We LOVE This Stock for the Millennial Boom 🤩

Plus, details on the No. 1 uranium stock — and a new #GBC milestone!

Disclaimer/Legal stuff written in plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. It's your money and your responsibility.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️❤️️

ATG stands for Against the Grain. ATG represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider. Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 4,541 (+29)

Questions? Concerns? 🤔 Look Below 👇

Have questions or having trouble accessing your account? Please reach out to us at contact@atgdigital.media or schedule a call and our Customer Support Manager, Kate, will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG!

Toni Segota: 1 Stock for the Millennial Boom💥

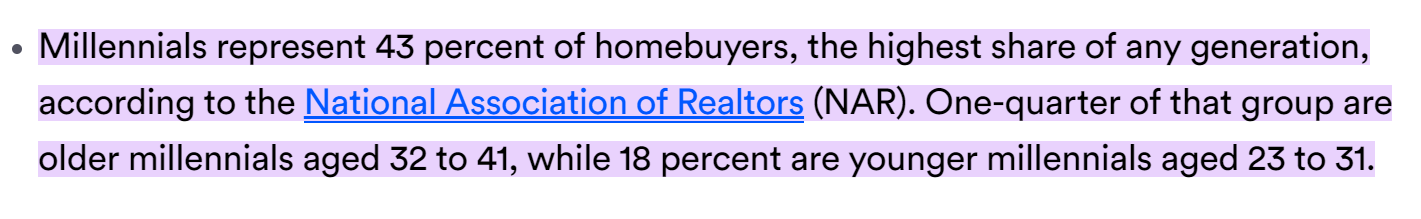

Millennials now make up the largest portion of homebuyers in the U.S.

And Millennials are important because they both outnumber Gen Z and Baby Boomers, and they’re just coming into their peak earning years.

Housing is an incredibly important portion of the economy because buying a home usually involves a myriad of other purchases that go along with the home — such as furniture and electronics, to name a couple.

And today, I’d like to discuss one stock that’s benefiting greatly from the new wave of homebuyers!

