Government's Shutdown Is Pumping This 🚀

This rally is practically free money. 😎💰

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company’s Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,345 (+2)

A Triple-Digit Winner! 🥳

Today, members of our Platinum Tier had the opportunity to lock in a triple-digit win on an options trade in ProShares Ultra Silver (NYSE: AGQ).

Take a look!

Results not guaranteed.

And we heard from one ATG Digital member who was able to profit! 🙌

Nathan, thank you for writing in! We’re thrilled to hear this!

On that note, if you have a success story to share, drop it in the comment section.

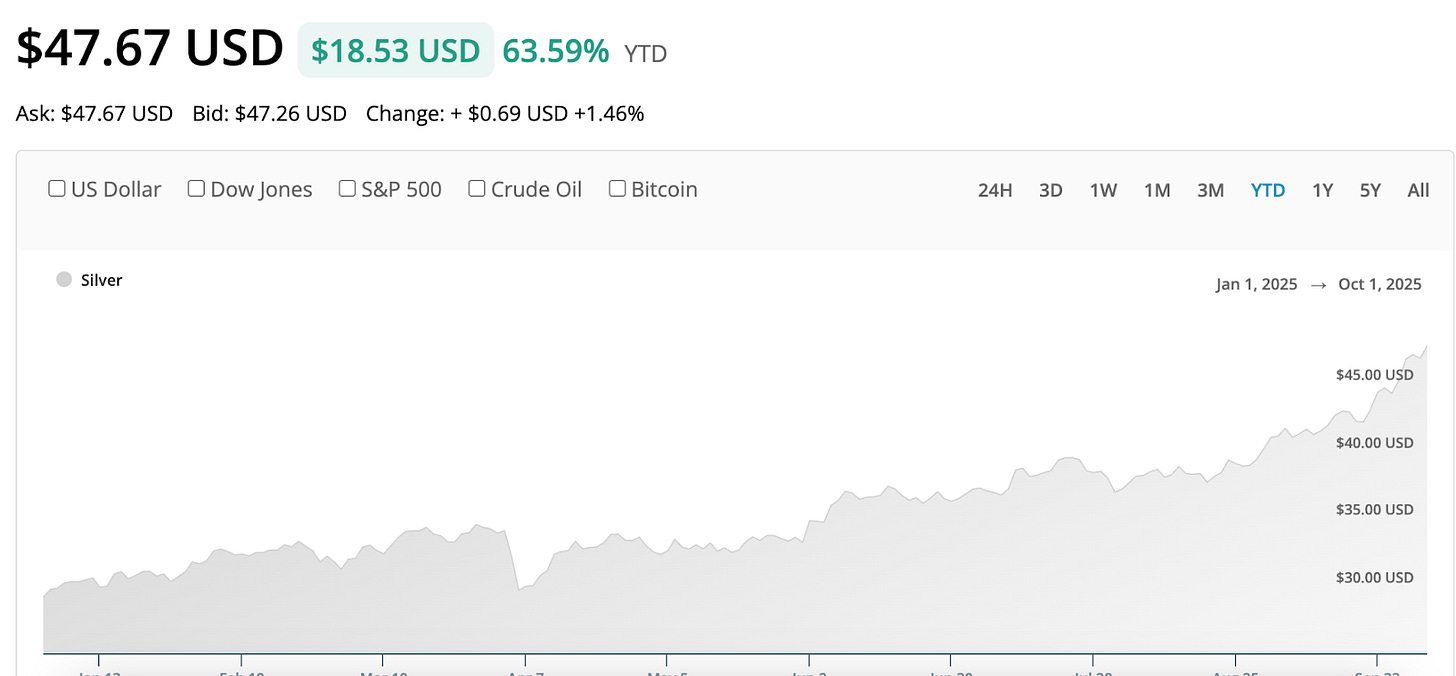

Our AGQ options trade was a leveraged play on silver’s breakout.

Of course, not every trade will be a winner.

Our options portfolio has its swings — some up, some down.

But when the conditions align, we stand a chance to capture quick, “in-and-out” wins.

If you’re not a member of our Platinum Tier but would like to become one for future options trades like this one, consider joining today! 👇

Just 1 Day Away — Unlock Paul’s Gold Strategy! 🥇

Tomorrow’s the big day . . .

