AI Like You Never Imagined ✨

Forget NVDA — this AI stock is on fire! 🔥

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company’s Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,359

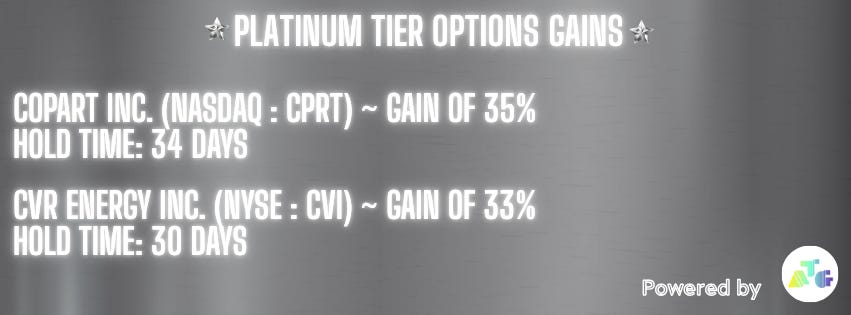

Did You Catch These Wins? 💸

Today, Platinum Tier members had the chance to bag two double-digit winners on options trades in Copart Inc. (Nasdaq: CPRT) and CVR Energy Inc. (NYSE: CVI).

Take a look:

Results not guaranteed.

Options trading is a powerful tool to capture fast, short-term potential gains.

The upside can be huge — but the risk is just as high.

That’s why timing and discpline matter.

Not yet a Platinum Tier member but would like access to future options opportunities like these?

Just click below to see what’s waiting for you and how to get in on the action.

P.S. For a refresher or to jumpstart your options trading journey, consider our Options 101 beginner course below!

Dean: The AI Mania Continues 💹

Yesterday, NVIDIA Corporation (Nasdaq: NVDA) made history as the first company to reach a $5 trillion market cap:

While we’re dodging artificial intelligence (AI) euphoria, we do have exposure via an unusual group of stocks.

Rather than chase hyped stocks with potential, we decided to bet on AI companies inking huge deals — we’re talking billions!

In fact, this one company just expanded a deal for a whopping $9.5 billion! 👇

The Wolf of AI Mania 🐺

I’m referring to TeraWulf Inc. (Nasdaq: WULF) — a $14.50 stock representing a $6 billion Bitcoin USD (BTC-USD) mining and AI company.

After locking in a deal with FluidStack to host its AI infrastructure, WULF 0.00%↑ shared that it’s expanding this partnership to achieve:

✅ More AI hosted infrastructure

✅ Larger energy commitments

✅ Deeper strategic alignment

✅ Wider site usage

The stock popped on the news, bringing our open gain in our micro-cap Diamond Tier model portfolio to 565%.

Our position was up as much as 600% before sellers pushed it down.

While WULF 0.00%↑ hasn’t reported earnings yet, on Tuesday, it shared that it expects revenue for the third quarter (Q3) to fall between $48 million and $52 million.

This would represent an 84% increase from just $27 million in Q3 of 2024.

Should BTC make new highs, this would create another tailwind for the BTC mining company.

So, for now, we’ll hold for more potential upside!

Real AI Revenue 🤑

Projections of revenue from AI startups years out sound great in a less competitive environment.

But considering elevated interest rates and sticky inflation potentially becoming stickier courtesy of yesterday’s rate cuts, we want to see revenue growth now!

And WULF 0.00%↑ is delivering exactly that for our Diamond Tier micro-cap portfolio.

We’re very bullish on this miner’s upside potential in both the crypto and AI markets.

But we’re not just banking on this position . . .

We have exposure to crypto-miners-turned-AI companies in both our mid-cap Gold Tier and our micro-cap Diamond Tier portfolios.

These companies have built-in computing power, making them ideal for AI infrastructure deals.

For access to these picks — including ongoing coverage, buy and sell guidance, and weekly portfolio commentary — click the button below! 👇

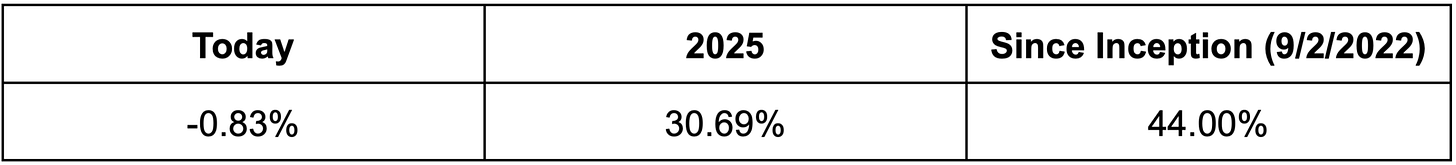

#OGI100: Thursday, October 30, 2025

The #OGI100 is down 0.83% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan shares a play benefiting from the energy boom. 💥

Wall Street’s Hidden Playbook 🤫

Did you catch the latest Bald Man Speculating podcast episode? 🎙️

This one’s a total eye-opener!

In it, Paul pulled back the curtain on how Wall Street pros manipulate markets, control narratives, and quietly pull profits from everyday investors.

Learn to recognize their clever tactics and spot traps before they strike — so you can safeguard your hard-earned wealth!

Click the image or button below to listen now. 👇

Enjoyed the episode?

Please leave a quick rating and review on Spotify — it helps more market explorers find the show.

On Thursday, October 30, 2025, we truly appreciate your support! 🙏

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It’s your money and your responsibility.