Disclaimer/Legal stuff written in plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. It's your money and your responsibility.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

ATG stands for Against the Grain. ATG represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider. Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 4,755 (+2)

Questions? Concerns? 🤔 Look Below 👇

Have questions or having trouble accessing your account? Please reach out to us at contact@atgdigital.media or schedule a call and our Customer Support Manager, Kate, will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

$1K+ Donor Event Was a Success! 🥳️

Yesterday, the team held a private Zoom meeting for $1K+ donors.

To everyone who attended: We had so much fun chatting with you and hope to hear from you again soon!

As a reminder, we have another event coming up next week — a Community Board Meeting for $10K Donors.

There, $10K donors can meet with the executive team to discuss the current state of the company, along with our plans for the new year.

Bring your questions or suggestions on Thursday, December 15 at 5:30 p.m. ET. We look forward to hearing them!

Paul Mampilly: Things Are Looking Up for 2023 🎉

2022 was … not the best.

But 2023 is already shaping up to be much, much better for our investments.

Because I believe the macro environment is going to help us.

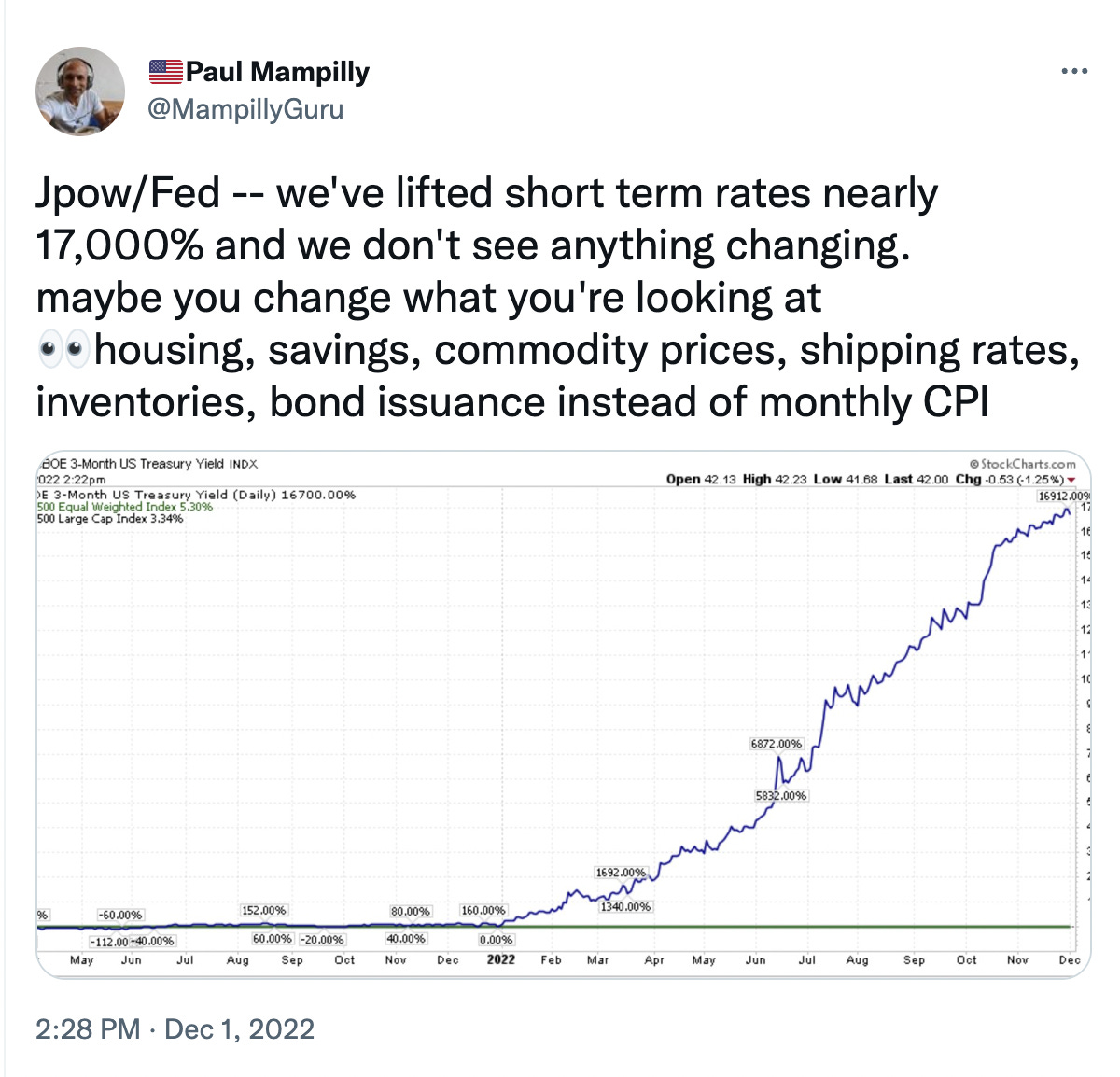

In 2022, we got crushed by the Fed’s shock therapy of raising interest rates as if it was playing a video game. But 2023 is setting up quite differently.

And this setup favors our investments in a BIG way…

Deflation Driven by Crazy-High Inventories Is Coming

You already know that the Fed’s interest rate hikes have caused shocking levels of inventories to accumulate.

As you can see, this inventory spike is unprecedented. We’ve never had this much stuff pile up so fast … EVER.

Worse, this pileup is happening as the peak effect of the Fed’s interest hikes really starts to hit hard in the first half of 2023.

By “hit hard,” I mean that spending for these goods is set to see a complete collapse.