The Numbers So Far 🧐

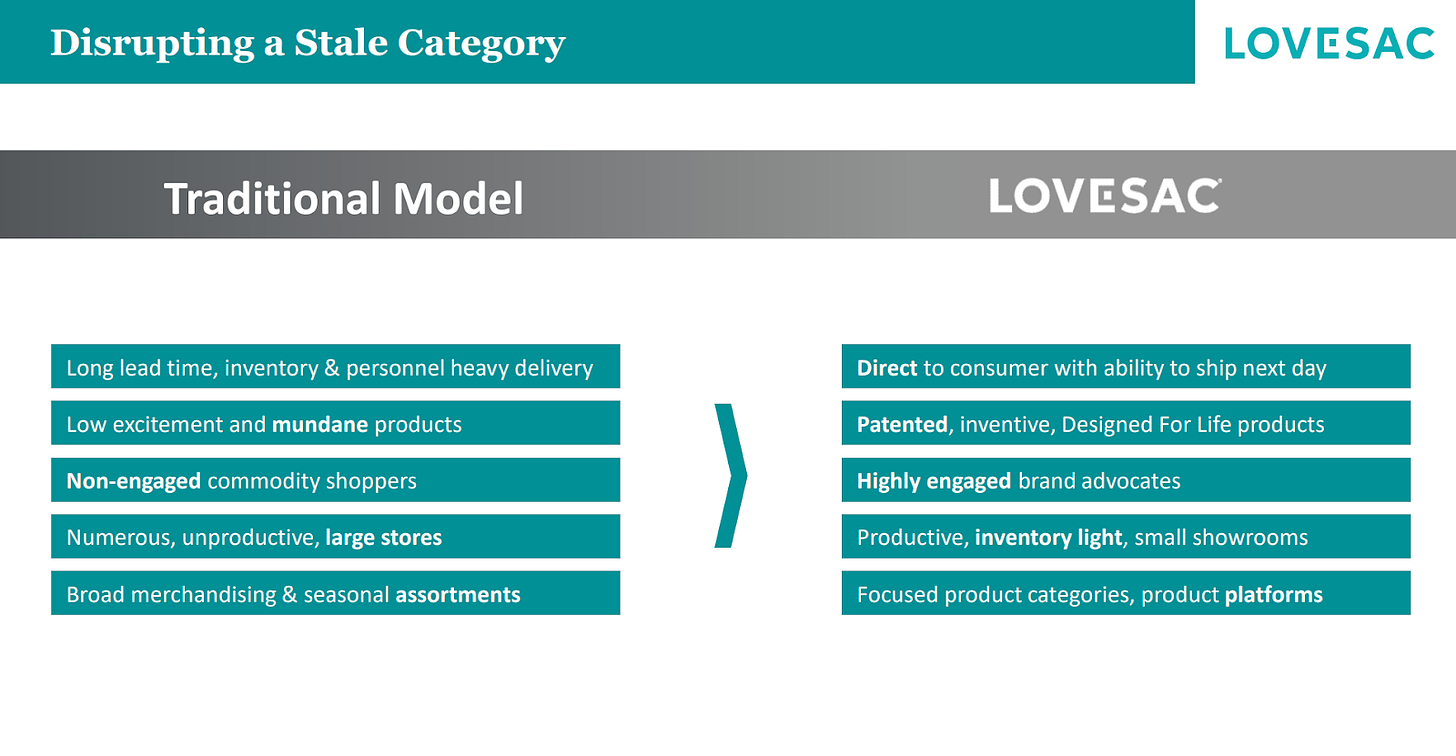

The Lovesac Company (Nasdaq: LOVE) is rethinking the way traditional furniture is produced and sold.

Its numbers are a testament to its improved business model and the comfort and flexibility that it provides customers.

For instance, between 2017 and 2022, it grew sales from $76.3 million to $498 million — a 552% increase!

And because of its nimble business model, it was able to achieve profitability in 2021.

LOVE 0.00%↑ is still a small company with a market cap of $356 million, so the sky's the limit for what this stock could do.

Future Growth 🤑

Despite displaying strong numbers year after year, LOVE 0.00%↑ is still projected to grow in the double digits through 2027.

In fact, it’s on track to grow its sales by 31.2% this year — from $498 million in 2021 to $635.7 million.

And by 2027, analysts expect LOVE 0.00%↑ to grow sales to $1.15 billion, while substantially increasing its profitability!

