Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on ideas preselected by you. (Purple Tier Members)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,018

Dean: The Coast Is Clear 😮💨

We weathered a long and trying journey, but I think we can finally say it . . .

The worst of the bear market is behind us.

Tesla Inc. (Nasdaq: TSLA) climbed back above $400, Bitcoin USD (BTC-USD) crossed $100K and looks primed for more, and our stocks are seeing daily bids.

In fact, one stock from our Silver Tier model portfolio just entered triple-digit territory!

5.2 Million Stores Globally 🌎

E-commerce giant Shopify Inc. (NYSE: SHOP) has attracted consistent bids.

It’s up 26% on the month, 80% in the last six months, and 100% in our Silver Tier model portfolio!

We entered this stock at a price of $56, and just this week, it hit a high of $118!

Back then, SHOP looked undervalued considering that it’s a leading e-commerce solution used by over 2 million people daily across more than 5 million virtual stores globally.

As digital storefronts continue to grow in adoption, we can expect an e-commerce leader like SHOP to gain market share.

We aren’t surprised to see its phenomenal growth in Q3 . . .

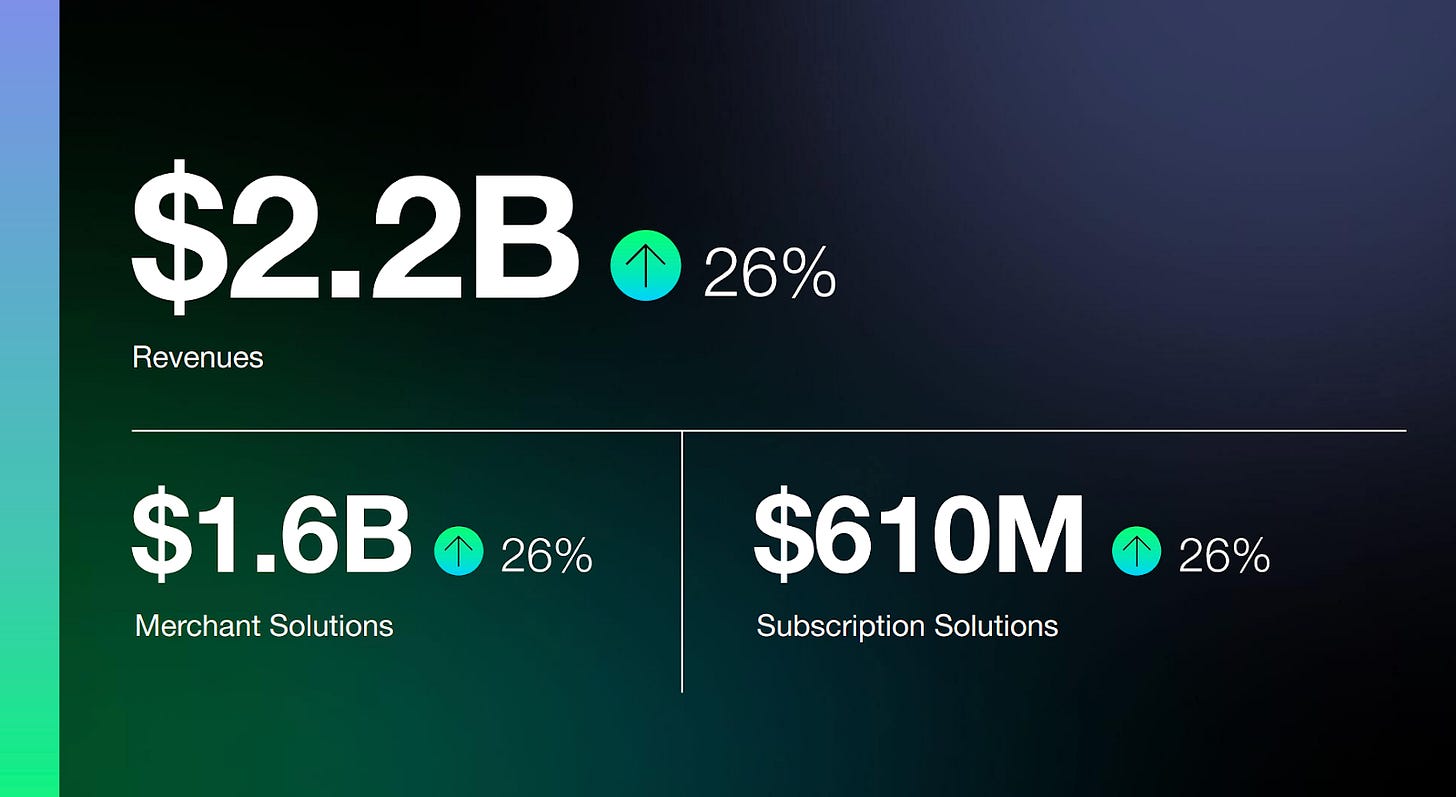

The company grew its revenue to $2.2 billion, a 26% increase year over year (YoY).

It’s seeing growth in both its merchant solutions as well as its subscriptions:

We can see efficiency improving in its business as its gross profit increased to $1.1 billion — up 24% YoY!

SHOP is also well-capitalized with $1.5 billion in cash.

Considering how well the business is performing and the influx of capital returning to the market, we’ll continue holding it in our Silver Tier model portfolio.

Get Exposure to Growth & Innovation 📈

In our opinion, this isn’t the time to be sidelined.

To get exposure to growth and innovation stocks across a variety of sectors — artificial intelligence (AI), biotech, housing, new energy, you name it — click here.

Subscriptions are as cheap as $9.99. 👆

“Thank You, Paul!” 🙏

Yesterday, our lead analyst, Paul Mampilly, went live on YouTube to discuss hot topics like TSLA and BTC . . . 🔥

And one loyal subscriber had this to say:

Liz, we love your #BOP (bullish, optimistic, positive) outlook — and we agree wholeheartedly! 🫡

If you haven’t already, be sure to watch the video below:

Be sure to subscribe to our YouTube channel for more content like this! 📺

#GBC100: Wednesday, December 11, 2024

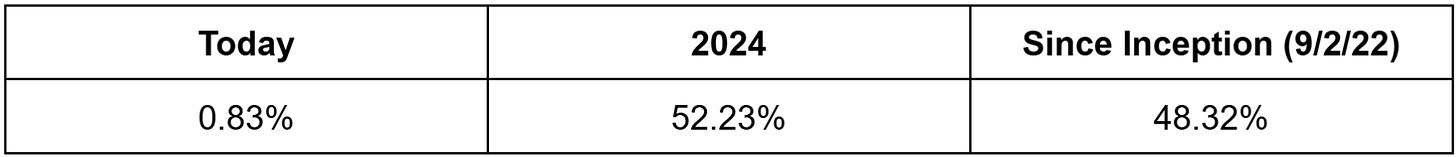

The #GBC100 is up 0.83% today.

Created on September 22, 2022, the #GBC100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #GBC100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #GBC100 into an ETF.

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dean will cover a company in the fintech sphere. 📱 Don’t miss out!

Here at ATG Digital, we talk a lot about crypto . . .

Just last week, we released four articles on it! 👇

And one subscriber had this to say:

We’re thrilled to hear that our community is finding success in the crypto market! We look forward to even more from this sector in the future. 🤗

On Wednesday, December 11, 2024, we hope to hear from more members seeing results with our recommendations! 💪

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.