Powell Cuts? These Stocks Could Explode 🚀

The Bald Man Speculating is back! 🧑🦲💸

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company’s Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,359

Paul’s New Episode — Out Now! 🎙️

Ever wonder why Wall Street always seems a few steps ahead?

Simple — they run the game.

In the latest Bald Man Speculating episode, Paul exposes the sneaky strategies pros and institutions use to transfer wealth from everyday investors to themselves.

If you want to see how the Wall Street game is really played — and avoid the biggest traps set for investors like you — this one’s a must-listen.

It will completely change the way you look at every market move. 💥

Just click on the image or button below to listen now!

If you enjoyed these insights, please leave a rating and a review on Spotify — it helps more market enthusiasts discover the show.

We truly appreciate your feedback and support! 🙏

Dean: Value Investors, It’s Your Time to Shine ☀️

Ever heard the saying that a consensus trade — meaning everyone’s in on it — doesn’t have much fuel left?

That’s sort of what we’re seeing in artificial intelligence (AI) stocks.

This euphoria began creeping into the gold trade as well, which made me a bit nervous.

But right on cue, it corrected, leading to doom and gloom takes across social media and news outlets:

After rallying over 50% year to date, an 8% drop from $4,300 spooked the market.

But for value investors like me, I can’t help but feel like . . .

Because in our view, these four catalysts are likely to push gold to new highs in 2026! 👇

Catalyst #1: Rate Cuts

Just in, Federal Reserve Chair Jerome Powell cut rates by 0.25%:

Though Powell noted a December cut is ‘far from certain,’ this move reinforces the broader trend of dollar debasement driven by easing monetary policy.

In addition, his term is up in May of 2026, allowing President Trump to appoint someone whose monetary policy is in alignment with his.

For context, President Trump prefers lower rates.

Should we continue on the current trajectory, the dollar will likely lose more purchasing power, enticing investors to buy safe-haven assets like gold.

