China’s Quiet Long-Game ♟️

The trade that backfired on the West. 🌎

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company’s Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro-analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,352

Standout Wins in a Volatile Market 📈 📉

The crypto market’s been tough lately . . . dumping across the board, with Bitcoin USD (BTC-USD) even slipping under $100K.

No doubt, we’re experiencing one of the most difficult stretches of the cycle.

But even in this environment, ATG Digital members scored some notable wins in crypto these past few days.

Last Friday, Gold Tier members had the opportunity to lock in two triple-digit gains from our crypto miner plays in IREN Limited (Nasdaq: IREN) and Cipher Mining Inc. (Nasdaq: CIFR).

Take a look:

Results not guaranteed.

Earlier today, Diamond Tier members had the chance to lock in these four profits from crypto miners:

Results not guaranteed.

We’ll be first to say it: We don’t always get everything right.

In full transparency, not all of our recent crypto trades were winners.

We also closed several positions at a loss in both tiers as selling pressure hit the entire sector.

Crypto is high risk and high volatility.

But that volatility is the price you pay for the chance at outsized gains — the kind that can shift your portfolio in a single move.

We remain long-term bullish on crypto.

But with the recent market reset, we’re tightening up: securing gains where we can and cutting losers quickly.

If you want to better understand crypto before the next major turn — which we fully expect — grab your free Crypto Cheat Sheet below. 👇

Paul: How We Handed Our Future to China 🔍

In the 1990s, Western CEOs hitched their wagons to a new vision: outsourcing the so-called “dirty work” to China.

This post-Cold War idea would allow these companies to keep profits while they basked in a service economy boom.

At the time, the logic seemed airtight.

Shifting manufacturing to China slashed costs by up to 70% in industries such as textiles and electronics.

Public companies from the U.S. offloaded the gritty jobs as shareholders reaped rewards through stock buybacks and mega-mergers.

But while Wall Street cheered quarterly earnings, the West began hollowing out its own industrial base.

In the U.S., this resulted in shuttered mills and ghost towns in the Rust Belt.

America assumed it would always control design and demand, even if it no longer built anything.

China’s Quiet Checkmate ♟️

While the West celebrated its cost-cutting measures, China played the long game.

The Chinese government subsidized infrastructure and developed domestic talent, ensuring the know-how could be cultivated and ingrained in their culture long after Western firms left the country.

In doing so, China rewrote the Western playbooks.

By 2010, the Chinese controlled 97% of rare earth output, according to the United States Geological Survey (USGS).

China also dominated lithium processing and built a fortress around the resources that power everything from electric vehicles (EVs) to smartphones.

This transformation was subtle but seismic.

While Western markets focused on short-term profits, China built supply chains that are difficult to replace.

Then came the West’s green revolution . . .

The Mirage of ‘Green’ Progress ♻️

Policymakers in the West declared a clean-energy future, championing EVs and renewables.

Governments worldwide poured trillions into climate technology such as solar, wind, and batteries.

Except much of that “clean” progress rides on dirty Chinese supply chains.

For example, 80% of solar panels are made in China, often using coal-powered electricity.

Many EV batteries depend on Chinese-refined lithium and cobalt, a practice linked to human rights concerns because some of these metals are mined in forced-labor camps.

The West didn’t eliminate pollution — it just exported it.

Fast-forward to 2025 and every major supply chain — from pharmaceuticals to semiconductors — has some critical dependency on China.

Ventilator valves, microchips, and rare earths come from China.

Tariff fights, tensions in Taiwan, and pandemic-era disruptions only made these vulnerabilities more visible and urgent.

Meanwhile, China used that time to consolidate its economic and geopolitical power.

The Long Road to Sovereignty 🛣️

There’s no easy off-ramp here.

Reclaiming industrial strength means embracing the “ugly” again: mining, smelting, refining.

These are processes investors once shunned as too slow, dirty, and hard.

But companies harnessing these tough sectors offer the foundation for a more resilient future.

We’re talking about rare earth producers, domestic energy refiners, and critical metals startups.

To make the transition, the U.S. must permit reforms, provide targeted subsidies, and offer incentives for reshoring.

And as Dan covered in Friday’s Substack, efforts to revitalize U.S. manufacturing and onshoring production are already underway.

We want to see capital flowing into projects that build real infrastructure, not just market hype.

At ATG Digital, we believe the future belongs to the builders . . .

The chemists purifying vanadium, the engineers reviving America’s forgotten mines, and the founders building chip fabs outside the shadow of Shenzhen.

These aren’t alluring, sexy businesses.

But they’re the essential ones we’re backing.

When the next crisis hits (be it a flu, a flashpoint, or a flood) we can’t afford to outsource our national sovereignty.

See What We’re Backing Next 🚀

At ATG Digital, we placed our bets on the industrials and materials reshaping the West’s future — and the new era of re-industrialization is just beginning.

Want to see the positions we hold to capitalize on this megatrend? 👀

Click below to join a tier and discover our high-conviction plays, including exclusive access to model portfolios, live trade recommendations, weekly portfolio update, and much more. 👇

Don’t miss the next move — subscriptions start at just $9.99/month! ✨

#OGI100: Monday, November 17, 2025

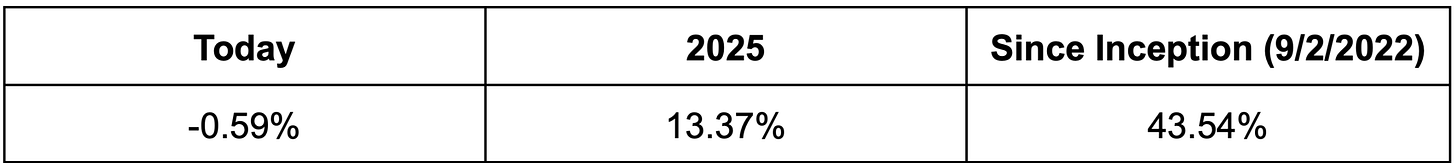

The #OGI100 is down 0.59% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio composed of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan shares an infrastructure-focused energy play. 🔥

Banks Aren’t Ready for This . . . But You Can Be 💥

There’s a revolutionary shift unfolding in crypto . . .

One that doesn’t wait for market hours, bank approvals, or anyone’s permission. 🤯

And most investors still have no idea how fast it’s accelerating.

In his latest video, Dan explains the tech behind it that eliminates middlemen and lets you trade, borrow, and earn anytime, anywhere. 🌍⚡

To discover the side of crypto that banks hope you ignore, hit play below.

And we want to thank your viewers for these amazing comments:

Got insights of your own? 👀

Drop a comment on our channel — we read every one and we’re always looking for ways to serve you better.

On Monday, November 17, 2025, subscribe to our YouTube channel for more content from the ATG Digital team!

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It’s your money and your responsibility.

I ran 💨away with profits from IREN and Siphoned off biggest profits from Cipher mining. . . best picks ⛏️ gotta love 😍 ATG gold tier!