How Can We Tell This Collapse Is Coming Soon? 🤔

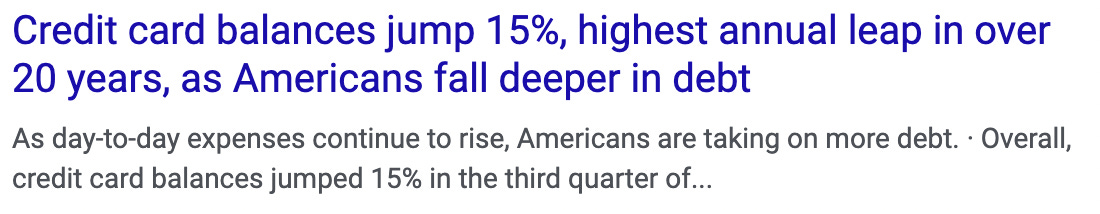

Because macro indicators show us that Americans are:

Rapidly going into debt as rates go up — which is unsustainable.

Rapidly depleting their savings.

In this chart from Ian, you can see that savings spiked up to more than $6.25 trillion in 2020 and are now down to $426 billion. More than $5.8 trillion is gone! Poof.

Where did it go? Inflation spiked spending.

Why Does This Matter for Us?

A collapse in buying means overall economic growth is setting up to slow down. It also means that inflation is setting up to crash as well.

Both of these things are positive for our investments.

Why? Because slowing economic growth makes growth a scarce commodity to find in the world. Scarcity drives value. And this, in turn, drives demand.

As the buyers come, they’ll have to bid prices higher, which become gains in your portfolio.

I’m v v v #BOP 🚀 on our stocks/crypto. A bright and prosperous future lies ahead for us! ☀️

For exposure to stocks that, in my opinion, will benefit from the trends I’m seeing, check us out at www.atgdigital.media!

There you can find guidance and coverage on BIG opportunities we see building in the markets!

Toni Segota: This Sector Is Propelling Us Into the Future

I spoke about semiconductors in last Friday’s Substack.

That’s because semiconductors will be in virtually every product in the future, especially as the Internet of Things (IoT) picks up momentum and our devices begin to interact with each other to give us the best customized experience possible.

And there are many ways to play the semiconductor industry, such as suppliers of critical systems, cleaning services, designers, and foundries to name a few.

Last week, I spoke about Aehr Test Systems (Nasdaq: AEHR), a provider of systems used to ensure semiconductors aren’t defective in the production stage.

I also discussed how the global semiconductor industry is set to grow from around $600 billion to over $1 trillion this decade. If you’d like to find out more about AEHR 0.00%↑, check that Substack out here.

