42 Dividend Hikes in a Row? Yes, Please! 💹

Watch Dean's brand-new video — streaming now! 📺 🍿

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company’s Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,358

Your AI Hype Check 🤖 💹

Is the AI boom nearing its breaking point? 🤔

Dean is back with a must-watch update on the AI trade, covering the latest bold move made by a legendary “Big Short” icon that has everyone talking.

He also reveals an overlooked group of stocks quietly powering the AI revolution from behind the scenes and generating massive returns for early investors.

Click below for the full details.

Enjoying these timely insights?

Be sure to hit the “👍” and subscribe to our YouTube channel for more content from the team!

Dan: 1 Explosive Play for the Energy Boom 💥

Electrification is booming — and the trend’s just getting started.

Electric vehicles (EVs), AI-driven data centers, heat pumps, industrial automation — they’re all driving massive power demand growth across the U.S. and the globe.

The big opportunity we’re betting on?

Utilities.

These companies stand to benefit not just from selling more electricity, but also from justifying billions in new infrastructure investments.

Major grid expansion projects are breaking ground in the Southeast and Texas to handle growing EV and AI demand.

That’s why the energy boom is our second-largest portfolio trend across ATG Digital model portfolios.

Here’s one powerful utility play that could benefit directly from this explosive trend.👇

Infrastructure + Dividends = 🔥

Atmos Energy Corporation (NYSE: ATO) is one of the largest fully regulated natural gas utilities in the U.S.

It distributes natural gas to more than 3.3 million customers across eight states and owns thousands of miles of pipelines and underground storage — including high-value assets in Texas.

$ATO also operates a steady infrastructure maintenance segment that adds another layer of stability.