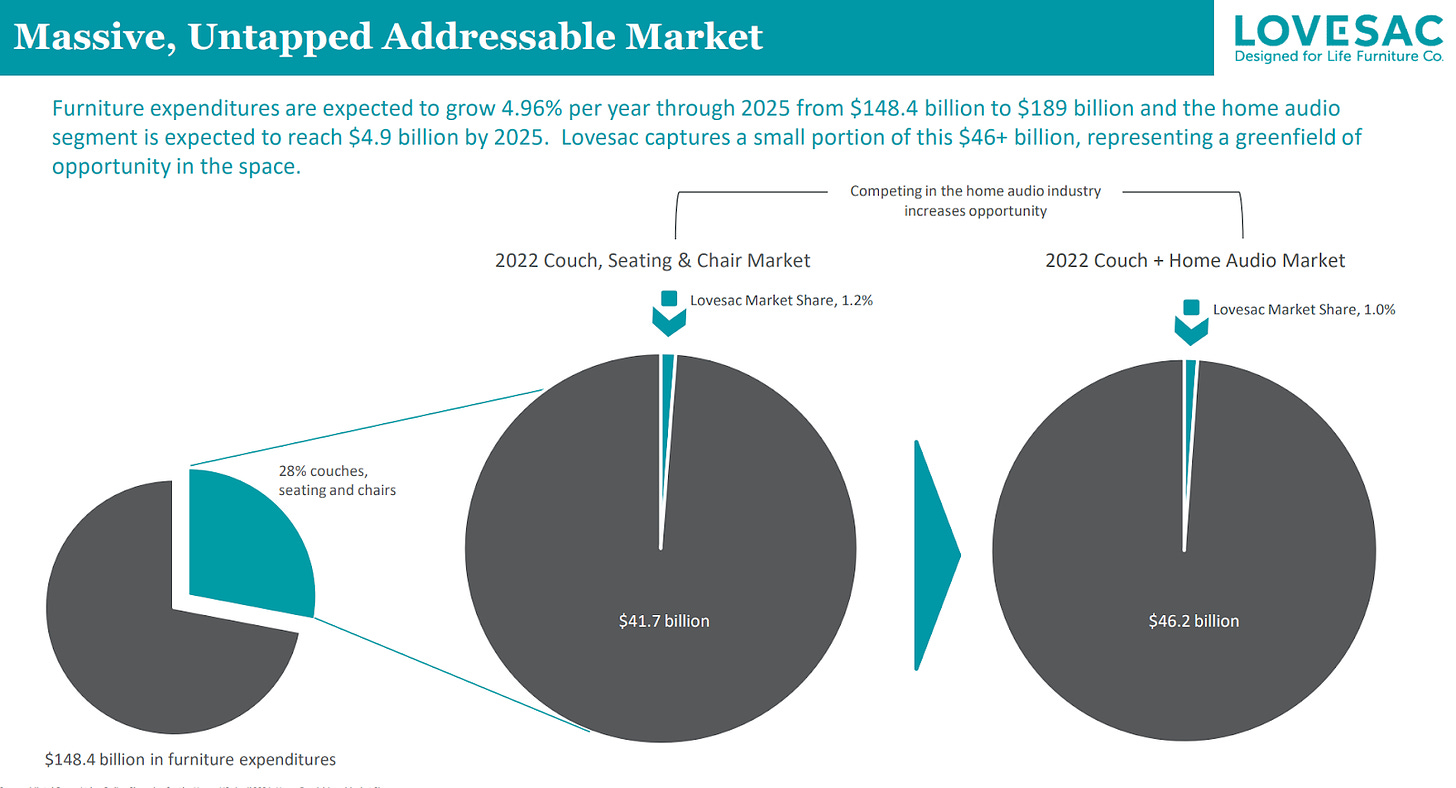

But the best part is that LOVE 0.00%↑ has only penetrated a very small portion of its market thus far — only 1.2%.

So, as more customers use and become aware of its products, its revenue could accelerate further — especially considering that 41% are repeat customers!

And according to management, LOVE 0.00%↑’s primary customers are millennials between the ages of 25 to 45, so they’ll reap the rewards of the millennial boom.

Products & Business Model 💼

LOVE 0.00%↑ offers two primary products: sacs and sactionals.

Its couch products — or sactionals — come in pieces, which makes them rearrangeable and easy to ship. In fact, LOVE 0.00%↑ has the capability to ship products directly to its customers as soon as the next day!

Sactionals also come with removable covers that are 100% machine washable, which means that if you’re changing a room's aesthetic, you can simply buy a cover(s) that fits your needs.

And if that’s not enough, there are additional options, including built-in speakers and charging ports.

Its other product is one that I’ve personally owned: sacs.

Sacs are oversized bean bags that are incredibly comfortable.

Now, LOVE 0.00%↑ operates almost exclusively online, save a limited number of showrooms and pop-ups in stores like Costco and BestBuy. So, by disrupting the traditional model of furniture sales, it’s been able to keep costs down and inventories light.

LOVE 0.00%↑ is set to report its Q3 earnings on December 8, which I’ll discuss in our Extreme Fortunes service. If you’d like up-to-date coverage on any developments for this stock, consider subscribing to our Gold Tier membership.

That’s all for now, but I’ll see you on Monday for more coverage on biotech!

Patrick Goodrich: Deep Dive on Energy Fuels Inc.

War in Europe.

Destruction of the Nord Stream Pipeline.

Sanctions on Russia.

And Saudi Arabia on high alert of imminent Iranian invasion…

That certainly wasn’t on my bingo board for 2022.

