Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on ideas preselected by you. (Purple Tier Members)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 5,991 (+5)

It’s a Short Week! 🗓️

Hey there, ATG Nation! Dean here. 👋

As we mentioned yesterday, the team will be off Thursday and Friday this week for Thanksgiving break. 🦃

But we’ll be back on Monday with another Substack!

Don’t fret — we’ll be keeping an eye on the market in the meantime. 👀

Now, let’s see what Dan has to say . . .

Dan: The ATG Community Will Win Big 🤑

It really doesn’t matter if you’re a paid member of ATG Digital or not — we want you to win regardless.

Which is why we created the “GBC 100.”

While we don’t send trade alerts for this portfolio, subscribers can emulate it to get exposure to growth and innovation.

It features 100 companies that embody growth and innovation at their very core.

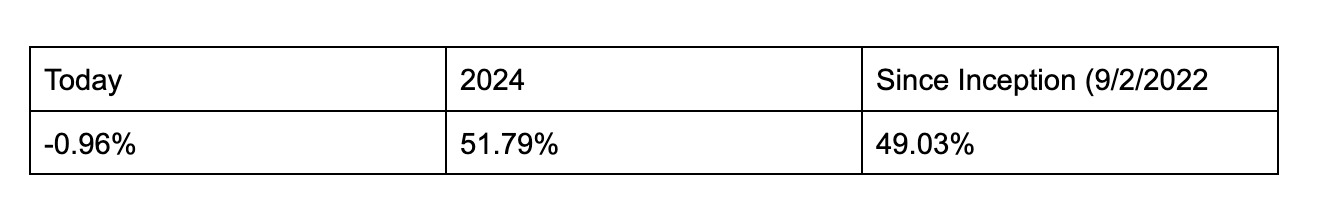

This year, the GBC 100 portfolio is up over 50% and showing no signs of stopping!

Truthfully, our goal is to turn the GBC 100 into an exchange-traded fund (ETF), offering a streamlined and accessible way to invest in innovation.

If you were watching this portfolio recently, then you know that one stock is rocketing after being doubted and written off . . .

Zooming Into the Future of Communication 🤳

We hold Zoom Video Communications Inc. (Nasdaq: ZM) in both our GBC 100 and our Silver Tier model portfolio.

It evolved from a pandemic-driven growth stock to an essential technology company in the digital communication and collaboration space.

Despite short-term headwinds from declining pandemic-related demand, the company’s long-term growth potential remains optimistic.

Its prospects are driven by diversification, innovation, and a robust positioning within the unified communications market.

Zoom is a household name in video conferencing, often synonymous with virtual meetings.

The shift toward hybrid work is here to stay, and $ZM remains central to this transformation.

$ZM focused heavily on a cloud-based PBX system addressing the unified communications market, expected to grow at a compound annual growth rate (CAGR) of 16.8% by 2030.

Most recently, it implemented AI-powered analytics and tools to enhance meeting productivity.

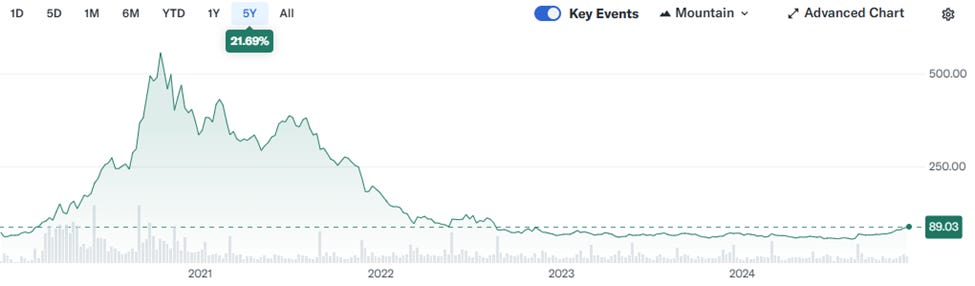

After a steep selloff from its pandemic-era highs, $ZM’s valuation has moderated.

At a price-to-sales (P/S) ratio significantly below historical averages, the stock offers an attractive entry point relative to its growth potential.

Currently, $ZM has a market cap of $27.4 billion and trades at a 5.9X P/S multiple.

With the infrastructure in place and strong growth prospects ahead, $ZM’s stock is set to run much higher, evidenced by its recent earnings!

Showing Signs of Strength 💪

Yesterday, ZM 0.00%↑ released its Q3 earnings results, sharing that revenue for the quarter is up 3.6% year over year (YoY) to $1.18 billion.

Income from operations and operating margins also improved courtesy of 3,995 customers who contributed more than $100K each in the last 12 months — up 7.1% YoY.

$ZM ended the quarter with $7.7 billion in cash, representing roughly 28% of its market cap.

That’s enough cash to further operations and spur innovation and growth. It’s also enough cash to repurchase common stock and boost shareholders' value.

Speaking of which, $ZM stated in Q3 that it repurchased 4.4 million shares of common stock.

But it gets better . . .

It also increased its stock repurchase authorization by $1.2 billion, resulting in approximately $2 billion available to use for repurchasing shares.

Typically, when companies do this, they anticipate the stock surging higher.

It’s also a sign of strength in the companies’ finances to be able to allocate capital toward these efforts.

The Long-Awaited Reversal 🔃

No doubt, in 2020 and 2021, $ZM was a high flyer!

But after a multi-year bear market, valuations and sentiment have bottomed out and are now recovering .

$ZM bounced off its lows, and looks primed for a surge in the coming bull market. .

Starting or adding to a position now could produce nice gains!

We’ll continue to hold $ZM in our Silver Tier model portfolio and will be sure to notify members if anything changes.

Remember, you don’t have to rely on our GBC 100 portfolio alone!

Check out our Silver Tier model portfolio for access to large-cap growth stocks that still have plenty of upside!

That way, you have access to our investing strategies, a detailed portfolio, and trade alerts the moment we see an opportunity budding in the market.

To level up your investing journey, click here!

#GBC100: Tuesday, November 26, 2024

The #GBC100 is down 0.96% today.

Created on September 22, 2022, the #GBC100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #GBC100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #GBC100 into an ETF.

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dean will share a housing giant! 🏠

The 100K Bitcoin USD (BTC-USD) Waiting Room 🥱

BTC hasn’t crossed 100K yet, but big shifts are unfolding for our stocks.

Some are up 25% or more on the month . . .

For a breakdown on what’s happening, watch the video below! 👇

On Tuesday, November 26, 2024, we hope you enjoyed this video — and that you subscribe to our YouTube channel for more content like it. 🙌

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.