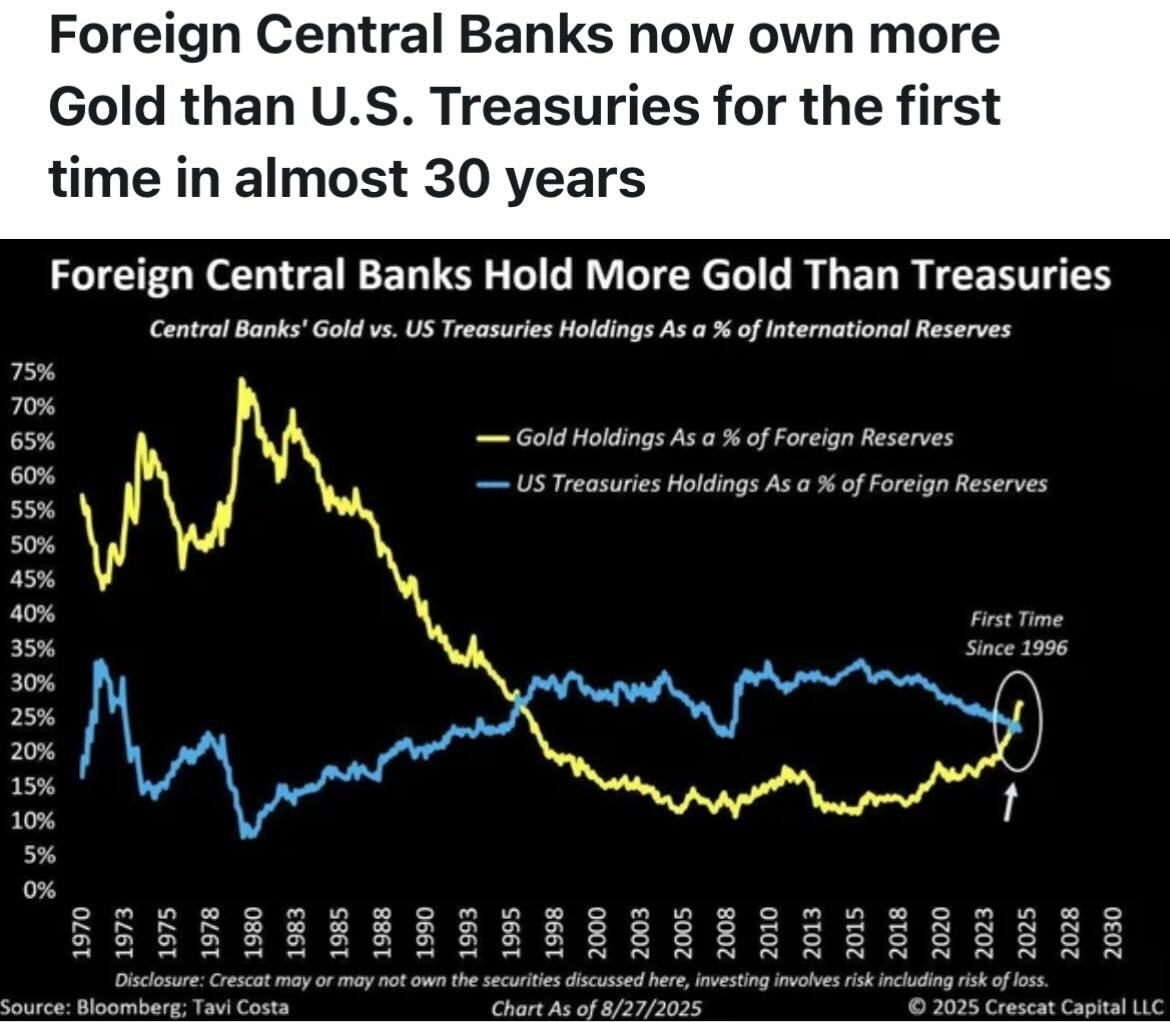

Catalyst #2: Global Accumulation 🌎

And if you think gold is overbought, think again.

Right now, holders of gold stocks are riding a tailwind that hasn’t appeared in years — decades even:

What you’re seeing unfold isn’t mere speculation . . .

It’s more accurately described as a broader strategic realignment in reserve management.

In other words, these banks aren’t buying for a quick flip.

The large accumulation of gold represents three core concerns:

❌ Concern about U.S. debt levels (treasuries are dominated in dollars)

❌ Distrust in future purchasing power of the dollar

❌ Trade war fears and geopolitical independence

What’s more is that these issues don’t look to be resolved anytime soon.

The U.S national debt won’t disappear overnight, interest rate cuts continue to debase the dollar, and trade wars along with geopolitical tension appear far from over.

But these aren’t the only tailwinds . . .

