Please be sure to read the disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's substack where we provide daily coverage of OGI (opportunity, growth, and innovation) market trends, macro level analysis and stock picks.

Like our name suggests, at ATG Digital, we go Against The Grain to support everyday people on their investing journeys.

It also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on preselected (by you) ideas. (Diamond Tier + Purple Tier)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 5,688 (+2)

A Market Note From Paul 📝

Yesterday, Paul went LIVE in our Facebook group to talk about the potential of Bitcoin (BTC) ETFs:

To listen to his commentary on BTC ETFs, click the image above! 👆

Also, please be mindful: Paul will never ask you to send me money, bitcoin or crypto.

He will never message you directly, as all communication on social media happens in the open, where everyone can see.

The moment you're being asked to send money or chat privately, know its a scam. Please be safe.

Wyatt: Keeping Up With New Tech 😎

Businesses that are on the cutting edge of technology move fast. They need to stay one step ahead without losing any momentum.

Let’s take the electric vehicle (EV) sector, for example. They build and make better and better models each year.

Since the technology is new, how do they stay ahead of the curve?

It’s too expensive and too laborious to physically build the car, then drive it for thousands of miles to see which parts will fail.

That’s why Tesla Inc. (Nasdaq: TSLA) uses digital twins of its EVs to run simulations and predict which components might fail. This saves $TSLA time and money by running the simulations virtually.

A digital twin is a digital model of an intended or actual real-world product, system, or process.

Digital twins are how companies keep up in such a fast-paced environment, and their use cases are endless.

I’ll talk about a company today that’s leading the charge in digital twins and show you why it is primed for action in 2024.

Matter of Fact 🧠

Matterport Inc. (Nasdaq: MTTR) is a 3D media platform that allows users to create, view, and share virtual spaces.

$MTTR is revolutionizing the way digital twins are used and expanding on multiple fronts. Here are a few examples . . .

In September, $MTTR introduced the next generation of intelligent digital twins with powerful new capabilities fueled by the company’s rapid advancements in artificial intelligence (AI) and data science.

It’s these kinds of advancements that make $MTTR a powerhouse in this space.

On top of that, it’s become an Autodesk premium partner. This partnership brings $MTTR’s 4K digital clones to more construction professionals than ever.

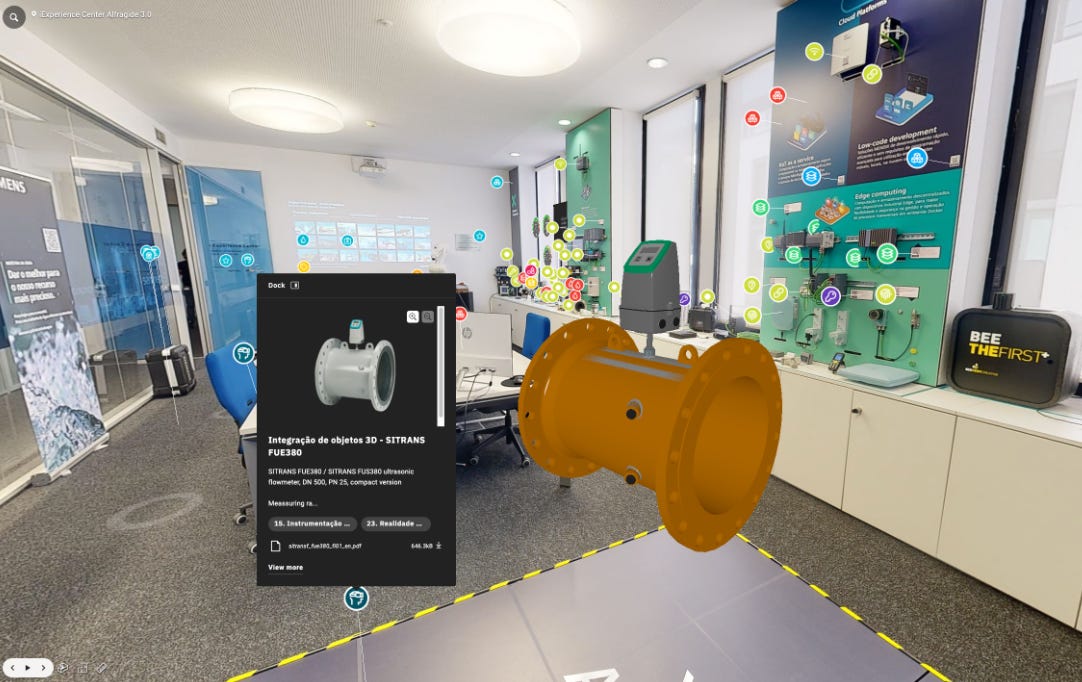

Lastly, $MTTR performed a case study with Siemens. Using its Pro3 cameras, Siemens captured its overseas manufacturing plants.

These high-resolution digital twins allow Siemens to meet virtually with customers to discuss the manufacturing plants in great detail.

Another case study showed a 50% decrease in in-person site visits, saving hundreds of employee hours annually.

