains out! 👇

GraniteShares 2x Long COIN Daily ETF (Nasdaq: CONL) — 40%

Direxion Daily Gold Miners Index Bull 2X Shares (NYSE: NUGT) — 28%

Block Inc. (NYSE: SQ) — 17%

Coinbase Global Inc. (Nasdaq: COIN) — 54%

MannKind Corporation (Nasdaq: MNKD) — 24%

Direxion Daily Small Cap Bull 3X Shares (NYSE: TNA) — 22%

If you’d like to join ATG Digital for opportunities like these, click here!

On Monday, October 21, 2024, we hope to welcome new members soon. 🤗

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.