Is Oil’s Slow Burn About to Ignite? 🔥

1 bet too big to ignore. 💹

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company’s Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,357

Weekly Roundup 🗓️

Missed this week’s articles? 👀

We got you covered!

Here’s your chance to catch up on the latest key moves, insights, and setups from the team: 👇

Monday — Thank Russia for This Bull Market 💹

Tuesday — Our Bread & Butter for Big Gains 💸

Wednesday — Powell Cuts? These Stocks Could Explode 🚀

Thursday — AI Like You Never Imagined ✨

Which take got you thinking . . .

Or maybe seeing a market setup in a new light? 💡

Let us know in the comments below!

Your feedback could drive what we cover next!

Dan: Paul’s Almost Sure Bet 💰

Energy prices remain surprisingly stagnant for most of the year — but under the surface, forces are building that could send oil soaring.

At ATG Digital, we’re very bullish on energy stocks.

So much so that oil and electricity-related companies now make up a significant portion of our portfolios.

We currently hold 23 electricity-related companies and 22 oil-related companies.

Today, we’ll dive into why oil prices are likely headed much higher — and how one lesser-known driller could benefit in a big way.

Why Oil Could Rip Higher 📈

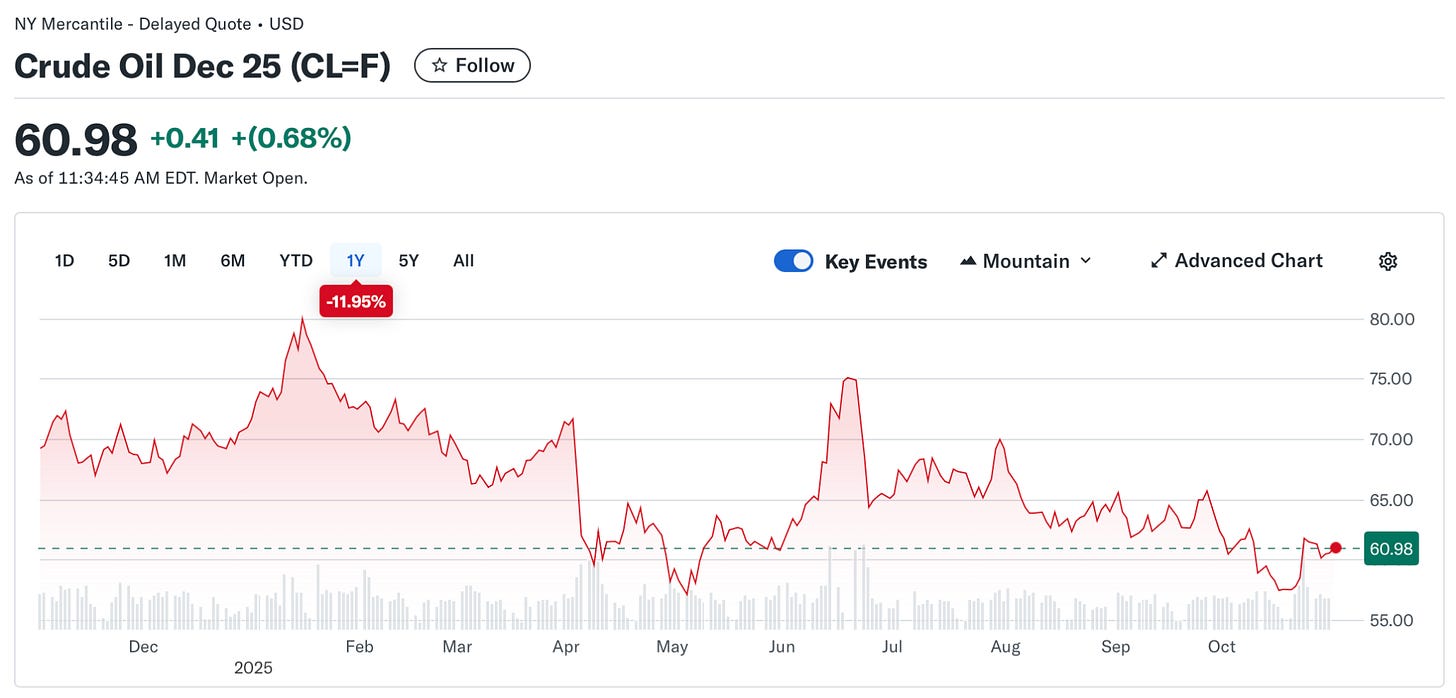

One of the easiest ways to follow oil prices is through West Texas Intermediate (WTI) Crude Oil Futures, ticker CL=F.

