Why Paul’s All In On This 🤑

Don't miss Paul's latest video! 📺 💥

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company’s Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,358

A Truce . . . Now What? 🌏 👀

Market’s just got a temporary truce.

But while most investors charge blindly into the same overcrowded trades, the real opportunity may be emerging against the grain. 👀

There’s a shift happening beneath the surface that could turn an overlooked group of stocks into massive winners.

If you want to be early to what’s coming next, click below to watch Paul’s latest video. 👇

Loving our YouTube videos?

Smash that “👍” button and share your take in the comments! 💬

Remember to subscribe to the channel — so that Paul and the team’s latest market insights reach your feed first! 🔔

Dan: The Setup We’ve Been Waiting For? 👀

We’ve been pounding the table: the energy boom thesis we’ve shared for months is unfolding.

Along with electricity and natural gas, we believe oil prices are setting up for a major move — and we’re positioned across our ATG Digital model portfolios to take advantage.

Today, I’ll reveal how the oil supply and demand imbalance could drive prices higher, including one of our top energy picks . . .

What’s Fueling the Oil Setup? 🌍

In my last Substack, I shared why oil prices are likely to rise:

The ongoing Russia-Ukraine war, rising global demand, and decades of underinvestment in drilling are tightening supply just as the world requires more energy.

The setup is clear: shrinking supply + rising demand = higher prices.

That’s why we added meaningful exposure to the energy sector with oil-related positions.

And one of them just released standout earnings . . .

