Rules of the Game review | Market making | Last tick for Bull market coming soon

Insider buying suggests 🆙 & China is looking like 📉

Disclaimer/Legal stuff written in plain english

What you read/watch/hear is OPINION not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/youtuber/podcaster. Despite best efforts we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans and risk preferences. It's your money and your responsibility.

YOU are AMAZING #stronghands #BOP community ❤️ — Thank YOU 🙏

$248,734 (up +$19,317 from yesterday) is our Kickstart campaign balance 🙏

856 (up +58 from yesterday) Kickstart members ❤️ supporting us 🙏

3,684 (up +20 from yesterday) substack email community members❤️

36,913 substack direct site hits from community members ❤️

5 days LEFT before our Kickstart ends! JOIN US to Kickstart #stronghands #BOP nation reopening

Link: https://fnd.us/LaunchATGD?ref=ab_8BeHmb_sh_aBf59f

B’s community notes

For today, there are no notes. But all comments and questions we will look to answer tomorrow!

After yesterday triple loaded 🍔 substack filled, today a shift in focus

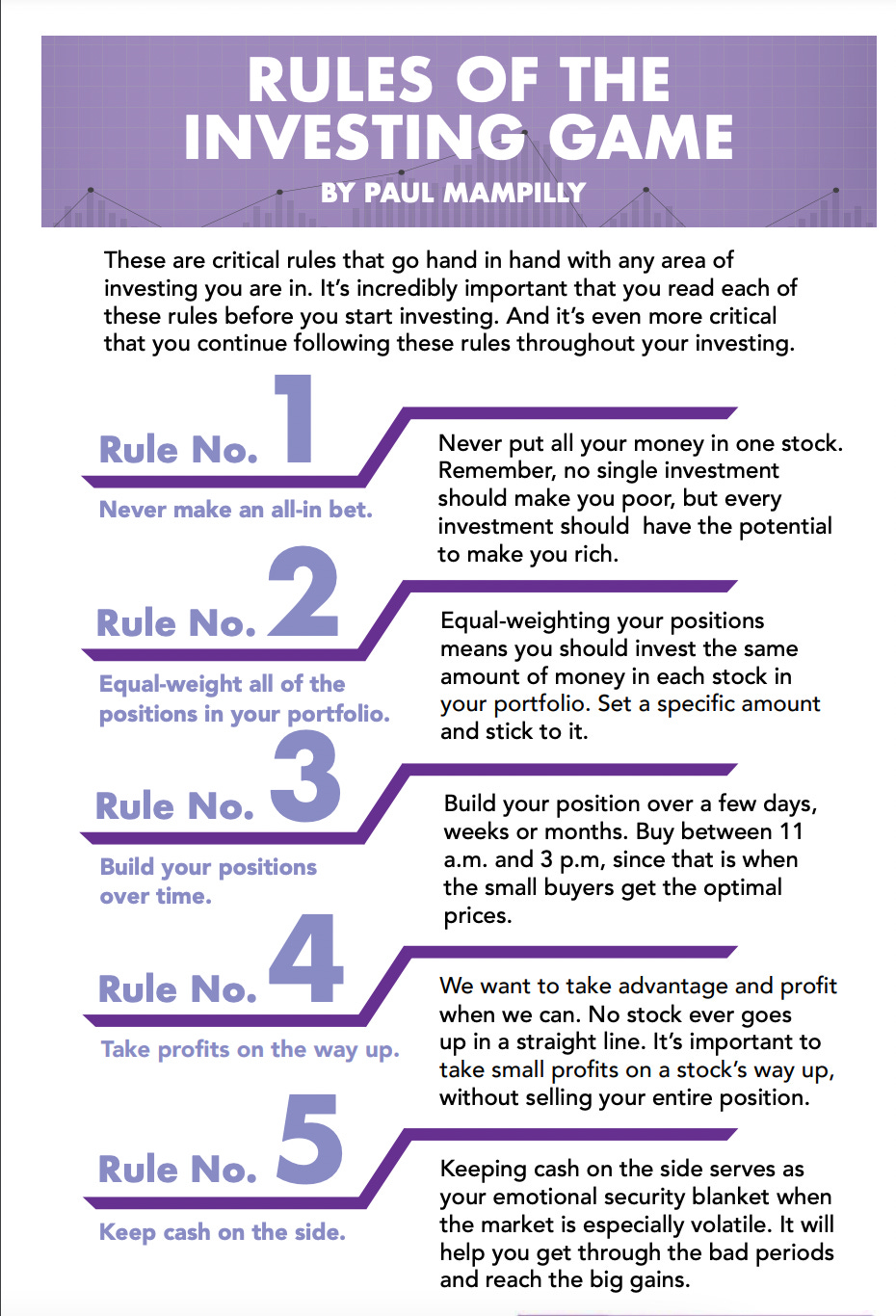

#1 Rule of the Game

This tweet illustrates the essence of Rule 1 of the “Rules of the Game.” Never make an ALL in bet on any single stock/investment. It’s pretty obvious why both from an UPside and DOWNside. On the UPside, if it works out, you effectively have a lottery/jackpot payout. On the DOWNside, if it does not work out, you’ve wiped out a huge amount of your capital, with no way to get it back.