Each futures contract represents the price per barrel in U.S. dollars.

Currently, CL=F trades around $60.73 per barrel — showing a mostly flat trend for the year aside from a brief June spike:

But we believe oil’s flatline won’t last.

Several tailwinds point to rising oil prices:

🛢️ Capital investment dried up.

After a decade of weak prices and growing ESG pressures, many oil companies slashed CapEx.

This slowdown in new wells and spare capacity — especially outside OPEC — is constraining future supply.

🛢️Emerging market demand remains strong.

Despite the global shift toward renewables, countries like India, Southeast Asia, and Africa continue to drive oil demand.

🛢️Russia’s war-fueled sales are shrinking.

As the U.S. and its allies tighten bans on Russian oil, global supply continues to shrink — which, in our opinion, could put upward pressure on prices.

These trends point to an environment where even a modest uptick in demand could trigger a sharp move higher in oil.

Offshore Drilling Is Back in Focus 🚢

Earlier this month, we added Transocean Ltd. (NYSE: RIG) to our micro-cap Diamond Tier model portfolio.

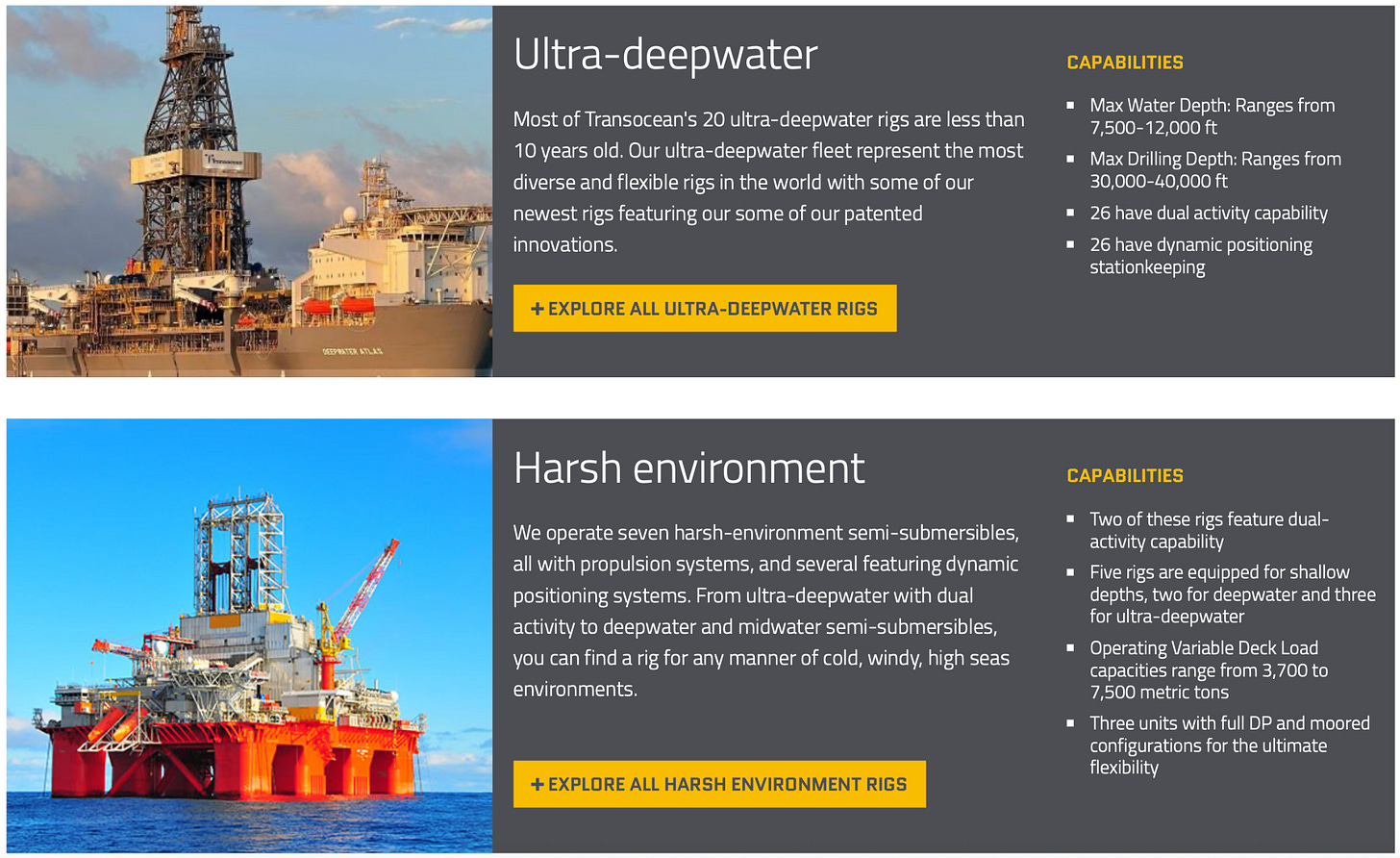

$RIG operates advanced offshore oil rigs — massive floating machines that drill miles beneath the ocean floor in places like the Gulf of Mexico, Brazil, and the North Sea.

But it doesn’t extract or sell oil.

Instead, it rents out rigs to companies like Shell, Chevron, and ExxonMobil.

But here’s where it gets interesting . . .

As oil prices rise, $RIG can charge more for its services — but its costs largely stay fixed.

And after years of underinvestment in offshore exploration, there are fewer players left in the market — affording $RIG stronger pricing power!

Strong Financial Results 💪

$RIG’s third quarter (Q3) 2025 earnings results confirmed our bullish outlook:

💹 Revenue: $1.028 billion — up 8.4% year over year (YoY)

💹 Rig Utilization: 76% — up from 63.9% YoY

💹 Service Backlog: $6.7 billion

💹 Cash on hand: $833 million

The company is valued around $4.3 billion and trading at a price-to-sales (P/S) multiple of just 0.9X.

