Bullish 🐂 on Crypto? Then You NEED This Stock!

Plus, one stock transforming the healthcare industry...

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors and owners of ATG Digital, LLC own/trade/transact in the stocks, options and crypto that are the subject of our trade alerts, updates, reports, commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate or invest. It's your money and your responsibility.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

ATG stands for Against the Grain. ATG represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider. Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 4,952 (+17)

Dan Shifflett: The Stock to Hold for a Crypto Run

Last week we saw both the stock and crypto markets demonstrate strong upward movements. There are plenty of ways to capture gains in these types of environments.

At ATG, we recommend individual stocks, options, and crypto opportunities. Last week, we recommended four trading opportunities — all of which’ll give investors big gains! 👇

Today, however, I want to talk about one company that saw hundreds of percent in gains during the last bitcoin (BTC-USD) bull run.

With bitcoin on the move this weekend, we believe this company can give the same returns — if not bigger ones — this time.

I’m talking about MicroStrategy Inc. (Nasdaq: MSTR).

Trading at 5X Sales!

We recommended MSTR 0.00%↑ back in October 2020 (we currently hold it in our Gold Tier model portfolio). Since then, it’s rocketed and then, with the rest of the market, come back to Earth in price.

However, we’re still up 35% since our buy recommendation.

MSTR 0.00%↑ is a business intelligence and analytics software platform that helps make data-driven decisions. It offers numerous advanced analytical capabilities, such as machine learning and predictive modeling.

Right now, MSTR 0.00%↑ is projected to end the 2022 fiscal year with $500 million in revenue … but we won’t know for sure until its projected earnings release on February 2, 2023. With a $2.6 billion market cap, MSTR 0.00%↑ is trading at just 5X its sales.

But this isn’t why we recommended it…

Why $MSTR’s Stock Price Will Rise 📈

We recommended MSTR 0.00%↑ because of its massive buying spree of bitcoin. As of last month, MSTR 0.00%↑ owns 132,500 bitcoin. With bitcoin trading at $21,000, MSTR 0.00%↑ has $2.78 billion in bitcoin!

Its bitcoin holding alone is worth more than what the company is currently trading for! Not to mention, MSTR 0.00%↑ still has its software business, earning $500 million in revenue in 2022.

If bitcoin continues to go up in the long run like we believe it will, companies that own bitcoin can see its stock price rise.

Why? Simply put, companies often trade at a multiple of their revenue and what’s on their balance sheets.

We believe as bitcoin goes on a run, MSTR 0.00%↑ will as well.

For continued coverage on this stock and other stocks with exposure to crypto, click here to find a subscription tier that fits your needs!

Toni Segota: 1 Company in a Game-Changing Sector

This week, I’d like to focus on diagnostic testing companies.

That’s because, with the progression of precision medicine, preventative care through testing will only continue to ramp up, saving patients millions of dollars per year that would’ve gone to treating disease or costly surgeries.

But testing to prevent disease isn’t the only form that’s been ramping up with the onset of genetically targeted testing.

Diagnostic tests are being released that help monitor disease as treatment is given, which helps both caregivers and patients create better treatment plans.

In fact, the diagnostic testing market is set to expand from $179 billion in 2022 to $348 billion by 2030, a compound annual growth rate (CAGR) of over 8%.

And today, I’d like to talk about one stock that’s developed tests in both classes.

