5 Traits 🖐️ Your Stocks Must Have

Have YOU entered the raffle yet?

Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,259 (+1)

Mark Your Calendars! 🗓️

Next Friday, on June 13, we’ll release our beginner’s options course . . .

When that happens, we want you 🫵 to be IN!

To kickstart your journey today, click here to unlock your options trading guides — before the course goes live.

Be sure to share this Substack by clicking the button below for a chance to win FREE access to our Options Trading 101 course, and click here to enter the raffle.

Paul: 5 Must-Have Traits for Today’s Bull Market

In today’s bull market — where stubbornly high interest rates and persistent inflation challenge every investor’s strategy — picking winners means focusing on five critical traits:

💵 Strong cash flows today

📈 Rock-steady revenue

💪 Pricing power

📃 Minimal (or no) debt

🌎 Scarcity

These qualities aren’t just nice-to-haves.

They deliver resilience and growth in an economy where inflation and high rates are here to stay.

Here’s why they’re your ticket to outsmarting the market . . . 👇

Cash Is King 💸 — Right Now

Why bet on shaky future profits that inflation erodes?

Companies flush with cash today are safe harbors in stormy markets.

And electric utilities are a perfect example.

Their reliable revenue — driven by constant demand for electricity that’s now supercharged by the massive energy needs of artificial intelligence (AI) data centers — can shield investors from market swings.

Electric utilities are uniquely positioned to cash in on the AI boom, making them the best bet to benefit from this unstoppable trend — in our opinion.

In an economy where high interest rates punish speculative bets, companies with current strong cash flows provide investors both stability and upside.

Revenue That Never Rests ⚡

I believe steady revenue is the heartbeat of a winning investment — especially as inflation keeps prices soaring.

Electric utilities again lead the pack.

Fueled by unwavering demand for power and supported by skyrocketing AI-driven energy needs, they can expect to see consistent income.

Avoid the speculative stocks of the last bull cycle . . .

Their rollercoaster earnings are now a trap for investors.

With AI pushing electricity demand to new heights, utilities are the best bet to profit from this trend, offering a shield against economic chaos and stable returns you can anticipate.

Pricing 🏷️ Power = Profit Power 💪

If a company can raise prices to match rising expenses while maintaining its sales — or slash prices to steal market share — it wins.

That’s pricing power.

This powerful edge comes from clever production or operating in tariff-friendly regions.

Tesla Inc. (Nasdaq: TSLA) is a master here.

Its scale and manufacturing efficiency allows it to slash prices (or keep them low) to stay ahead and outmaneuver legacy car makers.

This advantage allows TSLA 0.00%↑ to dominate markets while staying profitable, crushing competitors scrambling under inflation’s weight.

Skip the Debt Bomb 💣

High interest rates are here to stay, making low or no debt crucial for companies that want to thrive.

Companies drowning in debt face crushing borrowing costs that devour profits.

Many consumer staples stocks that pay dividends appear safe . . . boasting solid cash flows and steady revenue.

However, they fail the debt test.

Many are saddled with debt from buybacks and financial tricks.

That’s not strength — it’s a trap.

These moves hide weaknesses, effectively setting the company up for failure in a high interest rate environment.

Instead, look for companies with clean balance sheets or minimal debt.

Their freedom to reinvest cash — or reward shareholders — is a lifeline in a market where borrowing is a burden.

Scarcity 🌎 Sells

In a world of soaring inflation, scarcity shines.

Think gold, silver, rare earths, nuclear energy — assets with a finite or limited supply are in hotter demand than ever.

Companies involved with these scarce assets are likely to boom as money chases limited supplies.

Gold and silver hold value as inflation-proof havens.

Rare earths power electric vehicles (EVs), and nuclear energy shines in a volatile market driven by persistent economic pressures.

Final Take: Focus on What Works 🎯

To win this bull market, focus on companies with:

Cash that’s flowing now

Unshakable revenue

Pricing power to defend margins

Minimal debt and lean balance sheets

Scarce resources

These traits are your armor against unrelenting inflation and high interest rates . . .

And a path toward unlocking opportunities that have potential to deliver lasting gains.

Want help finding them?

Subscribe to ATG Digital for expert-vetted picks that embody these winning traits.

We’ll help you avoid the hype — and uncover hidden gems with the potential to thrive in the new bull market.

#OGI100: Monday, June 2, 2025

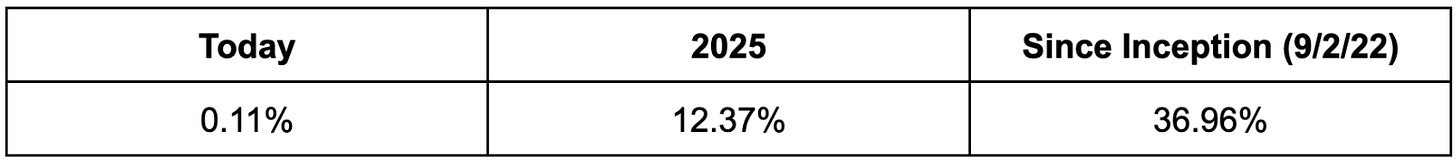

The #OGI100 is up 0.11% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan’s covering a precious metals play! 👀

$22 Million on the Line? 🤑

What do you think the Federal Reserve will do on June 18?

Believe it or not, speculators on Polymarket have over $22 million riding on Fed Chair Jerome Powell’s decision!

But we want to hear from you! 🫵

On Monday, June 2, 2025, we would love to hear from you! 🤗

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.