Note: Please read our disclaimer at the bottom of the article.

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,328 (+1)

Paul: 3 Red Flags 🚩 You Don’t Want to Miss

Retail investors have gone from underdogs, to top dogs in today’s market.

And in our opinion, that shift isn’t as great as it sounds.

So, let’s break down why that dominance could be dangerous — and what, in my view, you should be thinking about right now.

But first, let me say this clearly: This isn’t a hit piece on individual investors — I count myself as one.

The issue isn’t who is investing.

It’s when and how retail investors behave, especially at or near market peaks.

And right now? We’re near one of those moments.

Here’s what you need to know . . .

The Hard Truth for Investors 🧐

Here’s the first problem — most retail investors focus almost entirely on price.

You see, a stock jumps from $90 to $100 and they call it a bargain simply because it’s “rising.”

That kind of thinking leads to chasing momentum instead of understanding fundamentals.

Now, some institutional pros do chase performance since they’re judged on quarterly numbers.

But the biggest, most strategic investors? They look under the hood:

They ask questions such as:

Is the company profitable?

How’s the cash flow?

Where are we in the broader business cycle?

Retail investors often treat anything beyond price as noise.

But when prices are near all-time highs, gains can be deceptive — and risk is often ignored.

The hard truth?

In hindsight, many of the biggest winners at market tops were traps.

One or two years later, retail investors often wish they’d sold.

Fortunately, we know exactly how smart money beats the market — and you can, too. 👇

How the Pros Think About Tops 🧠

Big-money investors don’t wait for a flashing red light to sell.

They move early — not because they’re scared, but because they understand liquidity.

They can’t just dump billions at once.

They sell when others are buying — when liquidity is highest, even if it’s not the absolute top.

They also pay close attention to macro shifts, including:

🌏 Trade policy changes

🌏 Inflation expectations

🌏 Interest rate regimes

These are exactly the sort of key markers we’re tracking here for you in Substack and for our ATG Digital members.

For example, Warren Buffett is sitting on over $334 billion in cash as of 2025.

That’s no accident. He’s been building cash reserves aggressively since early 2024.

Meanwhile, legendary investor Howard Marks (managing $194 billion at Oaktree Capital Management) warned that long-term returns are unlikely to meet investors’ current expectations.

Avoid This Market Top Trap ⚠️

In my experience — including the dot-com crash in 2000 — most investors ignore warnings at the top.

Big gains feel too good and sexy to walk away from.

Research in behavioral finance backs this up.

It’s like being at a wild party: No one wants to leave while the music’s still blasting.

That’s why crashes keep happening — and why most investors sell after the damage’s done, not before.

I cover this psychological trap — as well as fundamental markers of a toppy market — in greater detail in my latest Bald Man Speculating podcast episode.

Click below to give it a listen on Spotify:

Red Flags 🚩 You Should Be Watching

In my judgement, today’s market is flashing warning signs that a major top is unfolding — especially in the S&P 500 and Nasdaq 100.

Here are three big ones:

⚠️ Valuations are stretched.

Price-to-earnings (P/E) and price-to-book (P/B) ratios are hovering near historic highs.

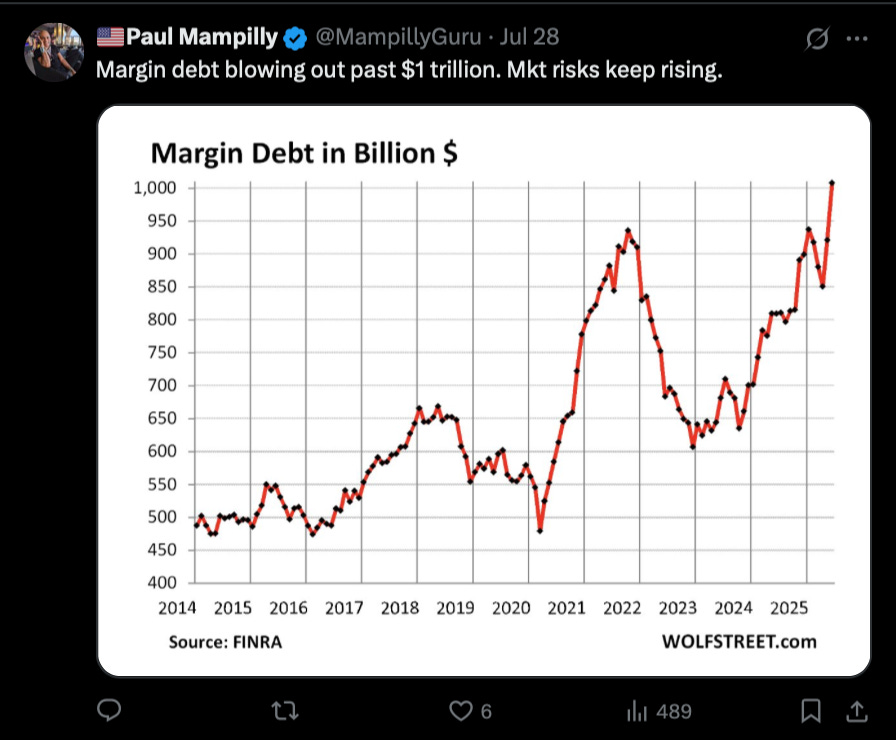

⚠️ Leverage is off the charts

Margin debt has ballooned past $1 trillion, meaning investors are borrowing heavily to keep up the chase.