1 Company Headed for Incredible Growth 📈

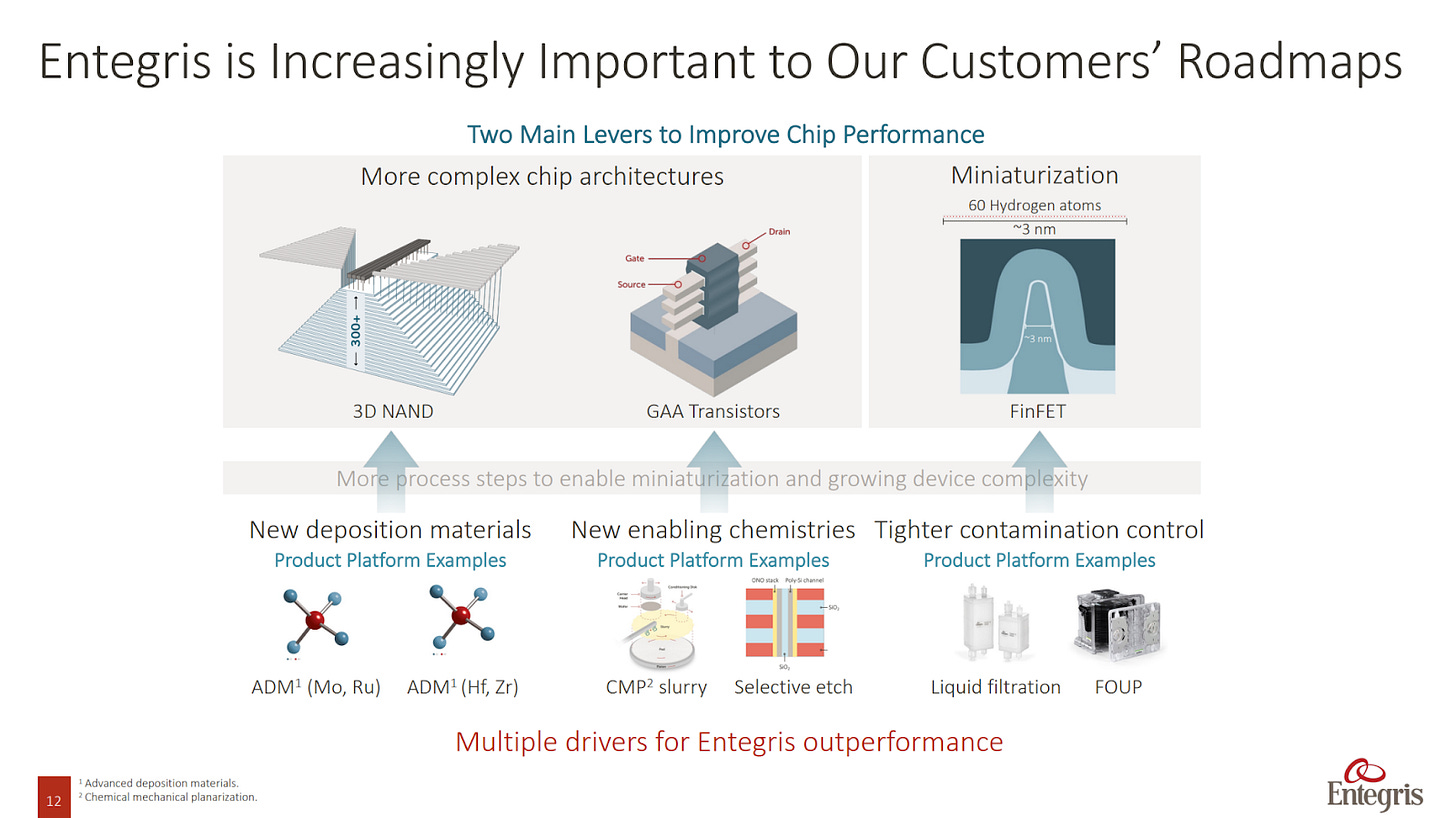

This week, however, I’d like to tell you about one company that makes new materials for semiconductors and saw amazing growth over the past year.

Entegris Inc. (ENTG) has been on an incredible growth path.

For instance, for Q3 2022, it reported $994 million in sales — a 71% increase year over year from $579 million.

Management has guided similar sales for Q4 between $930 and $970 million, which would give it full-year sales of over $3 billion.