However, these are the cards we’ve been dealt.

These circumstances pose a real threat to global energy production. But there’s hope…

Different Sources 🤔

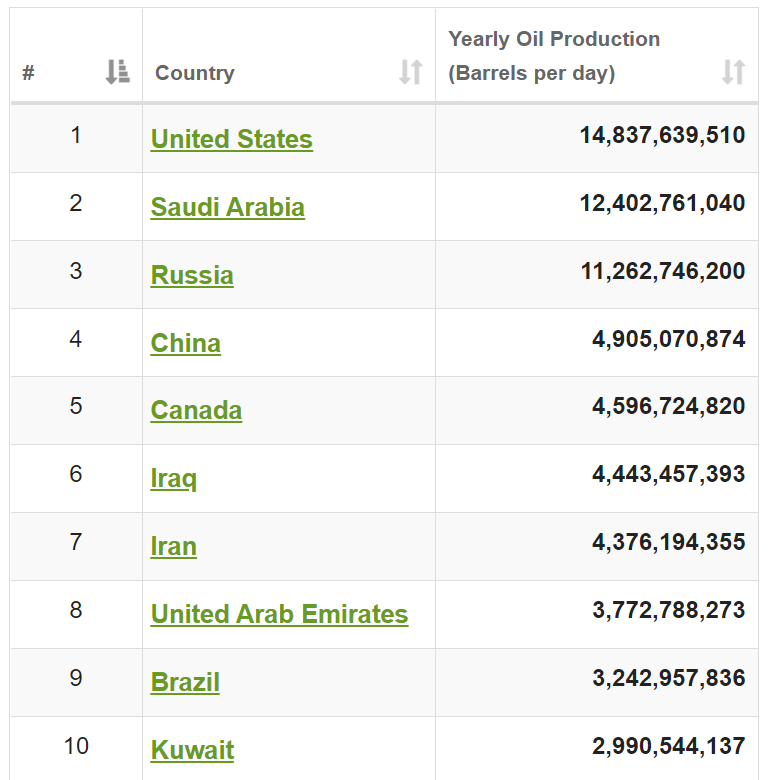

Oil production is one of the main sources of energy, as well as coal.

