The Best of 2023: Paul's BIG Money 💰 Investing Guide

Even Warren Buffett profited from THIS investing strategy...

Please be sure to read the disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of OGI (opportunity, growth, and innovation) market trends, macro-level analysis and stock picks.

Like our name suggests, at ATG Digital, we go Against The Grain to support everyday people on their investing journeys.

It also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email newsletter.

Stock Picking Guidance: Flash (buy/sell) alerts with targeted price points.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team based on preselected (by you) ideas. (Diamond Tier + Purple Tier)

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 5,652 (+1)

⭐️Editor’s Note ⭐️

Hey, everyone!

Dean here with our Best of 2023 Series!

These are past articles that YOU upvoted — by liking, clicking, commenting, or simply opening.

As we enter the New Year, we thought now would be a perfect opportunity to review Paul Mampilly’s, our lead analyst, guide on big money investing! 💰

He’s managed billions of dollars on Wall Street, so he has a wealth of wisdom to share with you!

And best of all, Paul, like our entire team, wants you to win in the markets. So get comfy and prepare for an insightful read!

P.S. If you have any friends that are interested in investing, this is the perfect Substack to share with them by clicking the button below!

Paul Mampilly: The 2nd Half of 2023 Will Be Huge for Us

As you may know, #OGI investments are smaller (low market capitalizations) and have higher growth (sales growth), higher volatility, and higher potential long-term returns.

They are unique and can be life-changing when they hit it big.

And right now, I see every sign that our investments are setting up for a big surge higher in 2023.

And so, in my Substacks, I’ll focus on showing different faces of the why, how, what, where, and when of these investments.

Sentiment — Selling the Lows, Buying the Highs 🥴

Volatility is one of the most difficult things to deal with in #OGI investing.

As you all know, there’s no feeling that’s worse than seeing your account balance getting lower daily.

It’s completely normal to experience negative emotions as this happens.

However, #OGI investing, which is BIG money investing, means going through periods of this kind of negative emotions.

This leads to periods when you feel #FUD (fear, uncertainty, and doubt). It’s the price you have to pay to get big returns.

You can’t make money by selling at the lows when it feels awful and buying back in at the highs when it feels awesome.

Truthfully, volatility, negative emotions, and #FUD are just a feature of all investing.

Even Warren Buffett has gone through it with his best investments.