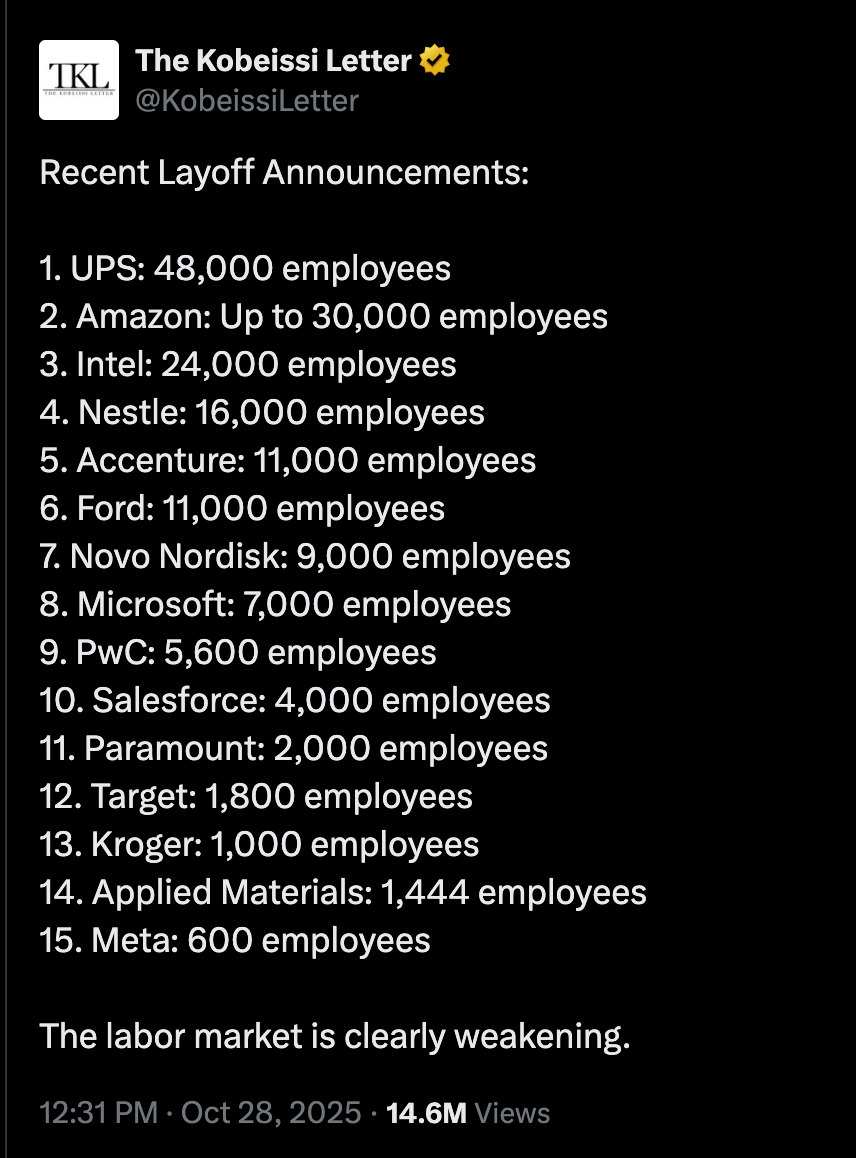

Catalyst #3: A Cooked Labor Market? 🍳

Recently, a slew of companies announced massive layoffs:

As the labor market shows signs of stress, there’s potential for investors to buy safe-haven stocks, like those correlated to gold.

Ironically, these stress signals are emerging as the S&P 500 makes new all-time highs weekly.

What could possibly go wrong?