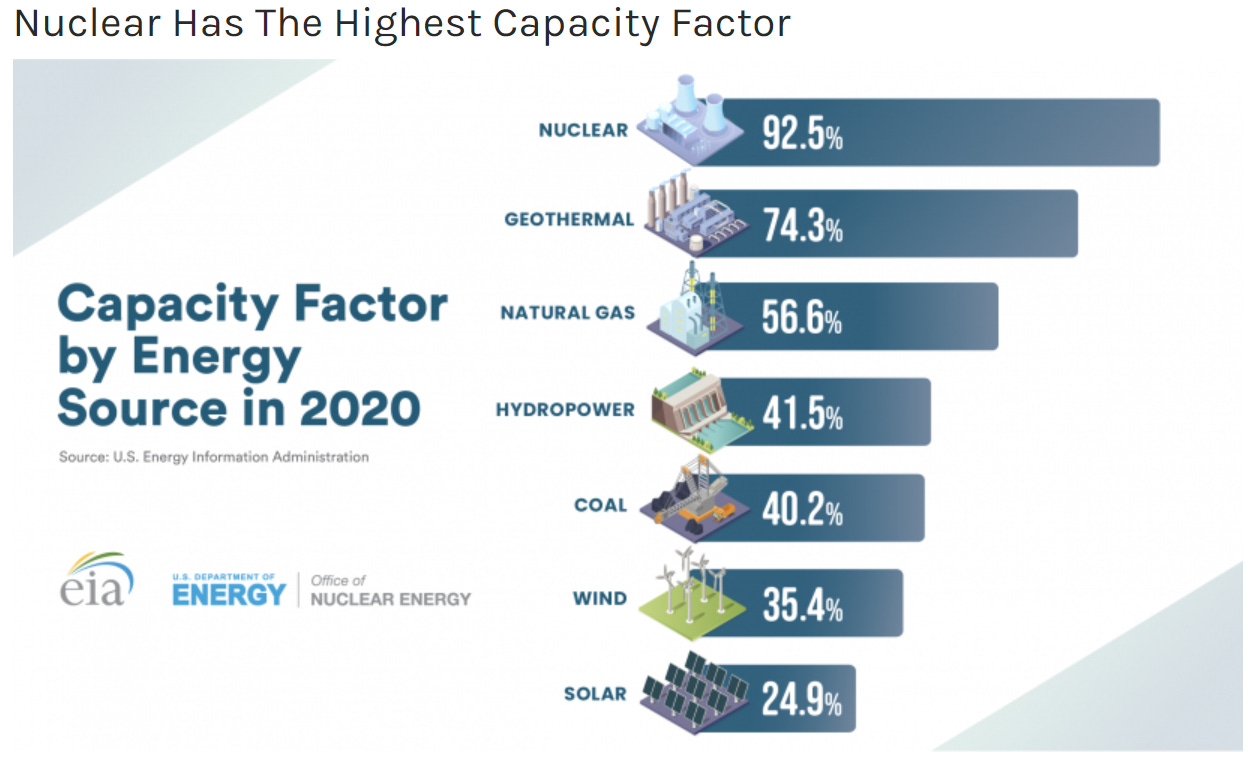

Yet, over the years, there’s been a push to shift to renewable energy, like wind and solar. But sometimes, the wind doesn’t blow and the sun dips below the horizon, causing a lack of solar energy in darkness.

This leads us to nuclear energy.

The above chart shows that 92% of the time, nuclear power is producing energy.

This is far more reliable than any other energy source.

