Global Slowdown = Our Stocks Up Soon | +732% STM in 5+ years

#GBC60 stock list is ready | new 🧑🦲 and Youtube vid | 3D printing deep dive

Disclaimer/Legal stuff written in plain english

What you read/watch/hear is OPINION not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/youtuber/podcaster. Despite best efforts we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans and risk preferences. It's your money and your responsibility.

#stronghands 🙌 #BOP 🚀 Nation Update ❤️

3,890 (+54) substack 🥞 subscribers

49,579 (+2,046) 🥞 direct site hits since July 15

B’s Community Update

Hi everyone! I hope that this message finds you well.

Kickstarter Contributors: I was able to put a large dent in my email inbox over the weekend and I am still diligently working through your emails. I have figured out a process to speed up my response process and have been cranking through emails all weekend to get caught up. I will continue to push to get through all of your emails as quickly as I can.

If you trying to gain access to your subscription through the website, by putting in your email address, that is not going to work. The website access is currently set to only allow access to the people who have set up a subscription through the link I have sent via email. If you did not see it, please search "Kickstarter Reward Perks: [put your reward tier level here]" (i.e. Kickstarter Reward Perks: Silver, if you gave between $10-$99). If not, please let me know and I will send it again.

Also, I have had other community members tell me that they were able to upgrade their membership level themselves after registering with the discount link from the reward email. So if you are interested in changing your membership level and I have not gotten to your email yet, please use the link from your email to start your membership and then login on our website to manually change your subscription level. If this does not work for you, reach out to me and I will do what I can to get you set up.

Launch Day: Tomorrow is our official launch day! We are so excited to serve all of you! Starting at 12 AM ET on Sept 7th, you will be able to click on the gold button in the bottom right corner of your screen and subscribe to your desired level of membership. Please be aware that you will not be able to access the website prior to our launch time, 12 AM ET on Sept 7th.

To access our website and sign up for your subscription tomorrow, please go to: atgdigital.media (←clickable link)

For any Kickstarter supporters that did not get to access their membership early, I will add a discount of the cost of one free week at your reward level to your account. *For example, if you gave between $10-$99, then you will get $2.50 (the cost of 1 week of the Silver Membership [$9.99 divided by 4 weeks]) applied to your account.* I sincerely apologize for the delay in getting you access to our services.

Until tomorrow. ❤️

Emoji & Shortcut Codes:

🥞 substack |🎢 market up/down| 📋 checklist| 🙌💪 #stronghands| 🚀#BOP| 🧡#LVOE

rn - right now | imo - in my opinion | #BOP Bullish Optimistic Positive

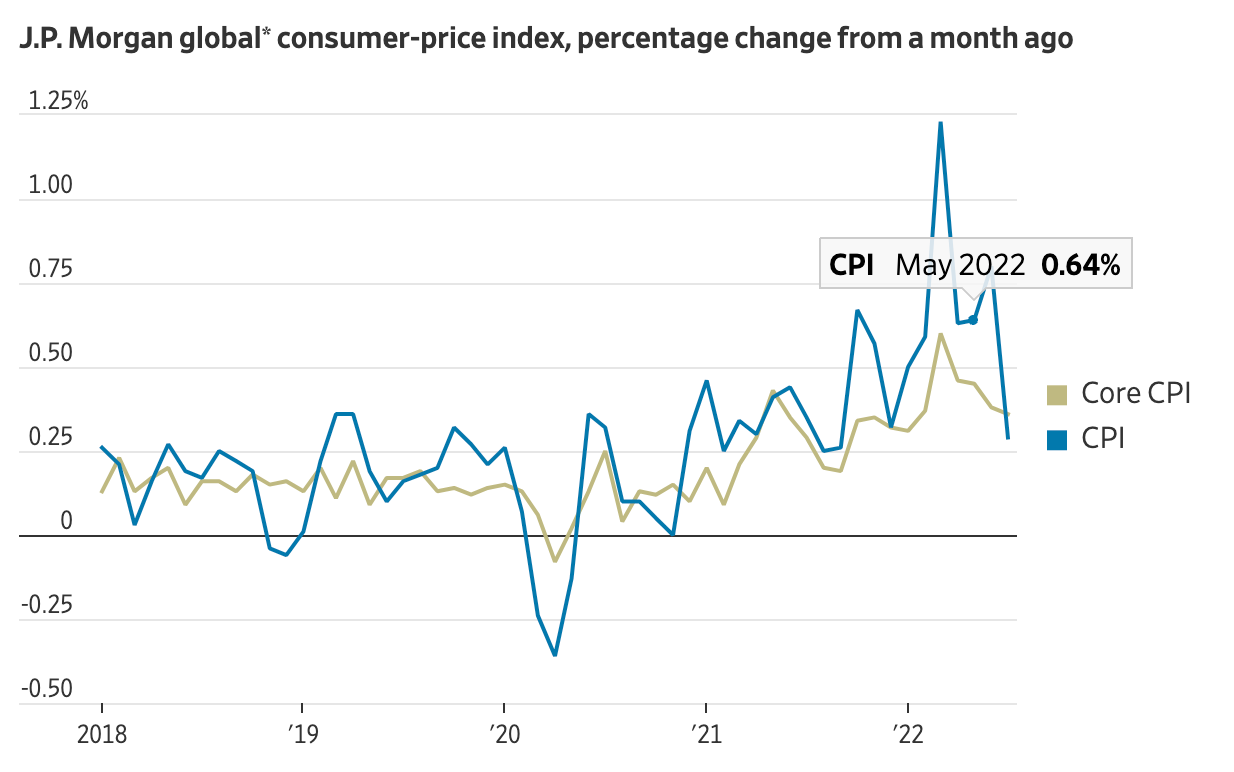

Fed Interest Rates is Crushing Growth/Inflation Globally

The Federal Reserve is crushing growth/inflation globally with its rate hikes. Remember that for growth stocks and crypto, weak growth is positive. Weak growth is positive because it makes growth scarce.

And when growth becomes scarce, it become more valuable. As it becomes more valuable, investors come to chase growth stocks and bid it up in price. Those bid up prices show up as gains in your account.

The World’s 2nd Largest Economy is Leading the Global Slowdown

China is one reason why growth is becoming scarce. China is the world’s second largest economy. “China in 2021 consumed 72% of the world’s iron-ore imports, 55% of refined copper and more than 15% of oil globally.”

Iron-ore prices are down around 40% from their peak. As China slows down, it uses fewer commodities. As China uses fewer commodities, it makes the prices of these commodities go down. As the prices of these commodities go down, inflation goes down.

China’s growth slowdown means inflation for energy and food commodities is nearing an end. This is good news for us, because like I said, weak growth is positive for growth stocks.

Consumer Spending Will Follow Consumer Sentiment

In the US, consumer spending is slowing. Consumer spending is slowing because the Covid era buying boom is over. Second, the inflation spike has crushed people’s sentiment/mood (feeling) to buy.

This crushed sentiment is dimming demand for “big ticket” items like cars and appliances. This dimming demand reduces demand for all commodities and all the things that go into these big ticket items.

This dimming demand is reducing growth. Weak growth, as I mentioned, is good for growth stocks.

US Housing Market is Now Going Backwards

The Fed’s rate increases have spiked the 30 year mortgage interest rate to 6%. The 30 year mortgage interest rates was at 2% in 2021. This jump in mortgage rates from 2% to 6% is now causing a major US housing market slowdown.

Housing is the one of the primary drivers of purchases. Once you buy a house, it triggers a series of expenses that supports all kinds of businesses.

The housing market slowing down means weaker overall US economic growth. Weaker growth makes growth stocks more valuable because growth is scarce.

What Does it All Mean For Our Stocks and Crypto?

I believe that it means that we’re nearly at the end of the bear market. The data/evidence overwhelmingly shows that the inflation/growth narrative that ruled markets for over 1 year is wrong.

The tug of war I wrote to you about last week is nearing an end.

I believe the Fed is going to change its rhetoric and bow to reality. Reality in my opinion means that the Fed acknowledges that the narrative of — too much growth/inflation — is false.

When this narrative collapses, the tug of war will end.

Next, buyers will come to lift the prices of our stocks and crypto higher. Truth is that our stocks are too low for a growth scarce world. Imo, they will rocket up once the Fed changes its rhetoric.

I believe that a BRIGHT, PROSPEROUS future lies ahead for our stocks and crypto. I’m v v v #BOP 🚀 on our stocks.

Our Time Frames Are Long Because We Want to Make BIG Money💰

Our time frames are 3 - 5 years from the time we put a stock into our model portfolios. That means you start the clock when you BUY and end the clock off when you SELL.

This is what we did with STM 0.00%↑ ST Microelectronics, where we owned the stock for a bit over 5 year and finally sold for gains of 732%.

As at Banyan Hill, our goal is to make BIG money over time. In that time, you can expect to experience bear markets, crashes, corrections, winning streaks, losing streaks, periods of outperformance and underperformance.

Nothing will be perfectly right. Sometimes I will miss things, or get things wrong. Our strategy includes taking risks to make money. It is NOT a safety first strategy.

We don’t embody the “steady-eddie” style of stock picking. Our focus is on making BIG money. And we believe that this period of time, represents a GENERATIONAL opportunity to make BIG money because of new technology and innovation.

But it’s never, ever going to be a straight line or be perfect. This is specifically why I say to use the Rules of the Game. In particular, keep cash in your investment account to ride through the tough periods.

Sell on the way up when your personal circumstances tell you it’s time to SELL - pay off the house, car, or use profits for retirement. Use the stock market as a means to an end to a better life.

