Double-Digit Gains With This E-Commerce 🛍️ Giant

We made a profit today!

Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on ideas preselected by you.

(Purple Tier Members)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 5,758 (+5)

Congratulations, Platinum Members! 🤩

Today, members of our Platinum Tier were able to bag a profit on our 3D Systems Corporation (NYSE: DDD) options! 👇

And that’s surely cause for celebration! 🥳

If you made gains off this trade, let us know in the comment section. 😊

However, if you’re not yet a member and don’t want to miss out on the next opportunity, click here!

Dan: Investing the ATG Way 🌟

ATG Digital offers several different subscription memberships, each pursuing varying opportunities in the market.

Our Diamond Tier model portfolio, for example, offers insight on microcap companies with the chance to give us triple- to quadruple-digit gains.

We currently have 45 open positions in our Diamond Tier model portfolio and believe big gains are coming for these small companies.

Many of these companies had their stock prices smashed over the past two years. But now, we’re seeing a massive bounce back!

Gains on the Way 📈

Earlier this year, on January 17, 2024, we alerted our subscribers that we were adding The RealReal Inc. (Nasdaq: REAL) to our Diamond Tier model portfolio.

At the time, the stock price was $1.73 . . .

Today, the stock is sitting around $3.60, giving us a gain of 108%.

We’re still holding REAL 0.00%↑ because we believe more gains are to come!

For starters, REAL 0.00%↑ is the largest pure-play luxury resale platform in the U.S., generating $1.7 billion in 2023.

This revenue was generated from gross merchandise volume and addresses a niche (personal luxury resale) that had previously been serviced by inefficient upscale boutiques and local pawn shops.

The company generates revenue via consignment and first-party sales on its online marketplace, and through a small volume of direct sales.

With a hands-on approach — that actively sources inventory and authenticates every item on its platform — REAL 0.00%↑ is able to justify much higher rates than peers.

This works out to roughly 34% of net merchandise value, which excludes returns, cancellations, and first-party sales.

Adapting to the New World 🌍

So why are we holding?

REAL 0.00%↑’s stock price is down 88% since 2021.

The high inflation and interest rate narrative killed REAL 0.00%↑, along with many other innovative and growth companies.

Since then, REAL 0.00%↑ has adapted to the changing environment.

We’ve stated several times now that companies can’t just grow revenue — they need to show a profit or, at the very least, a path to profitability.

That’s what REAL 0.00%↑ has done.

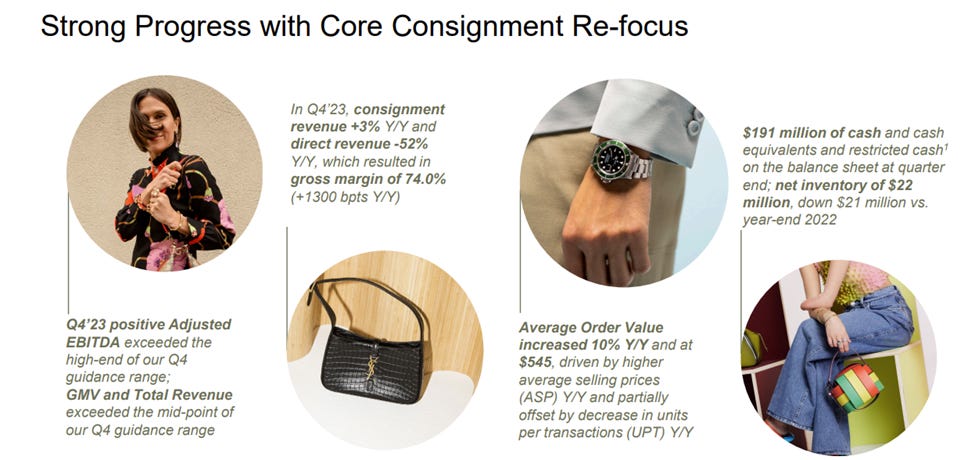

For Q4 and full-year 2023, net loss improved year over year (YoY) by $17 million and $28 million respectively.

In the fourth quarter of 2023, REAL 0.00%↑ delivered a positive adjusted EBITDA of $1.4 million — improving a whopping $22 million YoY.

REAL 0.00%↑ also has positive free cash flow.

Additionally, REAL 0.00%↑ was able to negotiate its debt on favorable terms. It was able to reduce its debt by $17 million and extend a significant portion of it to 2025.

Incredibly improved numbers and a strong balance sheet have enticed investors to come back into the stock, bidding the price higher!

In our view, this is only the beginning, and we’ll see this continue in REAL 0.00%↑.

There’s More Where That Came From! 👀

We’re REAL 0.00%↑ excited about this companies’ prospects, but it’s not the only one seeing rising price action.

Our portfolio is filled with companies that are experiencing — or, in our opinion, will experience — this type of move.

Many of these companies have seen their stock prices get crushed over the last few years.

Now, we’ll see their stock prices get bid up just like REAL 0.00%↑.

To see what else we hold — and for updates on those companies — check us out by clicking here!

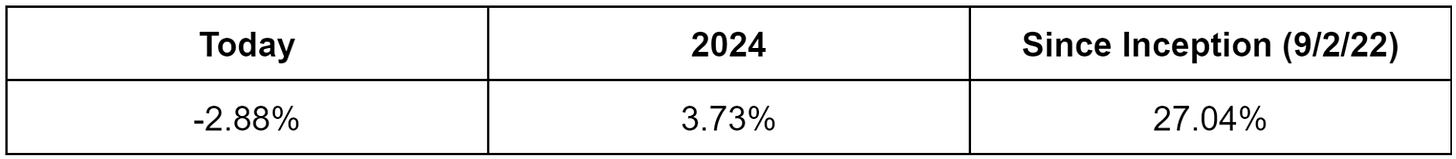

#GBC100: Tuesday, March 5, 2024

The #GBC100 is down 2.88% today.

With markets shifting in our direction, there isn’t anything new to write about. So, just to let you know, we won’t always be commenting on the performance of the #GBC100 daily.

However, we’ll be updating the performance, and we want to remind folks that our goal is to turn the #GBC100 into an ETF that offers a one-stock way to invest the ATG way — in innovation and growth.

To learn more or express your support for the launch of an ETF (by completing a poll), click here.

New YouTube 📺 Content

Earlier today, Paul went live on our YouTube channel to talk about Tesla Inc. (Nasdaq: TSLA). 👀

If you haven’t had the chance to watch it yet, be sure to check it out now! 👆

Tomorrow: Dean will discuss one crypto that’s currently soaring! 🚀

Paul recently received this comment on his Facebook page. 👇

Peter, thank you for writing in! We’re always thrilled to hear from people who’ve seen their financial journeys transformed with our help. 🤗

Because here at ATG, we strive to see our community thrive.

If you haven’t become an official member of the ATG Digital family, consider subscribing here today. 👈

Or follow Paul on Facebook by clicking here!

On Tuesday, March 5, 2024, we hope to hear from more of you soon. 😉

❤️️ This Substack made — by US, for YOU — with love. ❤️️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.

Still holding DDD from Banyan Hill days. Will it ever come back up or is it a lost cause?

Thanks for answering Dean!