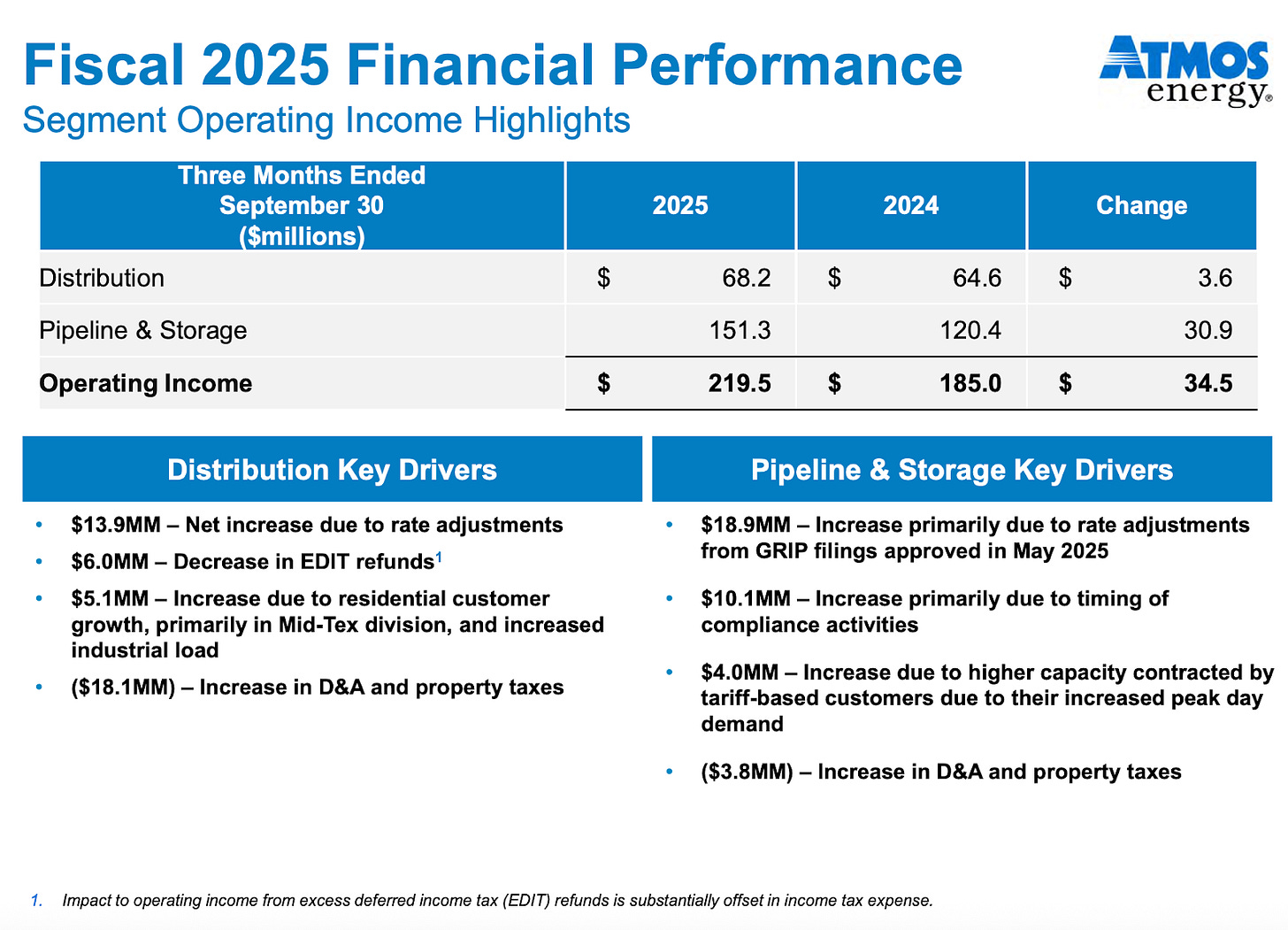

Here’s a look at the second quarter (Q2) results:

📈 Net income: $175 million, up 31% year over year (YoY)

📈 Quarterly revenue: $754 million

📈 Trailing 12-month net income: $1.2 billion, up 15% YoY

📈 Operating income: $219.5 million, up 18.6% YoY

$ATO credits its strength to rate adjustments, customer growth, and steady demand.

Looking ahead, the company expects net income to grow roughly 16% in 2026 — reaching $1.39 billion.

It also raised its annual dividend to $4.00 per share — up 14.9% YoY — marking 42 consecutive years of dividend increases.

In our view, $ATO is well-positioned for this power demand surge.

Valued at $28 billion and enjoying long-term regulatory tailwinds, it’s large enough to weather downturns but nimble enough to invest in growth.

As electricity usage climbs, natural gas demand may also rise — especially in areas where renewables can’t scale fast enough.

This bottleneck demand positions companies like $ATO for continued revenue and margin expansion.

Of course, energy isn’t the only commodity on our radar . . .

Commodity Tailwinds Are Strengthening 🌬️💹

We believe commodities are entering a prolonged bull market.

Oil, natural gas, precious metals, and even agricultural goods are breaking out after years of decline.

We’re adding exposure to commodities across all of our portfolios.

In fact, we just added three brand-new positions this morning to our micro-cap Diamond Tier for the chance to benefit from the electrification megatrend unfolding right now.

The market hasn’t caught on yet . . . but when it does, the potential returns from these holdings could be explosive.

To unlock our latest additions — and receive live trade alerts, weekly portfolio updates, access to four model portfolios, and more — click below. 👇

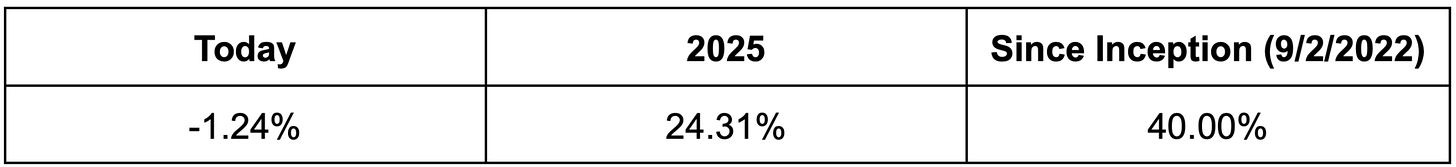

#OGI100: Friday, November 7, 2025

The #OGI100 is down 1.24% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Next Week: Paul reveals secret investing strategies for building wealth. 💸

Weekly Roundup 🗓️

Another week — another batch of expert insights! 💡

Missed any of our Substack articles?

No worries — we got them wrapped up for you here. 👇

Monday — China + U.S. = Your Edge 💡🌏

Tuesday — Why Paul’s All In On This 🤑

Wednesday — The Big Short Starring NVIDIA? 😳

Thursday — The AI Play of Your Dreams 💭

We had a blast preparing this week’s reads and hope you enjoyed them.

On Friday, November 7, 2025, cheers to staying sharp and in-the-know together! 🙌

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It’s your money and your responsibility.