Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on ideas preselected by you. (Purple Tier Members)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 5,909

Dean: Slowly, Then All at Once 📈

Yesterday, we shared a stock that’s rocketed 60% in less than five months.

Today, we’ll look at one that many counted out . . .

We’ve received countless questions from our subscribers concerning this stock: whether we’d cut losses or continue to hold, whether it would survive in a high interest rate environment, when it would see buying pressure . . .

While we couldn’t answer all of these questions, we did know one thing: We liked the company’s chances of being bid up again.

And boy, it didn’t disappoint!

AI + Lending = 🤑

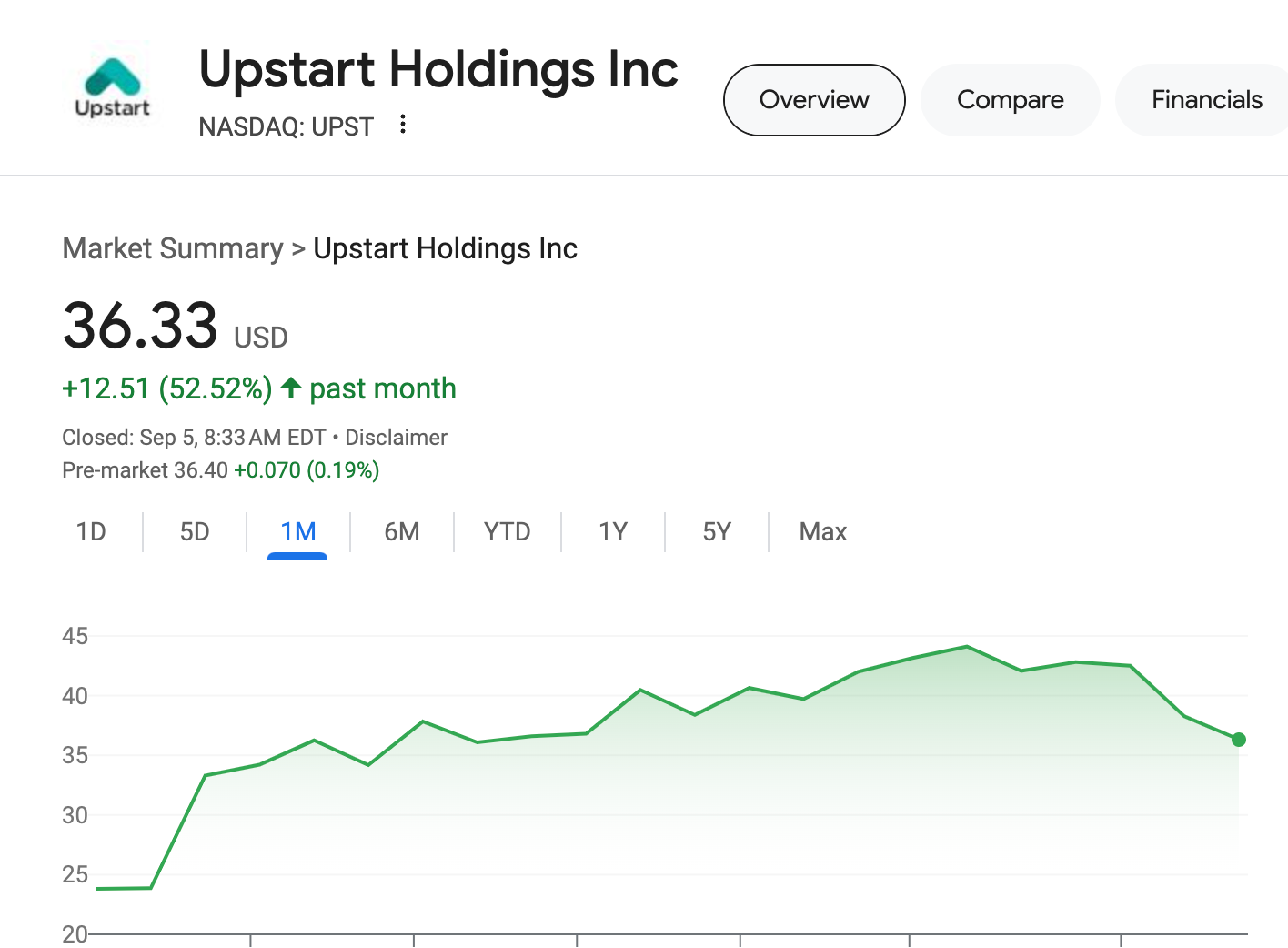

I’m referring to Upstart Holdings Inc. (Nasdaq: UPST), a fintech position we hold in our Gold Tier model portfolio.

UPST 0.00%↑ leverages the power of AI to enhance the lending process.

Its platform helps lenders assess the creditworthiness of consumers while simultaneously connecting them to lenders in a quick and seamless manner.

Ironically, the stock exploded upward — despite an unexciting earnings report:

When a stock sees relentless selling pressure, any good news can cause it to surge. That’s exactly the case for UPST 0.00%↑.

Keep in mind, lending companies are sensitive to interest rates — especially higher-than-normal interest rates like we’ve experienced.

In such an environment, many consumers are sidelined as they await more favorable interest rates.

In addition, lenders are more hesitant to lend to consumers in this environment because there’s a higher risk that the consumer could default on the loan.

In other words, these aren’t the best conditions for lending businesses of this nature to generate revenue.