Goodies For Kickstarter Folks

I’ve completed my #growthbluechips stock list. 60 amazingly extraordinary, phenomenal companies that I believe can absolutely make you a humongous amount of money over time.

The #growthbluechips is now live on a Google Worksheet. I’ve created a version that folks who gave to our kickstarter can access. You can easily copy and paste to customize it in any way you want.

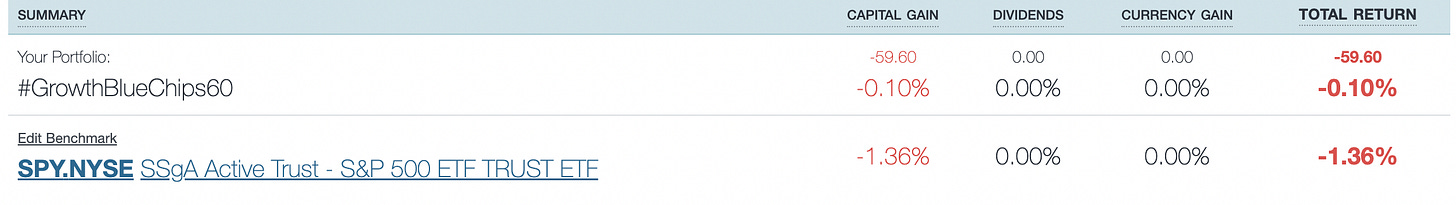

I’ve also turned this into an equal weighted index/portfolio/basket that I will be reporting on daily. Now, when we want to know how OUR stocks are doing as a group, I can look it up and tell you like this. This was taken at around 1 pm this afternoon.

And you can see that our stocks were doing better than the S&P 500 when I took this snapshot.

We’ll be looking to send out the #GBC60 list to all the folks who contributed to the Kickstarter soon. Once the list is sent out to supporters, we’ll send out an email invitation to a private livestream event for folks who supported us with $10k or more.

Then, we’ll take a transcript of this conversation and turn it into a report that we’ll send to all Kickstart supporters. When will this all happen? Well, we still have a 150+ of backlog of login/password requests still being processed.

B & Kate are doing superhuman work to get to everyone who is writing. So, we’ll get this out once that’s been completed. As I’ve mentioned to you before, we are operating at a Mom-and-Pop level compared to Banyan Hill.

Our operational team is B, Kate, and Mylah versus 30 or 40 people when we were at Banyan. We promise we are working at 1000% to get everything to you as fast, and as smoothly as we can.

A 3D Printing Deep Dive for Kickstart Folks With an +Extra for Those Who Gave $10k

Another Kickstarter goodie that is coming is a deep dive on 3D printing stocks. 20 hours of work in a labor of LVOE 🧡 to YOU #stronghands #BOP nation!

I’ll create a public Google worksheet for this as well. And then, we’ll send this out to Kickstarter supporters in the coming weeks. Those folks in the $1k and $10k supporter group will get a special version of the spreadsheet.

This special version of the spreadsheet will come with observations from me. These observations will be about the company and valuations. The observations will be on how to interpret things and will not be recommendations.

As a general comment, I can say that when you look at this information, you’re going to have the same view as me. I’m v v v #BOP 🚀 on 3D printing stocks!

BMS 🧑🦲 Now in 75 Countries!!!

🎙️ Bald Man🧑🦲 Speculating podcast is blowing up! We just crossed 10,000 listens on Spotify. We now have listeners in all 50 US states and 75 countries 🤯. I just recorded my latest episode which you can listen to on Spotify or using the link below.

BMS 🧑🦲 podcast: https://anchor.fm/paul-mampilly0/episodes/One-way-to-invest-for-BIG-money-success-e1n9051/a-a8fd3ur

📺 New Youtube video as well today!

It’s Tuesday. #stronghands #BOP 🚀 nation folks from around the world are adding a bit of hot sauce to make their Tacos 🌮 extra tasty today. Watch this ☝🏼to prepare for the massive bull market coming for our stocks!!!

No one knows anything, but everyone knows that every substack I gotta say “in the end there is only LOVE ❤️!!!” I ❤️ U

TODAY, on September 6, 2022, ME - WE - US - Brittany & Dean, Kate & Ian, Mylah, Patrick, Dan, Nicole, Anton, & Paul - We made this Substack just 4 YOU with LVOE 🧡 LOVE from our Heart ❤️

Hi Paul,

In the transition will you be helping us manage the stocks that have been recommend from Banyan hill for inner circle/all subscribers? I received a sell for four stock specifically FNMA/FMCC/ACB/TGOD- Paul- are these still a hold? Or a sell at this point. For all others recommended-are we expected to just manage these on our own now? Or will this new group be getting some recommendations on when to sell what has previously been recommended while at BH? I apologize ahead of time if this question has been asked and answered. Please point me in the direction where this question was answered. Much appreciated! Flo

Any chance of getting into the kickstarter still?