Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on ideas preselected by you. (Purple Tier Members)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 5,912 (+2)

Congratulations, Winners! 🎉

Back in July, we set a new summer goal: 6K subscribers by the end of August.

Now, we didn’t quite make it . . . but we did welcome lots of new members to the ATG Digital community!

And to us, that’s still something to celebrate. 🤗

That said, it’s time to name the winners of our contest — the three members who referred the most people . . . 🥁

Ray — 18 referrals

Mickey — 10 referrals

Mary — 1 referral

Congratulations, winners! 🥳 Keep an eye out for an email from us regarding your prizes.

All three of our contest winners will receive a copy of Paul’s book, Profits Unlimited . . .

But because Ray and Mickey both had more than 10 referrals, they’ll also receive ATG Digital t-shirts and a month of Silver Tier access — free of charge! ✨

For the opportunity to win these prizes yourself, simply click on the button below and start racking up the referrals:

P.S. Please note that the third-place winner was selected at random from a group of members who tied.

If you also had one referral and didn’t win, don’t give up! Just keep referring friends for a chance at the rewards shown above. ☝️

Dan: It’s THAT Time of Year 🎊

When earnings season rolls around . . . big shifts can happen.

Unexpected results from a company can cause a great deal of volatility in its stock price.

And a rising stock price is just about the best marketing a company can get in terms of enticing people to bid it up.

Afraid to miss the ride up as a stock unexpectedly surges, sidelined investors buy in. And then, it's off to the races . . .

After a stock has been beaten down, it sometimes takes a bit of buying pressure to lift it much higher.

This sort of buying pressure can come from any news, but earnings season is often the culprit.

And right now, one of our Gold Tier stocks is on its way up . . .

1 Stock Hitting Major Milestones 🍾

Last week, Affirm Holdings Inc. (Nasdaq: AFRM) reported quarterly earnings. Subsequently, the stock price jumped roughly 50%.

Today, it sits at $44 per share, a six-month high!

AFRM 0.00%↑ is a platform for digital and mobile-first commerce.

It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app.

The firm generates its revenue from merchant and virtual card networks.

And it just delivered excellent results!

For the last quarter, revenue jumped 48% year over year (YoY) to $659 million.

Gross merchandise volume popped 31% YoY to $7.2 billion. And adjusted operating income is up 900% YoY $150 million.

Most notably, AFRM 0.00%↑ achieved profitability.

In the current market, these numbers are no small feat.

AFRM 0.00%↑ hit these milestones due to continued product improvements, merchant growth, attentive risk management, and excellent capital execution.

Room for Growth 📈

Emphasizing its consumer-first approach, AFRM 0.00%↑ offers merchant-subsidized 0% and low APR deals.

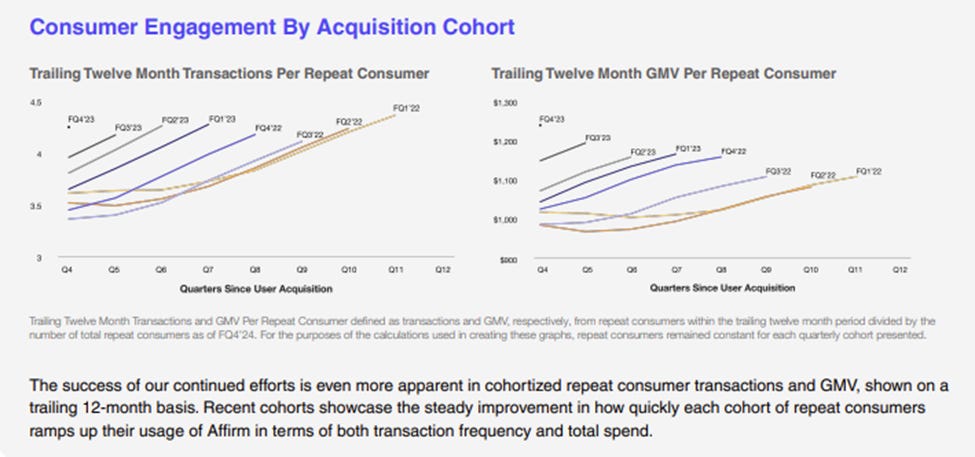

After using AFRM 0.00%↑ for the first time, 60% of customers repeat use within the first year — and the time to reach the second transaction is trending steadily shorter.

AFRM 0.00%↑ has over 300K integrated active merchants.

However, the Affirm Card can be used at nearly all merchants in the U.S. and Canada.

Active customers are 18.6 million, up 19% YoY.

In 2025, AFRM 0.00%↑ plans to continue building its platform and products.

Digital wallets are estimated to have processed more than $700 billion in North America in 2023, less than 1% was captured by $AFRM.

This represents a significant expansion opportunity!

With just a $13.7 billion market cap, AFRM 0.00%↑ is a small company with plenty of room for sustainable growth!

Considering that federal funds rate hikes are behind it and the fact that it has a strong cash position of $2.1 billion, AFRM 0.00%↑ looks ready to run higher once again.

We currently hold this stock in our Gold Tier model portfolio.

To explore the rest of the Gold Tier — and to receive trade recommendations and weekly updates on our positions — consider subscribing today by clicking here!

#GBC100: September 3, 2024

The #GBC100 is down 2.13% today.

Created on September 22, 2022, the #GBC100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #GBC100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #GBC100 into an ETF.

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Today’s Livestream 👀

After months without any movement, one stock is suddenly being bid up . . .

And Paul believes this is just the beginning of a rocket surge! 🚀

To find out what stock we’re referring to, be sure to watch the video below:

And don’t forget to subscribe to our YouTube channel for more content like this by clicking here! 🖱️

Tomorrow: Dean will discuss a pet supplier we’re keeping an eye on! 🐶

We hope the long weekend treated you well. 🤗

Before we wrap up, we’d like to thank these loyal subscribers who took the time to wish us well on Labor Day! 💞

Here at ATG Digital, we certainly enjoy time off — after all, we’re a small team doing a big job . . . 💪

But we always look forward to getting back to things with you!

So, let’s start September off on good note — with a #BOP (bold, optimistic, positive) attitude. 🚀

On Tuesday, September 3, 2024, we can’t wait to see what this new month has in store for us!

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.

So since the end of the bear market at the the end of 22’ your portfolio is averaging 7% per year. While completely missing (up to now) the whole AI boom with the exception of PLTR. What steps of Paul’s process is he going to change to get back on track?