Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on ideas preselected by you.

(Purple Tier Members)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 5,846

Dean: Time in the Markets > Timing the Markets ⌚

I remember it like it was yesterday . . .

The day an opportunity I never thought would come . . . finally came! And it was all thanks to legacy media.

I have a love-hate relationship with legacy media companies because they tend to hastily count our growth stocks and cryptos out.

That said, they’re phenomenal at creating great buying opportunities.

But I never suspected that I’d be able to buy this stock so cheap!

AI & Robotics on Discount 👀

Earlier this year, we saw dozens of articles detailing why Tesla Inc. (Nasdaq: TSLA) would go lower.

These articles cited all sorts of reasons why TSLA 0.00%↑ isn’t the innovative and valuable company we once knew.

In a Substack titled “Don’t Let Mainstream Media Fool 🤡 You,” I covered why these claims were mostly baseless.

Sure, revenue declined a bit. But these dips in productivity are addressable:

But mainstream media ran with this narrative. As fear hit the market, I couldn’t help but feel like:

That’s because I never loaded up on TSLA 0.00%↑ as much as I wanted to at what felt like very cheap prices.

On April 24, when the article above was published, TSLA 0.00%↑ traded for a measly $162 by close of day, and as low as $157 throughout the day!

Now?

It’s up over 50% since then!

Truthfully, we’re not surprised. We told members that TSLA 0.00%↑ was on clearance months ago. And recently, the stock showed investors why they should bet on it . . .

Delivery Delay Resolved ✅

One of the primary reasons that TSLA 0.00%↑’s stock took off was due to not meeting delivery expectations in Q1.

But like I said earlier, this is a more than addressable issue for a company as big as TSLA 0.00%↑:

In fact, it managed to deliver 443,956 vehicles in Q2, up 14.8% quarter over quarter.

With this issue seemingly addressed, it’s likely that TSLA 0.00%↑ will be bid up in the months to come.

Especially as it continues to bring its Cybertruck to market.

I’ve personally seen three of them on the road so far, and Paul seems to be enjoying his (she’s currently getting a bit of a makeover, so stay tuned for that) . . .

In our opinion, things are just heating up for TSLA 0.00%↑.

Get Ahead of Legacy Media 📈

We hold TSLA 0.00%↑ in our Silver Tier model portfolio at a gain of 1,079% and will continue holding to capture more potential gains.

If you want to get ahead of legacy media, consider subscribing for just $9.99 by clicking here!

Subscriptions include portfolio access, trade alerts, and weekly video or written updates on our positions.

#GBC100: Thursday, July 11, 2024

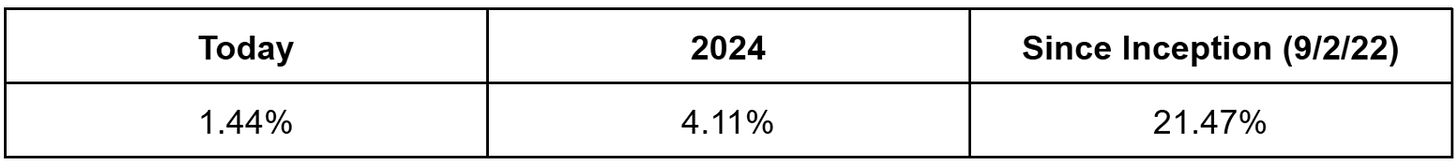

The #GBC100 is up 1.44% today.

Created on September 22, 2022, the #GBC100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #GBC100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #GBC100 into an ETF.

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan will cover a BTC miner. ⛏️ Don’t miss out!

Today, Dan released a new video on our YouTube channel . . . 📺

In it, he discusses a fintech stock that could soar as the buy-now-pay-later trend grows in popularity! 📈

On Thursday, July 11, 2024, we hope you enjoyed this video — and that you subscribe to our YouTube for more content like it!

❤️ This Substack — made by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.

Paul, when I suggested MSTR split their stock you acted like I was off base. You told me that most investors don't think of stock splits the way I do. Well today they announced a 10:1 split! Maybe now you'll say that most investors don't think about stock splits the way I and Michael Saylor do?

That Miami blue looks sick. My dad had a boss 429 mustang that color. Enjoy your new toy.