The U.S. Uranium Producer 👀

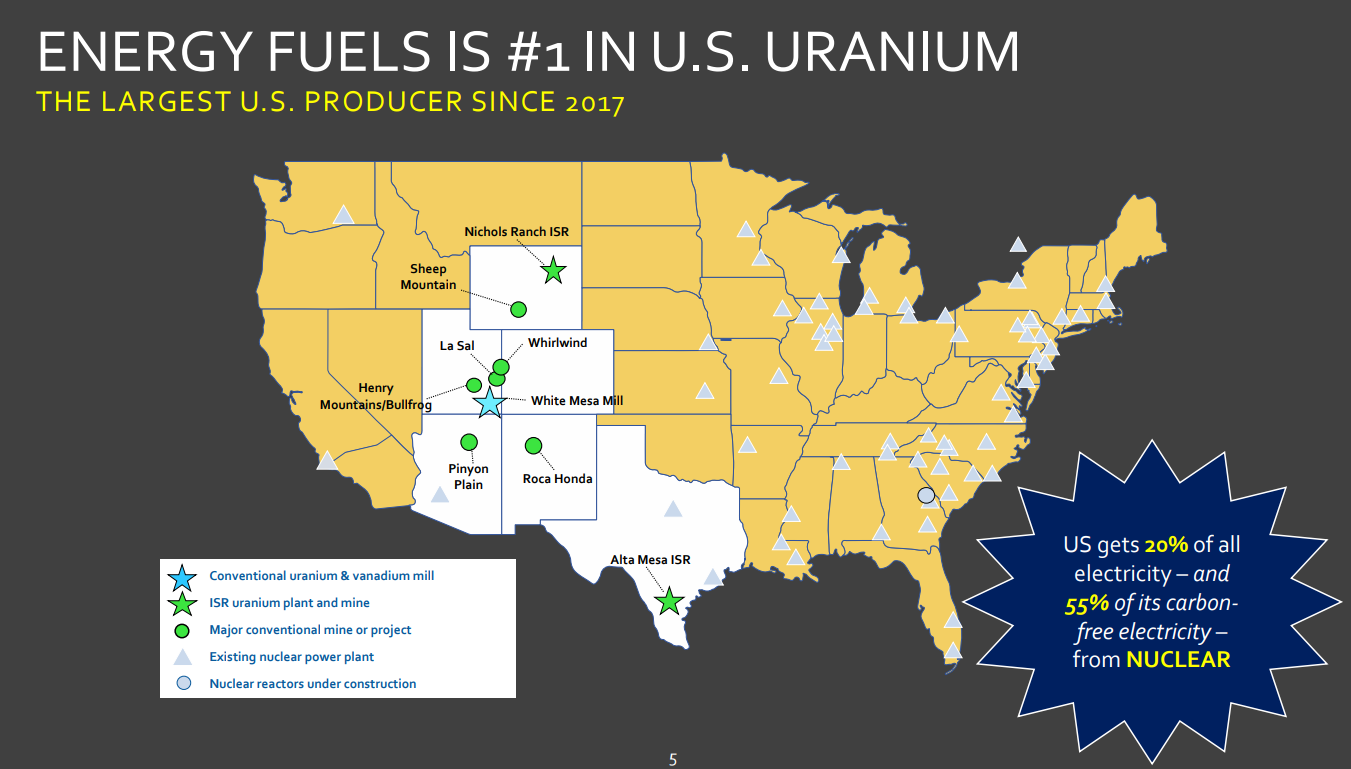

And one company that’s mining uranium here in the U.S. is Energy Fuels Inc. (NYSE: UUUU).