That’s a steep discount, in our opinion!

And it’s just the type of setup we look for: rising demand, scarce supply, pricing power, strong fundamentals, and low valuation.

We’re already up 21% on this position in just two weeks, but holding for a larger potential gain as energy tailwinds strengthen.

As this megatrend enters a period of sustained growth, undervalued opportunities like $RIG and others won’t stay hidden for long.

If you want to position yourself ahead of the energy boom, now might be the perfect time to act!

Click below now to get exposure to our most promising, high-conviction energy picks across our portfolios. 👇

#OGI100: Friday, October 31, 2025

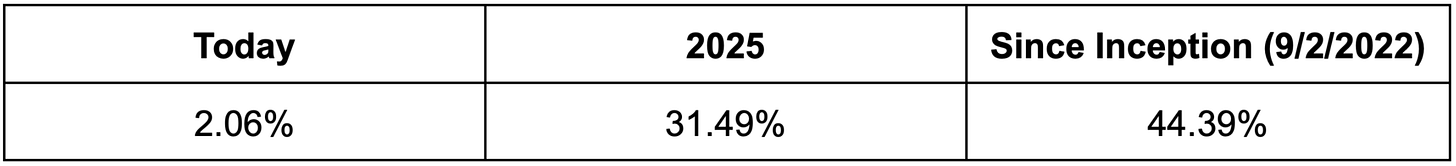

The #OGI100 is up 2.06% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio comprised of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Next Week: Paul reveals what the U.S.-China trade truce means for you.

Happy Halloween, ATG Nation! 🎃

As many are stocking up on candy, we’re focused on something sweeter — opportunity. 🍫✨

Markets can be full of tricks this time of year . . .

Sudden volatility, earnings surprises, unexpected dips — even full-blown historical crashes.

And with the major market shift Paul sees unfolding, it’s bound to spook many unprepared investors.

But for those who stay alert, that’s often when the most attractive deals show up. 🤑

Savvy investors know: when sentiment turns spooky, value often hides in plain sight.

So, no matter how scary the markets look, we remain #BOP — bullish, optimistic, and positive — watching closely for setups worth snatching.

The best part?

We’re sharing many of those opportunities here — and countless others in our ATG Digital Tiers for our members.

No matter how you’re spending this evening, we hope it’s both fun and rewarding.

On Friday, October 31, 2025, keep your eyes wide open for what’s next.🫣

🖤 This Substack was made — by US, for YOU — with love. 🖤

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It’s your money and your responsibility.

Happy Halloween 🎃 Don't be scared to tears of collapsing markets. . . Join ATG for some SPOOKTACULAR gains!