Billions — How Paul Did It 💹

The rule everyone quotes . . . but gets wrong. 😬

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company’s Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,348

Level Up Your Feed with ATG — All Free!

We love hanging out on Substack . . . but that’s just one of our favorite spots! 😎

You can catch Paul Mampilly and the ATG Digital crew across the web on these platforms:

📱Facebook — Tune in for posts from our lead analyst, Paul Mampilly.

🎧 Spotify — Stream Bald Man Speculating podcast on the go.

🔥 X (Twitter) — Catch Paul’s quick takes on trending market moves.

🎥 YouTube — Watch our team’s weekly videos and market breakdowns.

And the best part? It’s all 100% free to enjoy! 🙌

So, wherever you scroll, make sure you’re plugged in — you don’t want to miss what’s coming next! ⚡

Paul: Why “Buy Low” Feels Like a Trap 😵💫

You’ve probably heard it a thousand times: buy low, hold steady, sell high.

It’s the golden rule of investing.

But in my 30+ years managing money for billionaires, royalty, and an award-winning hedge fund, I’ve seen how that advice can backfire — especially when emotions take over.

Because the truth is, “buy low” doesn’t feel like an opportunity — it feels like panic.

The news screams collapse, pundits preach doom, everyone around you starts selling.

But here’s the twist most investors miss: markets price in fear fast.

And by the time those scary headlines hit, much of the damage is already done.

In our view, low prices often represent discounted recoveries — not red flags.

I’ve watched countless clients sell at the exact wrong moment — and live to regret it.

Today, you’ll learn how to avoid this mistake . . .

The Sunshine Scam at the Top 🚨

Flip it around. When markets hit new highs, you don’t see fear.

You feel euphoria.

The media glows with stories of tech revolutions.

Artificial intelligence (AI), quantum computing, nuclear fusion, space stocks — all promising trillion-dollar futures.

Investors pile in late, chasing gains they missed.

But here’s the problem: markets don’t price in reality — they price in emotion.

When stocks soar, they reflect the optimism of now — not the setbacks, delays, or slow grinds that lie ahead.

And having been through multiple bubbles, I can tell you this: euphoric tops are where dreams go to die.

2025 Feels Like 1999 🔁

If you were around for the dot-com bubble, you may remember this feeling.

In 1999, the internet was the AI of its time — hyped, overfunded, and poorly understood.

I watched colleagues throw everything into startups that barely had business plans, let alone revenues.

I dive into the market psychology that drove this boom-and-bust era in my latest Bald Man Speculating podcast episode:

Biotech got caught in the frenzy too — thanks to the sequencing of the human genome.

The result? Ashes.

Most of those companies no longer exist. Many of their backers lost everything.

And in our opinion, 2025 is déjà vu.

AI, quantum, nuclear, and space are all exciting sectors — but valuations today are based on story, not delivery.

Even the winners take years to mature.

Think Alphabet Inc. (Nasdaq: GOOG), which took nearly two decades to hit its stride, or Apple Inc. (Nasdaq: AAPL), which languished after the PC boom.

Not every “next big thing” is the next big winner.

Don’t let the fear of missing out (FOMO) drain your portfolio.

Contrarian Playbook 📖 for Real Wins

At ATG Digital, we’re not chasing headlines — we’re hunting fundamentals the crowd’s ignoring.

Here’s where we’re focused:

⚡The Real AI Trade

AI data centers need staggering amounts of electricity.

But the companies powering that surge?

Still undervalued.

We’re targeting plays in natural gas and grid infrastructure — essential, profitable, and overlooked.

🏭 Re-industrialization

U.S., Japan, and Europe are clawing back manufacturing from China.

Tariffs, reshoring incentives, and policy tailwinds are creating new “growth corridors” — and we’re positioning early.

💰 Gold, Silver, and Crypto

After decades of monetary excess, hard assets and select cryptos — like Bitcoin USD (BTC-USD) and Ethereum USD (ETH-USD) — offer long-term protection against currency debasement and geopolitical instability.

We believe these assets could be key drivers of asymmetric upside in a turbulent macro environment.

Market Chaos = Opportunity 🤑

Markets test your patience. Your discipline. Your gut.

But time, not hype, is what builds wealth.

We built our ATG Digital model portfolios to reward the patient contrarian — the one who tunes out noise and focuses on the emerging megatrends powering the next decade.

So, next time you hear “buy low,” remember: The trap isn’t the price — it’s the panic and euphoria.

Stick to the fundamentals, follow the Rules of the Game, and let time do the rest.

The market’s next big winners are already taking shape, and now could be the best time to get positioned.

Click below to find the Tier that fits your strategy.

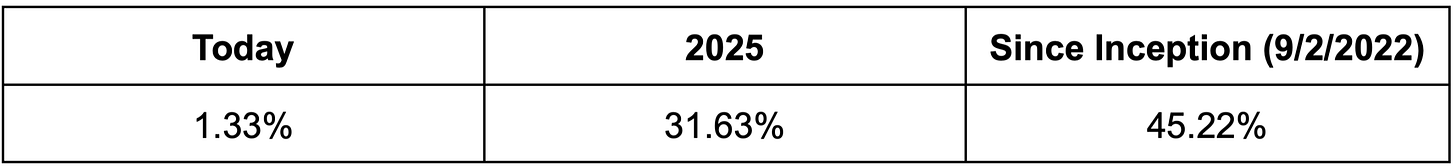

#OGI100: Monday, October 13, 2025

The #OGI100 is up 1.33% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan shares a surprising trend and company changing the game.

Your Next Big Move? 👀

A quiet boom is stirring overseas — and most investors aren’t paying attention.

Dan’s latest YouTube video uncovered the region showing signs of revival and potential big growth. 🚀

Could this be your next opportunity?

Watch the video now to see what’s unfolding. 👇

Enjoying the insights?

Hit “👍” and subscribe to our YouTube channel 🔔 to stay ahead of the trends.

On Monday, October 13, 2025, we want to hear your take in the comments!

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It’s your money and your responsibility.

The end of the world as we know it, but I feel fine . . . Knowing that stress is less and independence is more if you’re on an ATG tier of happiness…Don’t miss out!

Paul will steer you clear of chaos into the calm tranquility of your profits.