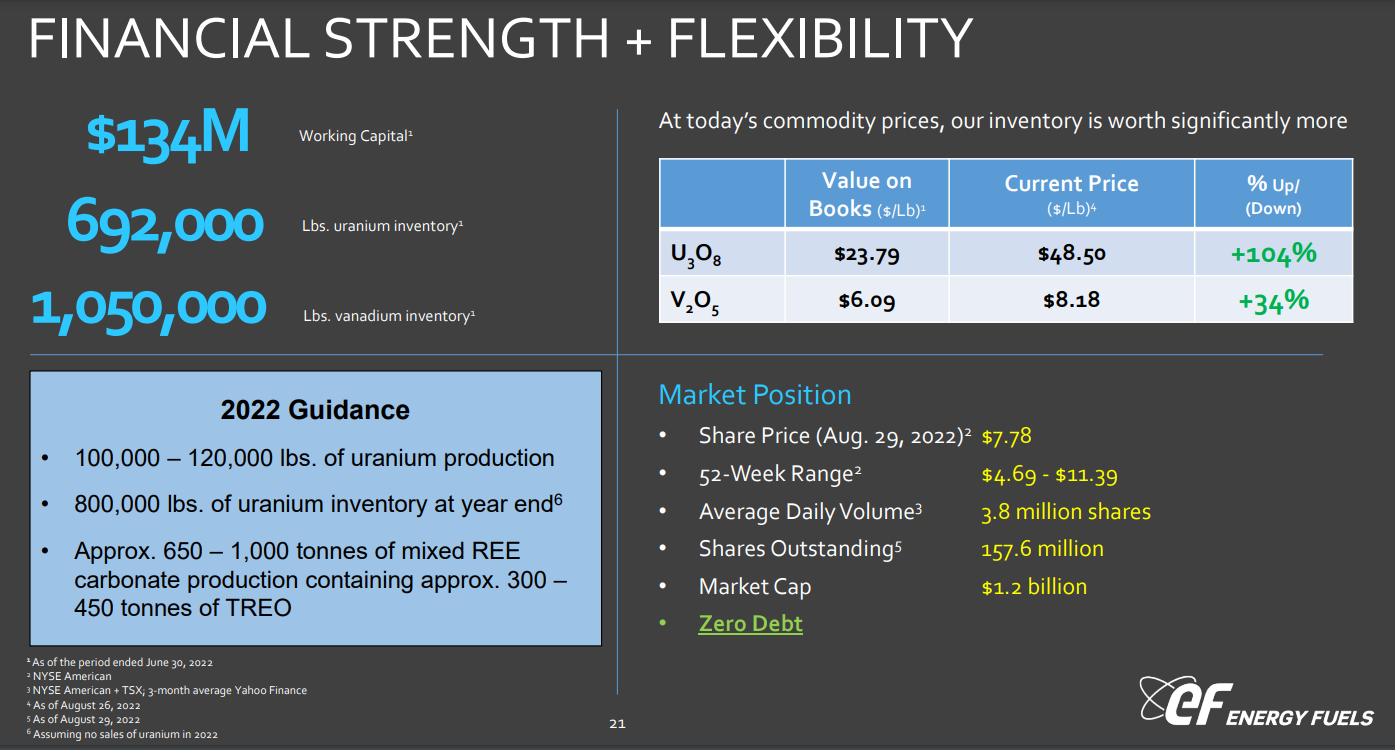

UUUU 0.00%↑ is the largest producer of uranium in the U.S.

Its market capitalization is about $1.1 billion.

And it has nearly $100 million in cash and no debt.

For 2022, the company expects to produce between 100,000 pounds to 120,000 pounds of uranium, which would total about $33.8 million worth of uranium.

UUUU 0.00%↑ owns and operates White Mesa Mill, which is the only conventional uranium mill in the U.S. This means that UUUU 0.00%↑ stock is scarce.

And this key point, as well as the natural tailwind of nuclear’s reliability, is likely to bring buyers to UUUU 0.00%↑ stock.

This is why we’re bullish on UUUU 0.00%↑, as well as other nuclear plays in our portfolio, such as CCJ 0.00%↑ Cameco Corp. (NYSE: CCJ).

You can find UUUU 0.00%↑ in our Gold Tier Membership. See you below at our daily #GBC80 check in! 👇

#GBC90 Update at 2:04 P.M.

Patrick here with your Wednesday #GBC90 update.

A quick reminder: It’s the team’s goal to turn the #GBC90 into an exchange traded fund (ETF). This will grant you easy access to the growth and innovation that’s shaping the future — all with one click in your brokerage account.

The Fed’s Decision

Today, the Federal Reserve decided to increase interest rates by 75 basis points (bps). This marks the fourth straight 75 bps hike.

The market expected this. And the Fed Funds rate is now 4%.

As we’ve been pointing out in other Substack articles, the pace of rate hikes is bound to come to an end.

And with every increase, we’re getting closer to a pivot from aggressive pushing to easing.

We’ll keep you updated on what to look forward to at the Fed’s December meeting.

For now, I’ll turn it over to Paul to give his take on his latest addition to the #GBC90…

Paul’s New Pick

Hi, Paul here.

We're going to add Match Group Inc. (Nasdaq: MTCH), the premier operator of dating apps worldwide, to the #GBC90.

Match helps people make meaningful connections across various spectrums of age, race, gender, sexual orientation, and backgrounds.

