Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,247

Dan: A Massive 54% Gain in a Single Day! 🚀

When President Trump drops a hint about the market or policy shifts — we pay attention.

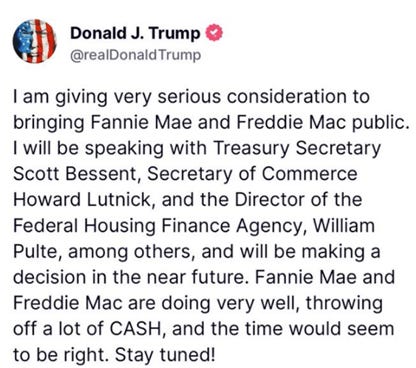

On Wednesday evening, he posted this notable statement on social media:

By Thursday, Federal National Mortgage Association (OTC: FNMA) skyrocketed 54%, and Federal Home Loan Mortgage Corporation (OTC: FMCC) surged 43.5%.

Our lead analyst, Paul Mampilly, covered these two companies for our ATG Digital community for some time now!

We originally added these positions in 2018 when Paul was still with Banyan Hill — purchasing $FNMA at $1.42 and $FMCC at $1.50.

We had high hopes that Trump would release these entities from government conservatorship during his first term.

That plan, however, was sidelined during the pandemic.

Now he’s back — and it’s one of his top priorities to release them.

Here’s what this means for these positions . . . 👇

Breaking Free 🦅

Releasing $FNMA and $FMCC from conservatorship means they will trade just like any other publicly traded company.

Currently, the profits that they generate flow directly to the U.S. government — not investors.

Releasing them would allow shareholders to once again benefit from their earnings.

That’s why the stocks’ prices surged to levels not seen since 2008!

To execute this release and maintain a stable housing market, President Trump is meeting with a few key figures to get the ball rolling.

Treasury Secretary Scott Bessent is tasked with evaluating the financial impacts of releasing $FNMA and $FMCC.

His focus is on mortgage rates.

He emphasized that any decision hinges on the question: Will privatization lead to increased mortgage rates?

With mortgage rates around a decades-high 7%, higher rates would cause even more turbulence in the housing market.

Commerce Secretary Howard Lutnick’s job is to assess the broader economic and financial implications.

The housing sector is a massive part of the economy, and $FNMA and $FMCC play vital roles in it.

This seismic shift could cause some ripple effects, and Lutnick is analyzing what this would mean for the economy.

As the Director of the Federal Housing Finance Agency, William Pulte oversees the conservatorship.

He was also the chairman of both companies and reversed certain regulatory measures to reduce compliance burdens.

His involvement signals a strong intent to push both companies toward privatization.

What We Expect Next 👀

All three — Bessent, Lutnick, and Pulte — have expressed their support for ending conservatorship, as long as the housing market can handle the major policy shift.

We believe that at some point during Trump’s term, this release will happen.

When it does, we expect $FNMA and $FMCC shares to soar even higher.

Although we’re sitting on huge gains in these positions, we think there’s still plenty of meat left on the bone.

Here’s a peek at our open gains on these in the Gold Tier model portfolio:

We’re continuing to hold!

But remember — if any gains look too good to pass up, it’s perfectly fine to lock them in at any moment!

Investing on the Next Level 📊

You just saw what can happen when you’re early — and positioned right. 💪

Now imagine getting live trade alerts the moment we spot big opportunities, like $FNMA and $FMCC.

Ready to level up your portfolio?

⭐ Live Trade Alerts — delivered in real time!

⭐ Full Portfolio Access — see what we’re buying and selling.

⭐ Weekly Portfolio Commentary — timely insights that cut through the noise.

⭐ Q&A Access — got questions? We got answers!

⭐ Bold Contrarian Ideas — takes you won’t find on CNBC.

Could FNMA and FMCC Be Set Free Soon? 👀

If you’ve been following Paul since Banyan Hill, then you know he made a bet that $FNMA and $FMCC would be freed from conservatorship.

And this week, the stocks soared after President Trump made a stunning announcement . . .

In today’s YouTube, ATG Digital analyst Dean talks about what that could mean for the stocks, but most importantly, the prices . . .

Click below to watch!

If you liked this video, be sure to “like,” comment, and subscribe to the channel here!

#OGI100: Friday, May 23, 2025

The #OGI100 is down 0.53% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Next Week: Stay tuned for your next Substack on Tuesday, May 27!

Missed our Substack articles during the week?

Check them out below:

Tuesday — Paul Found the Next Power Move 🔌

Wednesday — How Robert Reached 2,000% Gains 🤑

Thursday — $111K ATH! What’s Next for BTC? 🤔

On Friday, May 23, 2025, we hope you enjoy reading these articles as much as we enjoy putting them together!

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.

I bought over time and kept within my investment average. My averaged costs at .67 a share - finding some satisfaction in 1450% gains so far. Would never have evaluated this trade without ATG. Thank you.