Our quarterly Purple Tier Market Analysis Webinar goes LIVE! 🙌

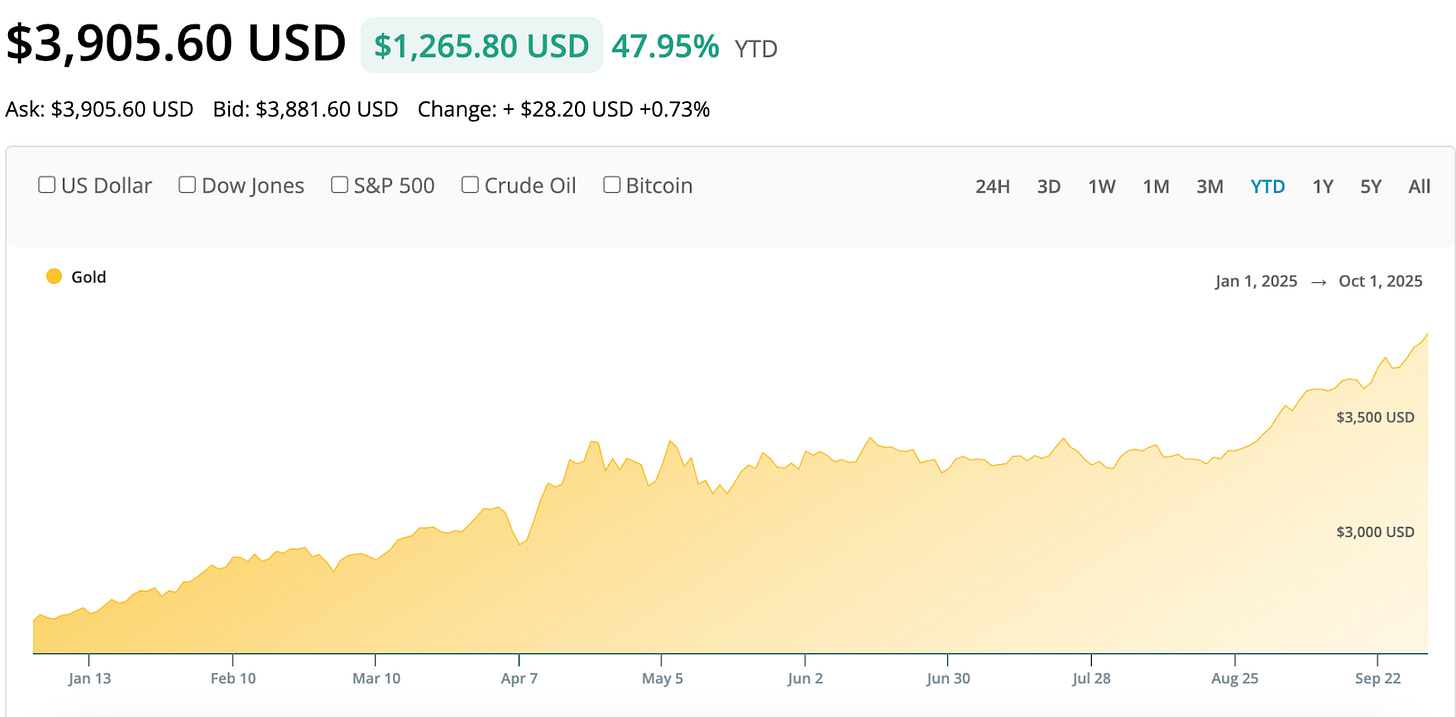

Lead analyst Paul Mampilly will cover the soaring gold bull market and share his top gold stocks.

🗓️ Thursday, October 2, 2025

🕔 5:30 PM EST

To unlock access to tomorrow’s event, click below to join the Purple Tier today!

You’ll also enjoy exclusive benefits and perks reserved for our most dedicated members! 💜

Dean: Please Don’t Make Me Say It 😩

I hate to be that guy who says it again but . . .

Gold and silver continue to break out!

We’ve shared why these metals continue to make new highs in a recent Substack, so I won’t do that here.

But what I will do is point to a few new catalysts lifting the price of precious metals! 👇

Pure Chaos 🔥

As if 2025 wasn’t eventful enough, the U.S. government is undergoing a government shutdown due to Republicans and Democrats being divided on a funding bill.

As a result, millions of Americans are going without pay.

This includes national parks staff, over a million serving in the military, healthcare workers, national cybersecurity experts, the Food and Drug Administration (FDA) — you name it.

Hopefully, this is resolved sooner than later.

But for now, it’s just another tailwind for risk-off assets like gold and silver.

The same can be said of the U.S. dollar’s decline, on track for its fourth consecutive red day, its longest losing streak since July.

In other words, there’s no shortage of reasons for investors to pile into investments typically viewed as safe havens.

Which bodes well for this miner! 🚀

Get in Before It’s Too Late 👀

To capitalize on rising demand for gold and silver, we added nearly 20 precious metals miners across our ATG Digital portfolios.

Miners are leveraged bets on the underlying assets they mine.

Currently, our metals miners positions are all up double-digits!