So, it’s no surprise that UPST 0.00%↑ reported a 6% decrease year over year (YoY) in revenue to $128 million.

But it did share some promising news . . .

Bank After Bank 🏦

In this year alone, UPST 0.00%↑ onboarded 10 banks to its lending platform.

These partnerships will likely propel the company, allowing it to reach even more consumers, generating more revenue in the process.

Right now, UPST 0.00%↑ is trading so cheap that it appears these developments haven’t been priced into the stock:

But some investors were forward-looking enough to bid it up over 50% in recent months!

Despite it being down 17% on the week, we hold it in our Gold Tier model portfolio at a gain of 62%!

Considering that rate cuts are nearing, UPST 0.00%↑ could see a boost in revenue as sidelined consumers enter the market for loans and lenders have less reason to be risk-off.

But truthfully, many of our Gold Tier stocks will benefit from this shift in interest rates.

To get exposure to our Gold Tier model portfolio, including trade alerts, commentary, and guidance, click here to subscribe for just $14.99!

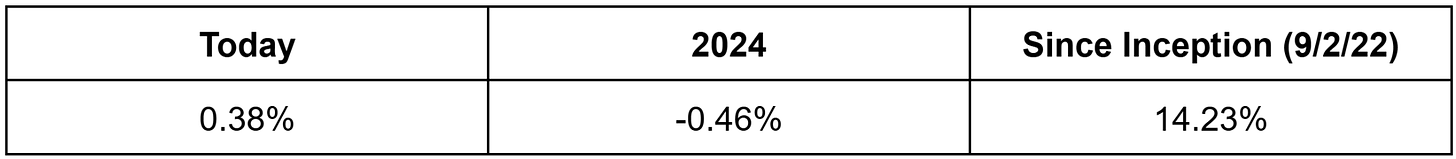

#GBC100: September 5, 2024

The #GBC100 is up 0.38% today.

Created on September 22, 2022, the #GBC100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #GBC100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #GBC100 into an ETF.

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan will cover a Millennial Boom stock . . . 💥 Stay tuned!

Speaking of Dan, he released a new video on our YouTube channel today. 📺

In it, he discusses a new energy company we’ve been keeping an eye on. 👀

If you haven’t already, be sure to watch it now for all the details!

On Thursday, September 5, 2024, we hope you’ll subscribe to our YouTube channel for more from the team! 😉

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.