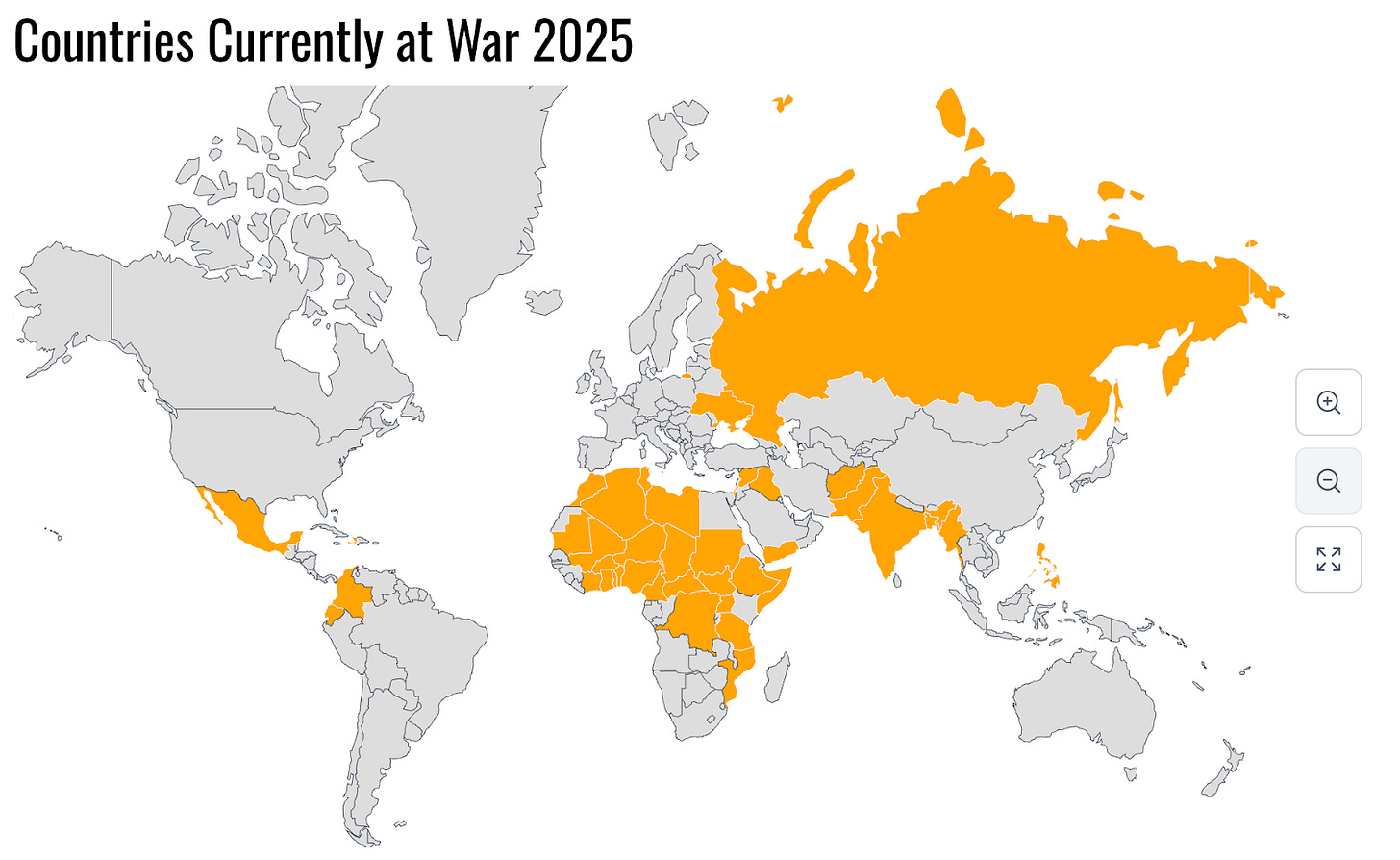

Catalyst #4: War Abound ⚔️

Not to mention the world’s navigating dozens of wars:

History shows that wars are inflationary, causing investors to seek alternatives to fiat currencies.

In addition, geopolitical issues could entice countries to hold less fiat currencies that could easily be restricted, like in the case with Russia after invading Ukraine.

All things considered, we like the chances of gold prices rising higher in 2026.

So, if you want leveraged exposure to this trend, precious metal miners are the way to go.

We have exposure to them across all our ATG Digital portfolios!

Many have pulled back, allowing a timely entry for savvy investors.

Get exposure today by clicking the button below! 👇

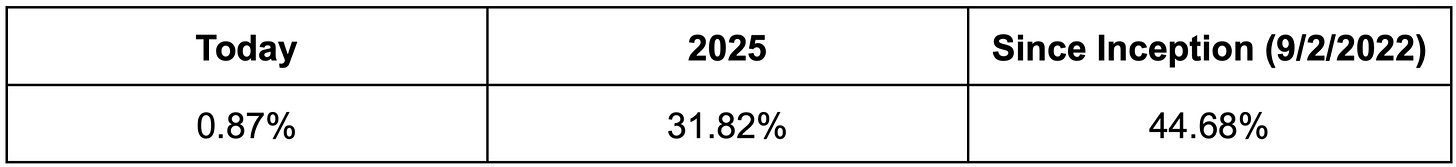

#OGI100: Wednesday, October 29, 2025

The #OGI100 is up 0.87% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dean covers a stock making a strategic AI move. 🚀

This Sector Refused to Stay Buried ⚰️

Something big is stirring in the markets — and clawing its way back.

In case you missed it, Paul covered it this week . . .

An overlooked trend he believes is gearing up for a major move. 📈

Don't be caught off guard — click below now for the details!

On Wednesday, October 29, 2025, we hope you enjoy this video — and that you subscribe to our YouTube channel for more content like it!

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It’s your money and your responsibility.