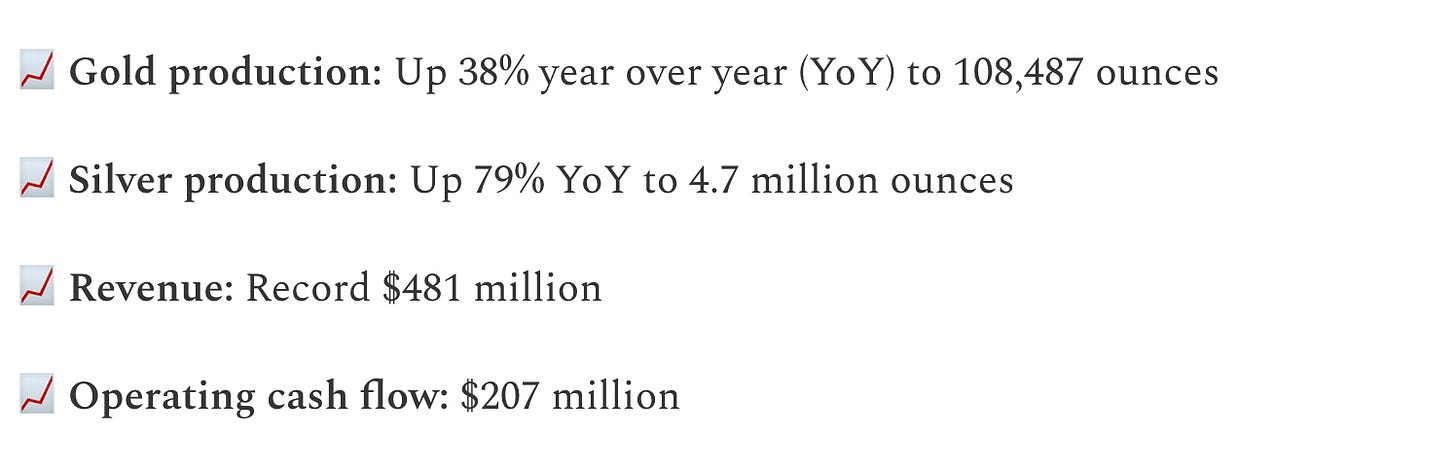

We shared Coeur Mining Inc. (NYSE: CDE) nearly two months ago in this Substack.

Then, it was only up 51% . . .

Now?

It’s up a whopping 150%! 🚀

So, what’s changed?

Nothing, really. Here’s a look at its latest earnings:

We anticipated increased demand as these companies’ margins expanded courtesy of rising gold prices.

With their operational costs remaining mostly fixed, these companies enjoy more profit per ounce of gold sold.

For now, we’ll continue to hold for more potential upside.

1 of Many Finite Trends 💹

In a macro landscape dominated by sticky inflation, increased money issuance, and growing concern for the national debt ($37.5 trillion), assets with built-in scarcity are the way to go.

The precious metals trend is one of many set to benefit from this environment.

The best part?

We’re very early in this transition from market darlings to companies backed by robust balance sheets and pricing power!

To get exposure today, click below! 👇

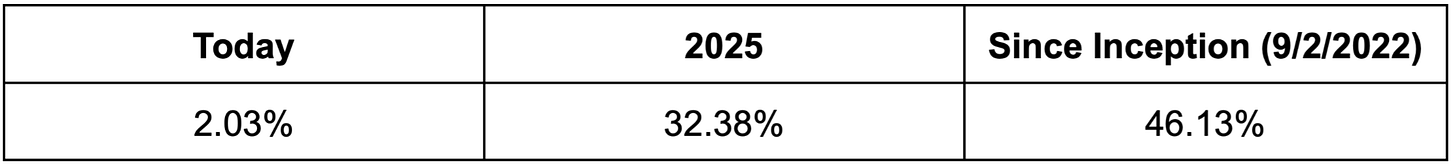

#OGI100: Wednesday, October 1, 2025

The #OGI100 is up 2.03% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dean covers a legacy titan’s bold move. 💥

Did You Catch This? 👀

Paul recently dropped his bold take on the next big moves in the market . . .

He’s calling for a major shift ⎯ the likes of which we haven’t seen in decades!

If you haven’t already, be sure to watch the full video below!

Loving these timely insights?

Hit the “👍” button and subscribe to our YouTube channel by clicking here! 🔔

Happy October! 🍂🥧

Today marks not just a new month, but the start of the final quarter of the year!

This is often where the biggest moves in the markets happen — and here at ATG Digital, we’ve got plenty brewing behind the scenes. ☕

From new market insights to expert trading strategies designed to help you stay ahead, there’s no better season to stay tuned.

On Wednesday, October 1, 2025, we hope you enjoy the fall season as you watch for more updates on the markets!

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It’s your money and your responsibility.

NASA has not "found" a gold asteroid in the sense of a new discovery. Perhaps Elon can catch it cuz it would be worth 1Trillion dollars.