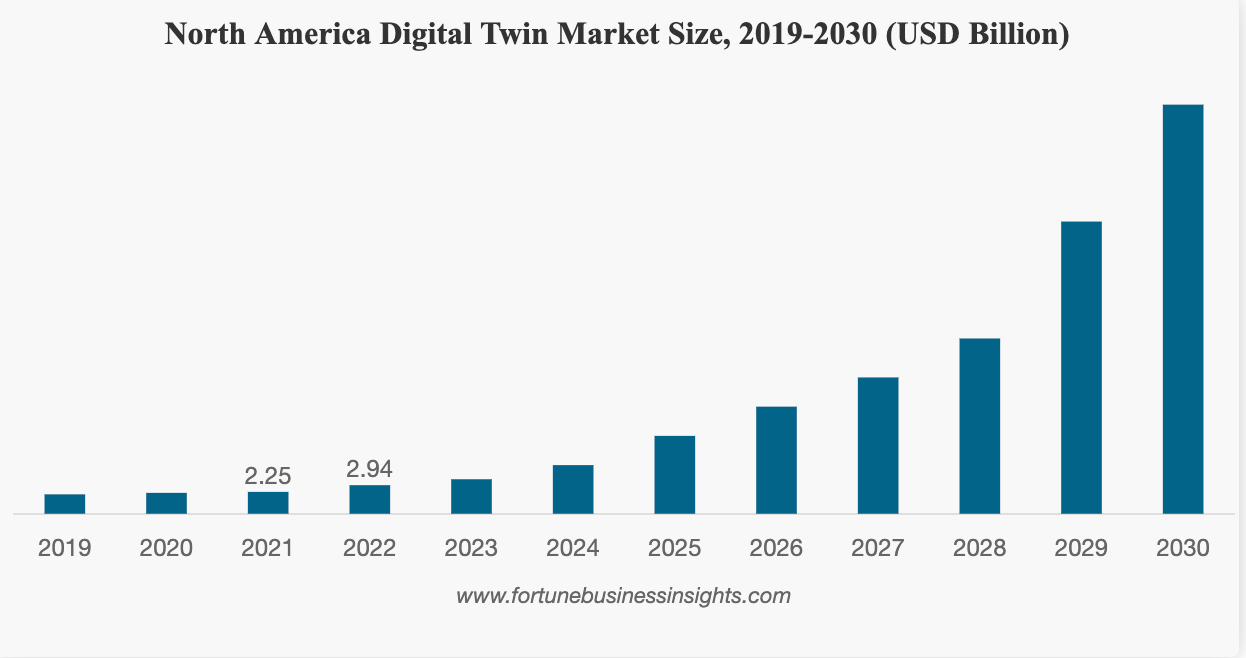

These are real use case scenarios with proven benefits that will grow in demand. The digital twins market size is expected to cross $137 billion from just 11 billion in 2022:

This is very bullish for $MTTR.

Up, Up, & Away 🆙

I’ve shown you what $MTTR is doing, now let’s look at how it's doing.

$MTTR announced its earnings in September 2023, and it was a breakout quarter. Its total revenue grew to $40.6 million, above the high end of its guidance range.

Subscription revenue jumped to a record $22.9 million, up 20% year over year (YoY).

Speaking of subscriptions, $MTTR’s total number of subscribers increased to 887,000, up 35% YoY.

You don’t have to be an analyst to see that all three of those numbers are extremely bullish!

With a market cap of only $718 million and $400 million in cash, $MTTR has more than enough to keep innovating and growing.

Investing In Solutions of the Future 🔮

We hold $MTTR in our Silver Tier portfolio.

For weekly coverage on more companies harnessing disruptive technology across sectors — including trade alerts on new positions — consider subscribing by clicking here!

Just look at the AI gains we closed in 2023:

#GBC100: Thursday, January 11, 2024

The #GBC100 is down 1.89% today.

With markets shifting in our direction, there isn’t anything new to write about. So, just to let you know, we won’t always be commenting on the performance of the #GBC100 daily.

However, we’ll be updating the performance, and we want to remind folks that our goal is to turn the #GBC100 into an ETF that offers a one-stock way to invest the ATG way — in innovation and growth.

To learn more or express your support for the launch of an ETF (by completing a poll), click here.

Yesterday, Dan published a new video on our YouTube channel:

In it, he follows up on Paul’s video on the Golden Age of Biotech!

To watch it, click the red button above!

Friday: Dan has another biotech 🧪stock to share as this sector heats up! 🔥

It happened👇:

This is truly a moment worth celebrating! 🥳

Cheers to more bullish opportunities in the market!🥂

On Thursday, January 11, 2024

❤️️ This Substack made — by US, for YOU — with love. ❤️️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at contact@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.

While I'll always be grateful to Grayscale for giving us a way to buy BTC other than actually buying the crypto itself. I think it's terrible that they're going to charge 1.5% because they know that we're stuck and don't want to pay the Capital gains!