Please be sure to read the disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's substack, where we provide daily coverage of OGI (opportunity, growth, and innovation) market trends, macro-level analysis and stock picks.

Like our name suggests, at ATG Digital, we go Against The Grain to support everyday people on their investing journeys.

It also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on preselected (by you) ideas. (Diamond Tier + Purple Tier)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 5,650 (+8)

⭐️ Important Note for Next Week ⭐️

Hey, Dean here with a quick announcement!

From Monday, December 25 through Friday, December 29, we’ll be releasing our “Best of 2023” Substacks.

These are past articles that YOU upvoted — by liking, clicking, commenting, or simply opening.

And don’t worry — we’ve made sure that the information in each of them is still relevant to you. 🤝

The end of the year is always a good time to do some reflecting … and we think this is a great way for us to do that as a community!

But until next week, we hope you enjoy our regular Substack content. Happy reading!

Paul Mampilly: A Bitcoin Fantasy 🔮

I don’t have enough fingers or toes to count how many times I’ve seen the two words “bitcoin ETF.”

Bitcoin (BTC) excitement is running high because of the potential for a BTC ETF.

If you’ve been reading our substacks and watching our YouTube channel, you’re pretty caught up on this development.

This week in my Substack, I want to focus on what seems like a fantasy and, perhaps, a delusion.

But I believe this fantasy is inevitable. Remember, nothing you read in this Substack is a guarantee or a certainty, it’s simply my opinion.

BTC = $1 million Soon Is Inevitable

Most BTC believers think that bitcoin will follow a nice, smooth pattern higher. Me, on the other hand, well, I’m not in this camp.

I believe that somewhere in the next three to five years, we’re likely to see a sudden, sharp, stunning rise that’s going to lift it to $1 million.

Now, my reasoning for BTC reaching $1 million is laid out in my previous Substacks.

BTC adoption is set to grow partly due to the absolute staggering issuance of money by the Federal Reserve and the U.S. government over the last four years:

This led to inflation and the decline of the purchasing power of the dollar.

Not to mention that U.S. debt now sits at a staggering $34 trillion 🤯. $13 trillion, nearly a third of that, has come in the last four years.

Wow, just wow.

Then, between 2020 and 2022, the Federal Reserve increased money issued from $4 trillion to nearly $21 trillion.

Astonishing. Incredible. Mind-blowing.

What Happens When Gov/World Banks Issue Too Much Money 🤔

If you look at the major economies of the world, you see the same thing repeated: governments and central banks have all increased their borrowing while issuing too much money.

This is why our economies refuse to go into recessions — simply way too much money in the system for this to happen.

Governments would need to cut spending by 10% to 20% to 2018 levels, while central banks would need to lift rates by another 5% for a recession to happen.

No government or central banks will do this.

If that’s right, sooner rather than later, big money players will want to hedge against the possibility of all this money causing even higher inflation in the future.

And the single best hedge that these folks don’t own is BTC.

Now, you might be thinking, “How can big money not be in BTC already?”

Bitcoin ETF Is The First Stage of a Massive Move Higher

Some of the reasons are a bit arcane – like custody.

Custody is where assets are stored. Most assets held by big money, like stocks, bonds, and cash, are in custody at big financial institutions.

But these institutions can’t hold BTC or crypto. And this is one reason why the BTC ETF is such a big deal for institutions.

It solves this problem by making BTC into an ETF (stock) that anyone can hold.

The other reasons for not owning BTC are that it’s new and still unconventional and controversial.

But that’s also what creates the massive potential because it means that there’s a vast amount of potential demand for BTC.

Finally, until now, BTC was quite small in the world of assets. It’s only now big enough, with a market capitalization of $808 billion, for big money to invest in.

My Model for BTC $1 Million 📈

Remember, the world of assets has a market capitalization of over $610 Trillion. If BTC can take a 10% market share, it would have a market capitalization of $61 trillion.

At that market capitalization, BTC’s notional price per coin (based on 21 million coins) will be an estimated $2,904,762.

In my opinion, BTC should and will take a 10% market share of the world’s assets.

But let’s say it takes about 3% to 5% market share. At 5%, BTC would have a notional price of $1.45 million. At 2.5%, it would be $726,190.

Big Money Will Come Sooner Rather Than Later 🧐

That will happen first and soon for the reasons I laid out. Plus, the world’s governments and central banks use U.S. dollars as their reserve currency.

While there’s no alternative right now in terms of fiat (paper) currencies, BTC is available as the first digital, global, independent, widely known/accepted, transparent, and finite currency.

Governments and central banks will be among the last to adopt it. However, people with vast wealth held in U.S. Dollar currencies will start investing in BTC now.

As they come with their billions to buy up BTC, we’re going to have a demand shock that can only be reconciled by a sharp, sudden, stunning, one-time move higher that reflects this new reality.

And in my opinion, that’s going to come when it’s least expected.

We’re All in on BTC & Crypto 🤝

In our model portfolios, we’re all in on BTC!

From stocks that will benefit directly and indirectly, like Coinbase Global Inc. (Nasdaq: COIN), Block Inc. (NYSE: SQ), MicroStrategy Incorporated (Nasdaq: MSTR), and CleanSpark Inc. (Nasdaq: CLSK), to bets on various crypto tokens that we believe will rise as all this unfolds.