And although it wasn’t profitable in Q3 due to a few large non-recurring expenses, management has guided for profitability in Q4.

Right now, ENTG 0.00%↑ has a market cap of $10 billion and a large cash stack of $754 million, so it has the resources to continue its growth.

As I mentioned above, ENTG 0.00%↑ is a maker of new materials and chemistries that enable better chip performance.

It has over 4,400 patents for its chip technology, and because much of its revenue is derived from its top customers, it has a ton of opportunity to expand with its market.

We’re very bullish on ENTG 0.00%↑ and are excited to see what the future holds for the company.

We currently track ENTG 0.00%↑ under our Tier 2: Gold Membership (in our True Momentum model portfolio).

If you’d like up-to-date coverage on ENTG 0.00%↑ or other stocks with strong growth potential, consider subscribing here.

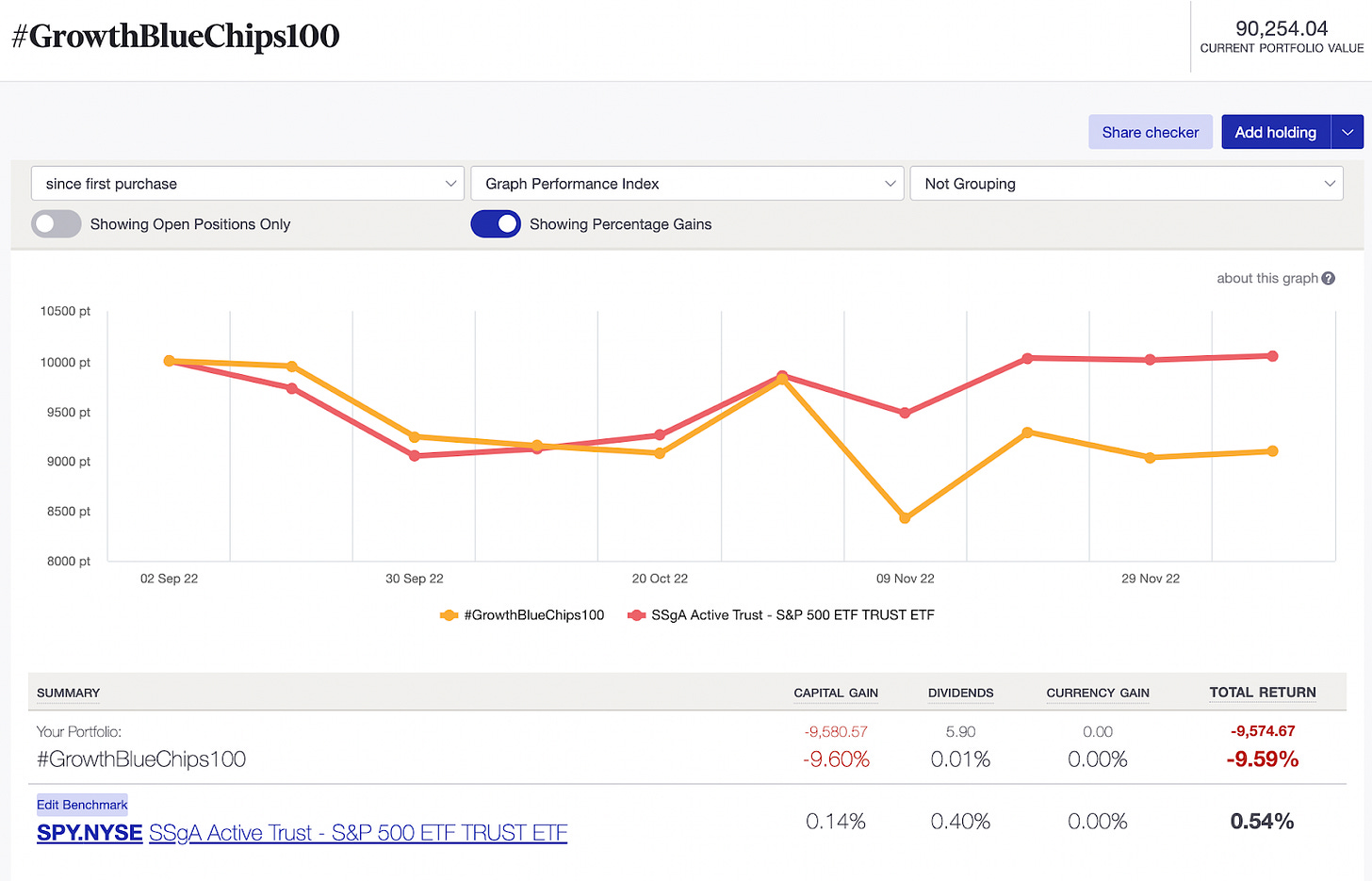

#GBC100: Friday, December 9, 2022

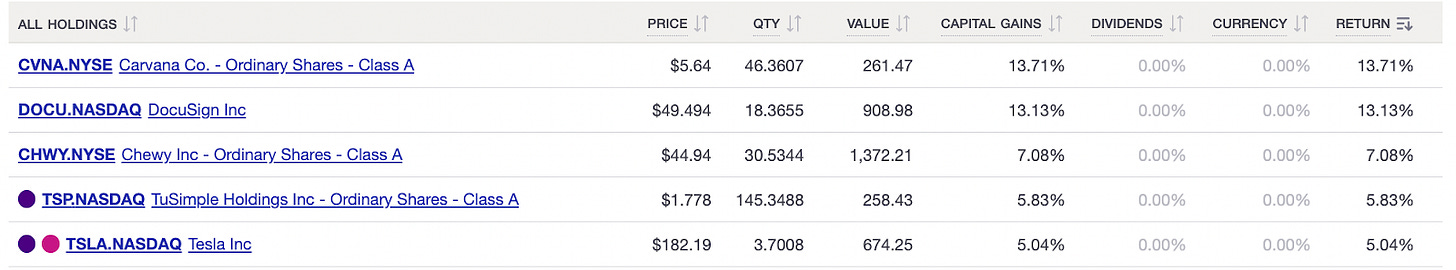

The #GBC100 is up +0.40% today and down -9.59% since we began it on September 2, 2022.

This morning, prices were marked down after wholesale inflation data came in “hot” (meaning above forecasts). Yet, that selling was absorbed by the market.

And by 11:00 a.m. (when this note is written), prices were being marked up for many of our stocks.

Still, expect more volatility as we have three major event-betting dates coming up next week.

On Tuesday, December 12, we have the release of CPI inflation data. On Wednesday, December 13, we have the Federal Reserve meeting.

And finally, we have “triple witching” expiration on Friday, December 16.

For those of you who don’t know, “triple witching” refers to the expiration of futures, equity options, and index options contracts.