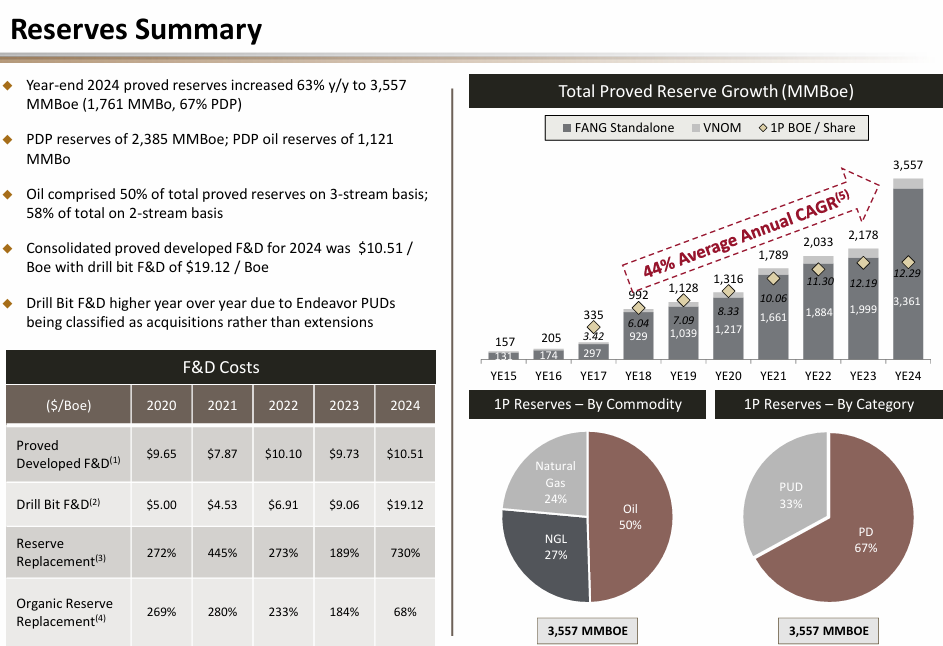

Massive Production Growth 💹

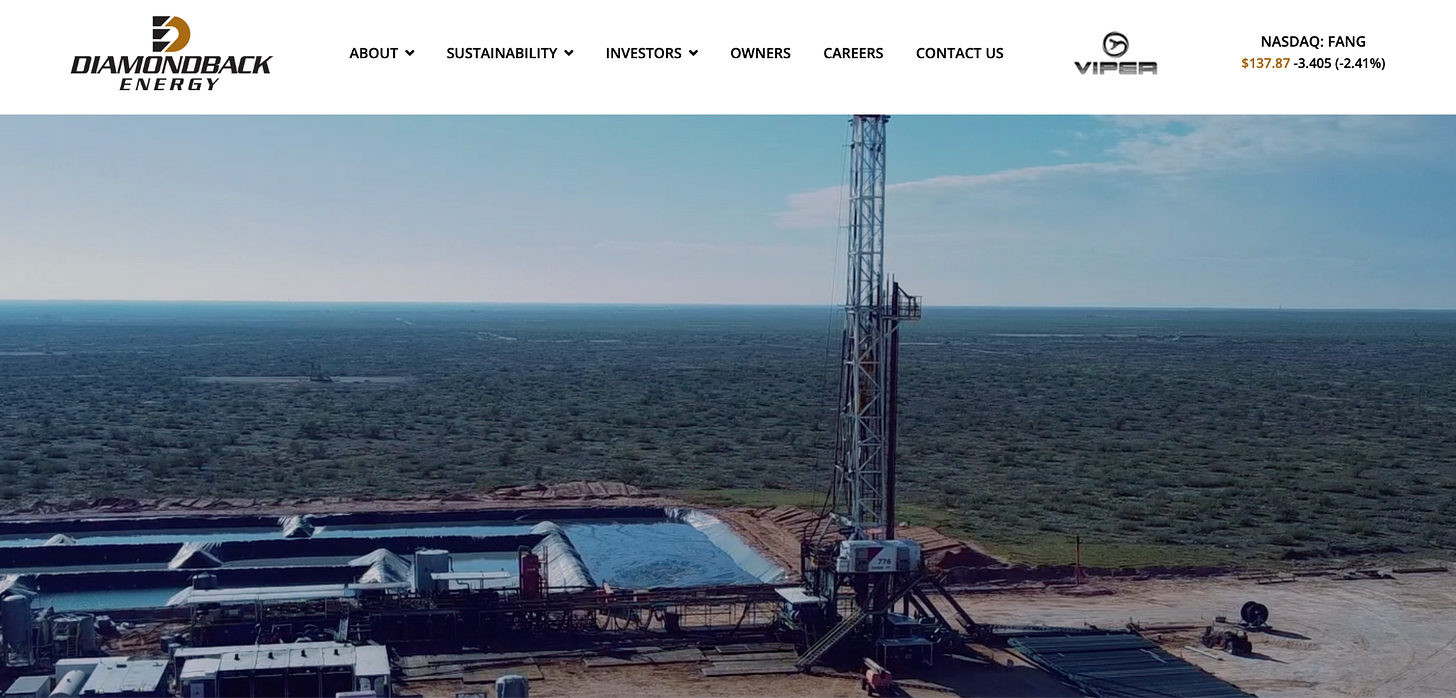

Diamondback Energy Inc. (Nasdaq: FANG) is a Texas-based oil and gas producer specializing in unconventional, onshore reserves — think horizontal drilling and hydraulic fracturing.

Its business model is straightforward: acquire mineral and land rights, drill wells, extract oil and gas, and sell into the market.

Its third quarter (Q3) earnings results demonstrate that this strategy is paying off:

📈 Production: 942.9 thousand barrels of oil equivalent per day — up 65% year over year (YoY)

📈 Revenue: $3.9 billion — up 48.4% YoY

📈 Operating cash flow: $2.4 billion

📈 CapEx: $774 million

📈 Free cash flow: $1.8 billion

📈 Dividend: $1.00 per share

📈 Buybacks: Repurchased 4.29 million shares at an average price of $140.70

As of today, FANG 0.00%↑ ’s stock trades at $138 per share — below its buyback average.

That tells us management sees value here — and is putting real capital behind it.

Undervalued & Oversold? 💎

Oil prices have remained relatively low throughout 2025.

So, despite a strong quarter, FANG 0.00%↑ is down 23% year-to-date.

The company is currently valued around $40 billion, trading at a price-to-sales (P/S) multiple of 2.7X and a price-to-book near 1X.

This is a low valuation, in our opinion!

Especially for a company generating strong free cash flow, hiking its dividend, and aggressively buying back stock.

If oil enters a bull cycle as we expect it to, stocks like FANG 0.00%↑ could see significant upside.

What We’re Watching Next 👀

As investors begin pricing in a potential oil rally, companies with increasing output and capital discipline could benefit the most.

We believe FANG 0.00%↑ fits that mold:

✅ It’s ramping up production to meet demand.

✅ It’s returning capital to shareholders.

✅ It’s trading at what we believe is a discount.

This is the type of setup we like to see!

Want guidance on navigating this explosive trend?

Get access to more high-conviction energy plays with real time trade alerts, model portfolios, weekly portfolio updates, and expert market commentary now!

Click below to unlock the “Against the Grain” (ATG) strategies we’re using to stay ahead.

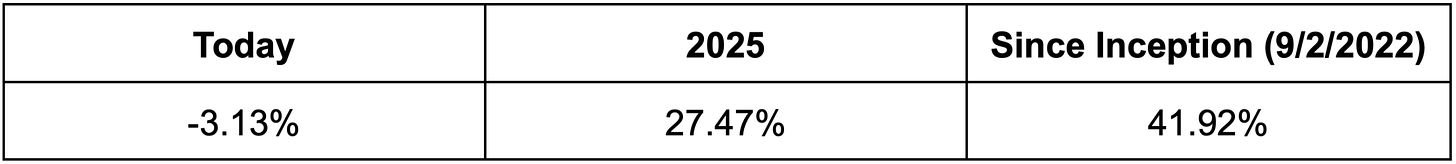

#OGI100: Tuesday, November 4, 2025

The #OGI100 is down 3.13% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dean’s back with the latest on the king of cryptos! 👑

Investing: The Ultimate Brain Expansion 🧠✨

Investing isn’t just about growing money — it’s brain expansion in real time.

It challenges you, stretches your thinking, and forces you to grow in ways most people never will.

We won’t sugar coat it: Investing isn’t for the weak.

You must wrestle with uncertainty, build discipline, and make decisions under pressure.

Only a small percentage of people become serious investors committed to the long game.

So, if you’re investing — even through the inevitable ups and downs — that alone is an accomplishment worth celebrating. 🙌

And with Paul’s 30+ years of investing experience guiding us, we learn faster and think smarter together.

Every trade, every lesson, and every market cycle stretches your mind a little further.

On Tuesday, November 4, 2025, we’re grateful you’re on this journey with us!

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It’s your money and your responsibility.