Now, not to be a wet blanket on your excitement, but I want to warn people that nothing happens in the market in a straight line.

There will be massive volatility that you will need to ride through before all this happens.

Markets always make you earn your returns. In our Silver, Gold, and Diamond portfolios, we’re buying and holding for the long term.

In our Platinum Tier, which is our short-term trading tier, we’ll look to ride this short-term volatility up through options contracts on BTC and crypto-related stocks.

We will also look to profit from rising crypto tokens with true use cases.

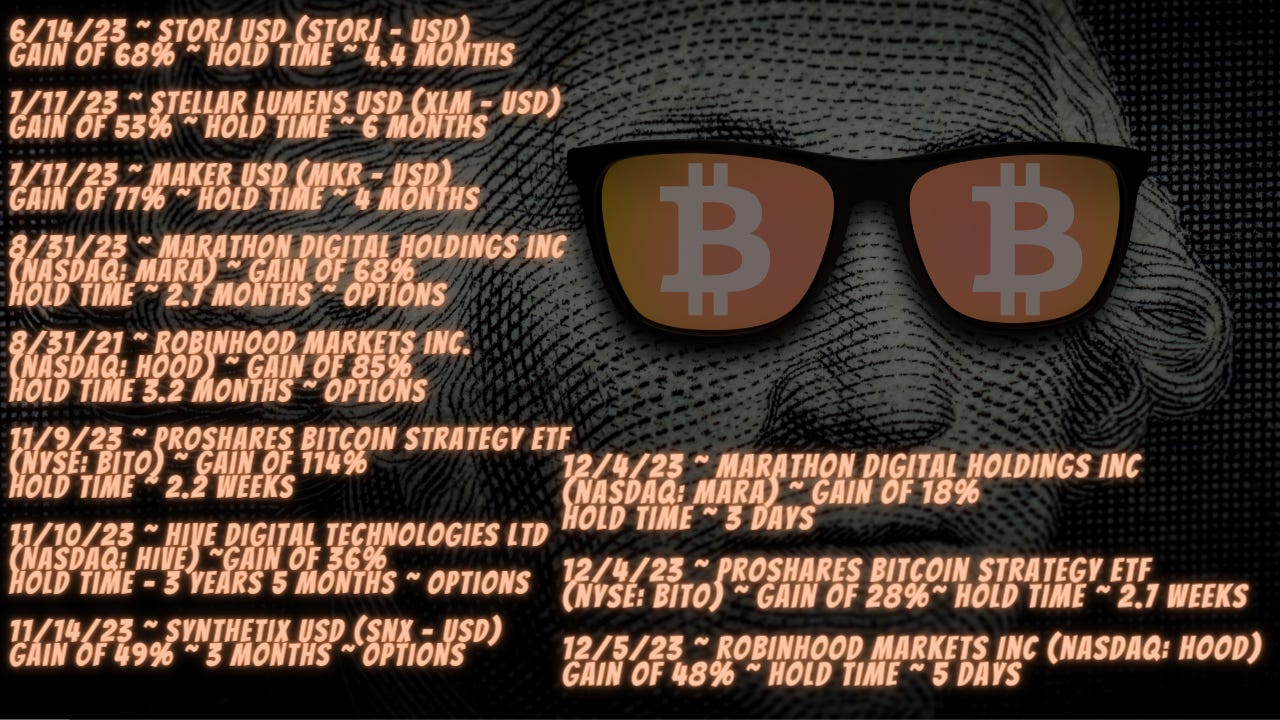

And so far, we’re already profiting from BTC’s upward trend:

And in our opinion, more BTC and crypto-related gains are to come.

To get in on exposure to this trend, including trade alerts, portfolio access and video and written guidance, sign up today for just $9.99 by clicking here!

#GBC100: Monday, December 18, 2023

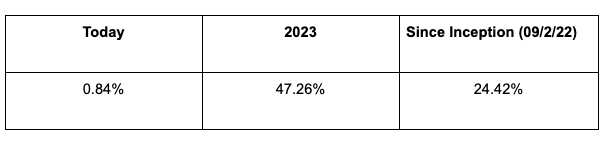

The #GBC100 is up 0.84% today.

With markets shifting in our direction, there isn’t anything new to write about. So, just to let you know, we won’t always be commenting on the performance of the #GBC100 daily.

However, we’ll be updating the performance, and we want to remind folks that our goal is to turn the #GBC100 into an ETF that offers a one-stock way to invest the ATG way — in innovation and growth.

To learn more or express your support for the launch of an ETF (by completing a poll), click here.

About a month ago, Paul released this video on our YouTube channel:

In it, he discusses when he thinks BTC will hit $1M!

If you haven’t checked it out, be sure to watch it by clicking the red start button!

Tuesday: Dan will reveal one opportunity in the 3D printing sector! 🔥

Happy Monday! 🌞

2024 is nearly upon us! That means new opportunities and new goals!

What are your goals for 2024? Let us know in the comments! 👇

On Monday, December 18, 2023

❤️️ This Substack made — by US, for YOU — with love. ❤️️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at contact@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.

My goal is to get back to where I was at the beginning/middle of 21' My account was 860k, it's now come back to 460k working my way back....