Ample Room for Growth

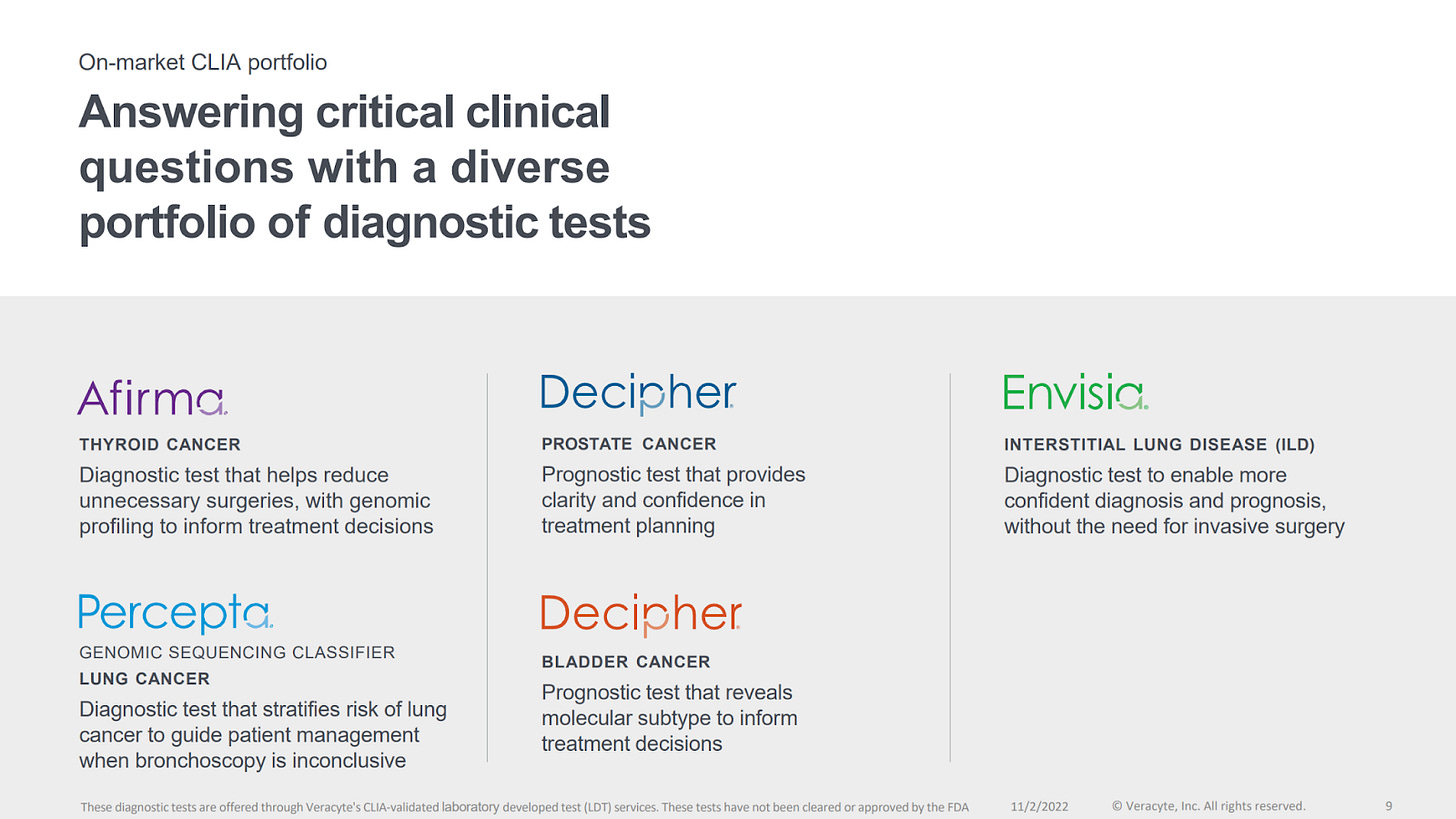

Veracyte Inc. (Nasdaq: VCYT) currently has a suite of tests on the market that cover everything from diagnosis to patient monitoring.

Its lead products, Decipher and Affirma, diagnose thyroid, prostate, and bladder cancers. Decipher is also used for treatment planning and monitoring.

For Q3 2022, VCYT 0.00%↑ generated $75.6 million in sales, 25% higher than the $60.3 million it posted for Q3 2021.

What’s more, VCYT 0.00%↑ is on track to grow 2022 annual sales by roughly 30%, increasing from $220 million in 2021 to management's guided estimate of between $288 million and $293 million.

But those numbers still pale in comparison to the $35 billion combined total addressable market that management highlighted as an opportunity once its products begin to mature.

So, there’s ample room for VCYT 0.00%↑ to continue to grow its sales.

Moving in the Right Direction

VCYT 0.00%↑ has a market cap of $1.9 billion and a large cash pile of $170 million with which to continue to fund growth and operations while it heads toward profitability.

And with each quarter, it nudges closer to achieving profitability.

For instance, in Q3 2022, it posted an $8.7 million loss — roughly a 40% improvement upon the $14.7 million net loss in Q3 2021.

With its proven growth and the expansion of the diagnostic testing market, we believe that VCYT 0.00%↑ can continue to execute and take market share. And as its sales climb, demand for its stock could cause it to shoot.

VCYT 0.00%↑ is currently located in our Gold Tier subscription portfolio, where we have a host of other stocks that we cover across the precision medicine megatrend.

If you’d like up-to-date coverage on VCYT 0.00%↑ or any of the other stocks in our model portfolio, consider subscribing here.

#GBC100: Tuesday, January 17, 2023

The #GBC100 is up 1.21% today, and down 5.52% since we began tracking it on September 2, 2022.

The short covering and beginning of year markups are continuing. With much of the macro-based inflation/interest rates events left behind in 2022, I believe 2023 will be a more normal year for prices.

Nonetheless, event-betting dates will still cause surges of volatility. And there are two event dates coming up.

The first is options expiration this Friday, January 20. Then, the Federal Reserve meeting will take place from January 31 to February 1.

RBLX 0.00%↑ Roblox Corporation, the metaverse company, leads the top performers after reporting monthly statistics that show that daily active users are up 18%.

MARA 0.00%↑ Marathon Digital Holdings Inc. and MSTR 0.00%↑ MicroStrategy Incorporated look like they’re seeing short covering as Bitcoin and crypto prices rebound from the washout at the end of 2022.

RKLB 0.00%↑ Rocket Lab USA Inc. is a new stock in our top five and is seeing some bid up action because of the increasing awareness of investors of the space business.

Check out my Friday Substack to read more about space!

Tomorrow: We’ll hear the latest from Paul. Don’t miss out!

Welcome back! 🎉

We hope you enjoyed the long weekend. The ATG team sure did. 😉

As much as we love having extra time off, we’re happy to be back to doing what we do best: bringing you exciting new content and gains!

On Tuesday, January 17, 2023, we look forward to the rest of the week. #BOP. 🚀

❤️️ This Substack made — by US, for YOU — with love. ❤️️

Don’t miss the latest from Paul! In this video, he shares his No. 1 biotech stock. 👀

Questions? Concerns? 🤔 Look Below 👇

Have questions or having trouble accessing your account? Please reach out to us at contact@atgdigital.media or schedule a call and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Ok this is kinda embarrassing, but can you please explain/break down the math so I can understand what you mean when you say a company is trading at 5X its sales or .4X it’s revenues? I need to be able to do that math in my head so when I read it I have an appreciation for what you are telling us/what that is communicating to us. So I get that it’s a fraction of what it should be trading at or what would be a more normal price if it were a more normal market environment.

Thanks in advance for my stock 101 class answer! 😂

Thank you for another great update, very helpful to see these!!!!!!