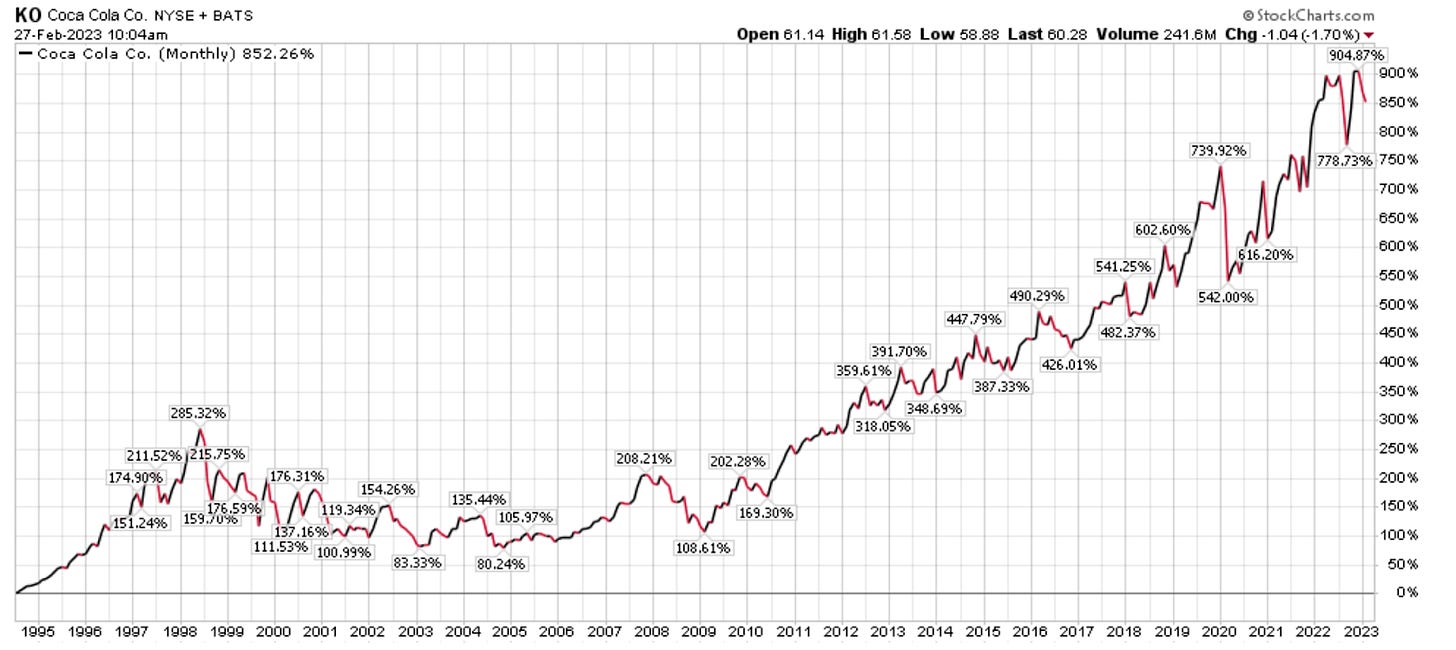

Just look at how much volatility he’s endured with KO 0.00%↑ The Coca-Cola Company, one of his early BIG money investments, since buying it in August 1994.

I Need My Money 💰 NOW

Many folks want gains now! And when I was at Banyan Hill, many of them would (not quite as nicely) say things like this to me:

“Buy and sell more often, Paul.”

“Tell us when stocks will rise so we can sell at the highs.”

“Then tell us when to buy back in.”

The reality, folks, is that no one times the market with such precision.

If you only want to be invested when prices are rising, the markets will disappoint you. That’s the best-case scenario.

Worst case, you often buy in when it feels “safe,” near tops and sell out when it feels “unsafe,” at bottoms.

So, it may come as a shock to see that long term, timing is good but doesn’t deliver as much as people may think.

Let’s also address the folks that got started late with investing for retirement and need investments to provide consistent, regular gains…

I’m sorry to disappoint you, but the stock market is too volatile to provide an experience that’s similar to a bank savings account.

BIG Money Investing Is For Some Parts of Your Investments ⚖️

Remember, we don’t provide financial advice. So you must determine if #OGI, BIG money investing, is right for you — and for what part of your money.

For some folks, it may be just 5% or 10%.

Others wanting to hit BIG home runs may want 100%.

At Banyan Hill, my Profits Unlimited updates suggested that everyone use a minimum of 30% of their account in cash.

Depending on your risk/volatility tolerance, you might keep 50%, 70%, or even 90% in cash.

This cash will serve as a volatility buffer and an emotional security blanket for lackluster years like 2022, when prices were smashed.

#OGI Offers a Shot at Financial Independence 🦅

Some of you may be thinking: “Why should I do this at all?”

Because #OGI investing offers the potential possibility for massive wealth creation. And it can happen somewhat quickly.

For example, think of our gains in STM 0.00%↑ STMicroelectronics N.V. and AMD 0.00%↑ Advanced Micro Devices Inc., which generated gains of hundreds of percent in a few years.

And those are just two of the big gains we generated!

Or think of our current “open” gains in TSLA 0.00%↑ Tesla Inc. and Bitcoin USD (BTC-USD) in our current portfolio now.

What might these gains turn out to be when we finally close them out? 1,000%? 2,000%? More?

We only need a few BIG money #OGI investments to hit, and they could carry your entire portfolio higher in a way that non-#OGI investments simply cannot.

Bottom line: Big money #OGI investing may not be for everyone or all your money. But if you size it right and endure, it can completely change your life!

If you want in on stocks with big money potential, consider subscribing here for as little as $9.99!

Big Money Investing 💰

We hope you enjoyed Paul’s BIG money guide to investing!

Understanding your risk profile, or how much you can stand to invest in #OGI investments is important!

That’s where you begin before you invest a single dollar.

Why? Well, just look at the gains from an open position in our Diamond Tier portfolio:

An amazing, staggering gain of 1127%! But this huge unrealized gain did not come without it’s fair share of volatility:

In 2022 alone, the stock crashed to $3! 😱

Mainstream media said MARA 0.00%↑ was done! Now?

It’s the rockstar stock of the coming crypto bull market, up over 700% since its supposed death.

That’s why having a plan to withstand volatility by imposing boundaries in your BIG money investing strategy is important!

Now, if you’re ready to kick start your #OGI investing journey, click here to sign up for just $9.99!

But if you want exposure to microcap stocks with the potential to rocket like $MARA, then our Diamond Tier portfolio is what you’re after!

Tune in tomorrow for part two of our Best of 2023 Series!

Tomorrow: Dean will review a bitcoin opportunity that was bid up in 2023, but could go higher! 📈

On Tuesday, December 26, 2023, we’re #BOP 🚀 on the future of ATG Digital.

❤️️ This Substack made — by US, for YOU — with love. ❤️️❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or having trouble accessing your account? Please reach out to us at contact@atgdigital.media or schedule a call and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.