Bottom line: Next week will feel like being on a roller coaster in terms of price movements.

CVNA 0.00%↑ Carvana Co. is continuing what looks like a short covering rally. This is coming after days of relentless selling caused by concerns about $CVNA’s debt levels.

DOCU 0.00%↑ DocuSign Inc. is rallying after announcing results yesterday that weren’t as bad as people expected.

CHWY 0.00%↑ Chewy Inc. is also rallying after posting results that were better than expected.

We’re dropping LCID 0.00%↑ Lucid Group Inc. from the #GBC100 today.

Yesterday, LCID 0.00%↑ announced it was offering a 10% discount to reservation holders to complete their purchase. That’s a bad sign for LCID 0.00%↑ because it suggests that demand for its cars is falling.

Even with $3.85 billion in cash, LCID 0.00%↑ is setting up to run out of money in 2023.

In its place, we’re adding SONY 0.00%↑ Sony Group Corporation to the #GBC100. Sony is a diversified electronics and entertainment business headquartered in Japan.

That’s all for now, but be sure to tune in on Monday for another #GBC100 update!

Tomorrow: We have a special Saturday send-out coming your way…

It’s that time again!

Tomorrow, we’ll be releasing another edition of our Saturday Q&A Substack. 🥳️

In it, Paul will answer questions from subscribers — and even address a suggestion he received.

This is all really great, helpful content … so be sure to keep an eye out!

On Friday, December 9, 2022, we look forward to every opportunity we get to communicate with our amazing subscribers!

❤️️ This Substack made — by US, for YOU — with love. ❤️️

Great breakdown for 2023 Paul! So happy to be apart of this ride with you and your team!!!!!!!!