The second element of Rule #1 is this. Give no single investment the ability to make you poor. But every investment should give you the ability to get rich. That’s the thing about so many of our ideas/investments/crypto/stocks — in success mode these ideas can really, genuinely deliver on this promise.

Here’s the rest of my Rules of the Game here

Before anyone puts a single dollar into the market, I would tell you that you should read this, understand this, plot out your plan and THEN go to invest.

How prices make lows and then suddenly move up - watch the vid

I’ve often tried to show people how prices in the stock market get set. And how market makers interact with buyers/sellers to “mark” or “set” prices. This video imbedded in this tweet really SHOWS you how it happens.

In the video two egg sellers interact and the way it happens is EXACTLY how it works in the stock market too. In the video, you’ll see the lady in dark blue is behaving like a market maker. Market makers create the market that favors them. This then allows them to set the price by eliminating all other sellers.

How often have you experienced this? A stock that’s in a relentless downtrend, suddenly reverses a begins what turns out to be a long bull market. Better than any explanation I can provide, in the video you’ll see exactly how this happens. The market price of eggs keeps going down, until ALL the low cost supply is taken in. Then suddenly the price is “marked up” to 3.5x the low price. Anyone who watches stock prices has seen this exact thing happen. What you’re seeing in the video is the demand and supply balance getting tipped over. Bear market —> Bull market.

What’s are the insiders doing with their companystocks?

As a Wall Street analyst, your primary job is to meet with the management of companies. Everyday 6 - 8 company managements — CEOs, CFOs — come in to “Sell” you on their stock. You’ll be shocked to know that CEO’s of many companies spend at least 50% of their time (my estimate) pitching analysts and portfolio managers. I base this on my 1000s meetings I personally took with company managements. These were pitch meetings. The goal is to get you to buy the stock of the company.

In these meetings I’ve had naked bribes offerred to me. The company wanted my/our shares voted in favor of a acquisition they were doing. Obviously, I/we didn’t take the bribe. We voted against the merger because it was a terrible deal. I’ve had offers to be flown to Aspen and god knows what else.

I had CEOs/mgmts disclose some scandalous stuff that I could never repeat. And you know while I had all kinds of things told to me in meetings. One thing that I NEVER ever heard from a CEO or managment is this — I never had a CEO/mgmt ever tell me it was a bad time to own their stock. Never.

I had to learn to look to see what they were doing rather than saying. Now the markets have changed a lot in the last decade. And the truth is that stock options/stocks are now such a big part of mgmt compensation that it’s hard to use information about sellling. However, insider buying is still definitely something that I have found to be useful.

So the signal in the tweet below is definitely something that caught my eye. And you know that this makes sense, especially for our companies. Our companies are cheap, having gotten smashed this year. I imagine that if insider buying for S&P 500 companies is this high, this it’s far higher for our companies because the stock prices are so low and the upside is so great.

China’s two decade+ run of growth is collapsing

China which grew at 10%+ for 2 decades is now in decline. The Chinese economy which is based on three things 1) domestic real estate market 2) infrastructure building and 3) exports are all in simultaneous collapse. Why do I bring this up?

Our stocks got crushed in 2021 and 2022 because “the narrative” was that inflation and growth is too high. And because of that we need high interest rates to bring inflation under control. That’s why the Fed is raising interest rates and keeps saying it’s going to continue doing so.

However, the forward looking data both in the US is showing a global economy that is undergoing a severe slowdown. Truthfully, Europe and China are terrible shape. US is in far better shape but it’s impossible for our to stay high while Europe and China goes thru a severe slowdown.

Companies like Apple, Nike, McDonalds, Starbucks and others have major exposure to China. These companies will definitely see a sales slowdown as a result of Europe & China’s declining economy.

Bottom line: The world economy is going in reverse (especially in Europe and China). That is going to cut growth for the US, because trade is important to the US, accounting for 23% of GDP. To have two of its largest trading partners with declining growth/recession is another data point that imo says that the Fed will need to stop raising rates soon. Not only that they will have to consider lowering them sooner than what the market is currently anticipating.

Which means it’s looks like the last ✅ in our Bull Market checklist likely to be ticked soon

You can read more about my three part Bull market checklist in this substack.

Listen to my BMS 🧑🦲 podcast about why our stocks are setting up to be the most scarce (and valuable) investments in the world. I go in detail about the issues I laid out above.

It’s Thursday. Some days are harder than others. Still it’s still the truth that in the end only LOVE ❤️ remains!!!

TODAY, on August 25, 2022, all of US - ME & WE - All of us - Brittany & Dean, Kate & Ian, Patrick, Dan, Anton, Paul - WE are are SO grateful for your belief and support! 🙏🙏🙏. We will get a picture of us together and put it up in a future substack!

🧡This Substack made by US for YOU with LVOE 🧡 LOVE from our Heart ❤️

Paul, PLEASE slow down. I feel bombarded with too many things from you. Slowly and clearly (no emojis) state what (how much) you want and for WHAT? What are tiers? How many are there? Why do they matter? What exactly is a kickstart? What in the world is substack?

Thanks to Paul and team. Surely ole Jerome is not going to take the risk of rising interest rates more than 0.25% given the perilous state the world economy is in. Even 0.5 would be a good signal. Just feels like the portfolio wants to break out. If I am right the bull is on!

Looking forward to the team photo.