⚠️ Market concentration is at an extreme level.

The top 10 companies make up nearly 38% of the S&P 500 and a stunning 70% of the Nasdaq 100.

Everyone keeps asking when the market will top.

But in my view, that’s the wrong question.

No one rings a bell at the top. But the storm clouds are gathering.

In our opinion, now’s the time to focus on risk management, not return-chasing.

How to Play Markets Like a Pro 🤑

Based on 30+ years of investing through cycles — including the tops in 2000 and 2008 — I believe we’re nearing a historic turning point.

So, what can you do as an individual investor?

In my view, the smarter play is to start repositioning toward defensive or underappreciated sectors of the market.

For instance:

🏅Gold and silver still have room to run, especially if capital rotates out of tech and into hard assets.

⚡ Energy stocks may benefit as inflation fears re-emerge and infrastructure demand surges.

Now, these hidden megatrends won’t stay under the radar for long.

And they’re also not the only ones unfolding right now . . .

So, if you're looking for a strategy that's already positioned for this shift, our ATG Digital model portfolios are built with that scenario in mind.

Discover how we’re playing the current market — and already benefiting from big moves — by clicking below.

#OGI100: Monday, September 15, 2025

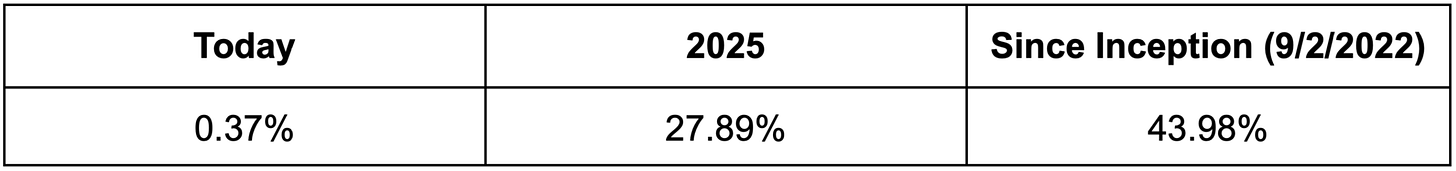

The #OGI100 is up 0.37% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan shares a crypto play that’s captured our attention. 🤩

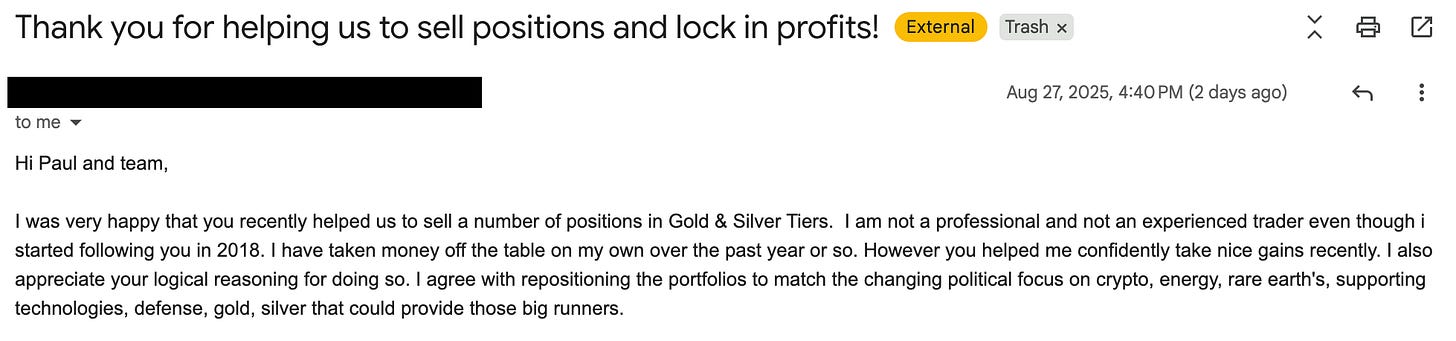

Members Are Winning — And We’re Cheering! 🎉

A couple of weeks ago, an ATG Digital member wrote in about our decision to sell certain positions across our model portfolios:

We chose to capture profits on stocks that no longer fit our thesis for the new market shift.

To the member who wrote in — thank you! 🙏

Your feedback fuels us, and we’re honored to know our work helped you lock in profits.

Our team reads every note that comes in, and nothing makes us happier than helping everyday investors capture real profits in the stock market.

So, if you have a story, win, or even feedback you’d like to share, we’d love to hear from you.

On Monday, September 15, 2025, tell us your story — we’re listening!👂

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.