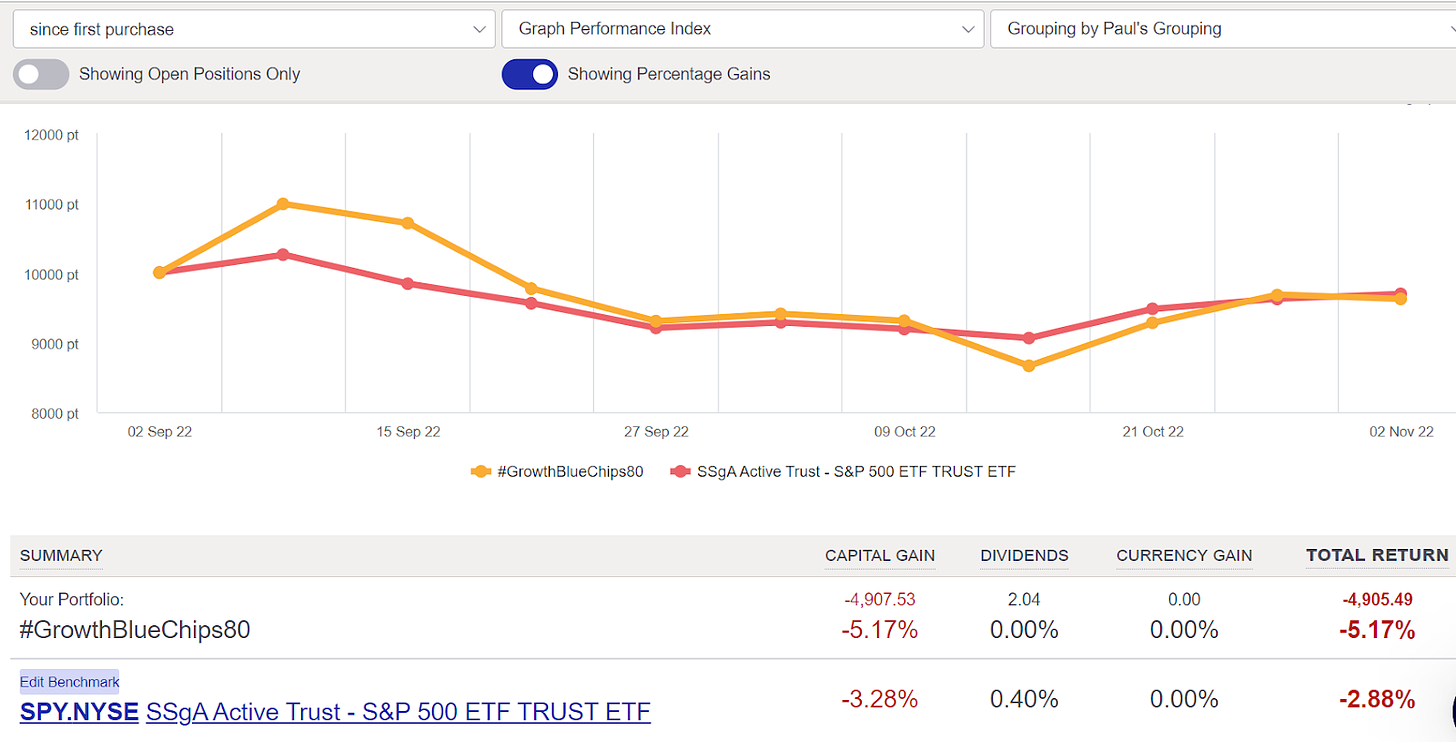

#GBC90 Performance

Our stocks, including the overall S&P 500, are seeing increased selling pressure, since the end of rising rates isn’t here yet.

The goal with raising rates is to soak up excess liquidity in the markets.

However, investors step in to buy stocks — like ours — when they’re confident that the Fed will stop raising interest rates.

Remember, the markets have endured one of the sharpest increases in monetary policy ever.

Sure, there’s been pain, but the end is coming. And with that, buyers are going to look for companies that are cheap but growing like gangbusters.

These are our companies … the #GBC90 stocks.

Our Stocks Soar 🚀 When Growth Is Scarce

Chegg Inc. (NYSE: CHGG) has soared 25% today after reporting a 9% increase in its subscribers year over year.

The company also set full-year 2022 revenue to be between $762 million to $765 million. This is an increase from August, when the company announced it saw full-year sales between $745 million and $770 million.

This is great news for us, and other buyers of CHGG 0.00%↑, who want to see strong growth.

That’s it from me, but before I leave, please consider following me on Twitter: @Fin_Farm.

You can also subscribe to my Substack, which I published another article in last week!

Tomorrow: We’ll hear the latest from Dan — and from Ian’s Crypto 🪙 Corner!

Last week, the team received this note. 👇

Paul, we appreciate your loyalty! Comments like this one remind us exactly how devoted our community is … and why we work so hard to bring you our very best.

On Wednesday, November 2, 2022, the ATG Digital team is grateful for all of you — our amazing subscribers — and the faith you’ve put in us.

❤️️ This Substack made — by US, for YOU — with love. ❤️️

Thanks Paul and Team...........if it was easy, everyone would have done it!!!!!!!!!!!!!!

Powell says that there is a "need for ongoing rate increases". And that there are “some ways to go” with rate hikes. What part of those statements indicate a pivot?