WTF Is Going On? 😬

Major tailwinds are pushing metals higher. 🌬️💹

#ATG 🙌 #BOP 🚀 Nation Update❤️️

Hi, I’m Paul Mampilly.

Welcome to my company’s Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro-analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,359 (+2)

Dean: Is the Economy Breaking? 🫣

I had every intention of following up on yesterday’s artificial intelligence (AI) Substack, but then something weird happened . . .

For the second time in the past month, the U.S. government won’t release key economic data:

Then, it looks like the White House backtracked, saying the data will be released . . . but without the unemployment data?

I’m not saying that it’s unusual that there would be complications with releasing the data, considering that the government shutdown lasted almost a month and a half . . .

But you have to admit it’s odd that the White House is opting to share only partial elements of the data.

Meanwhile, it’s clear that the job market is suffering:

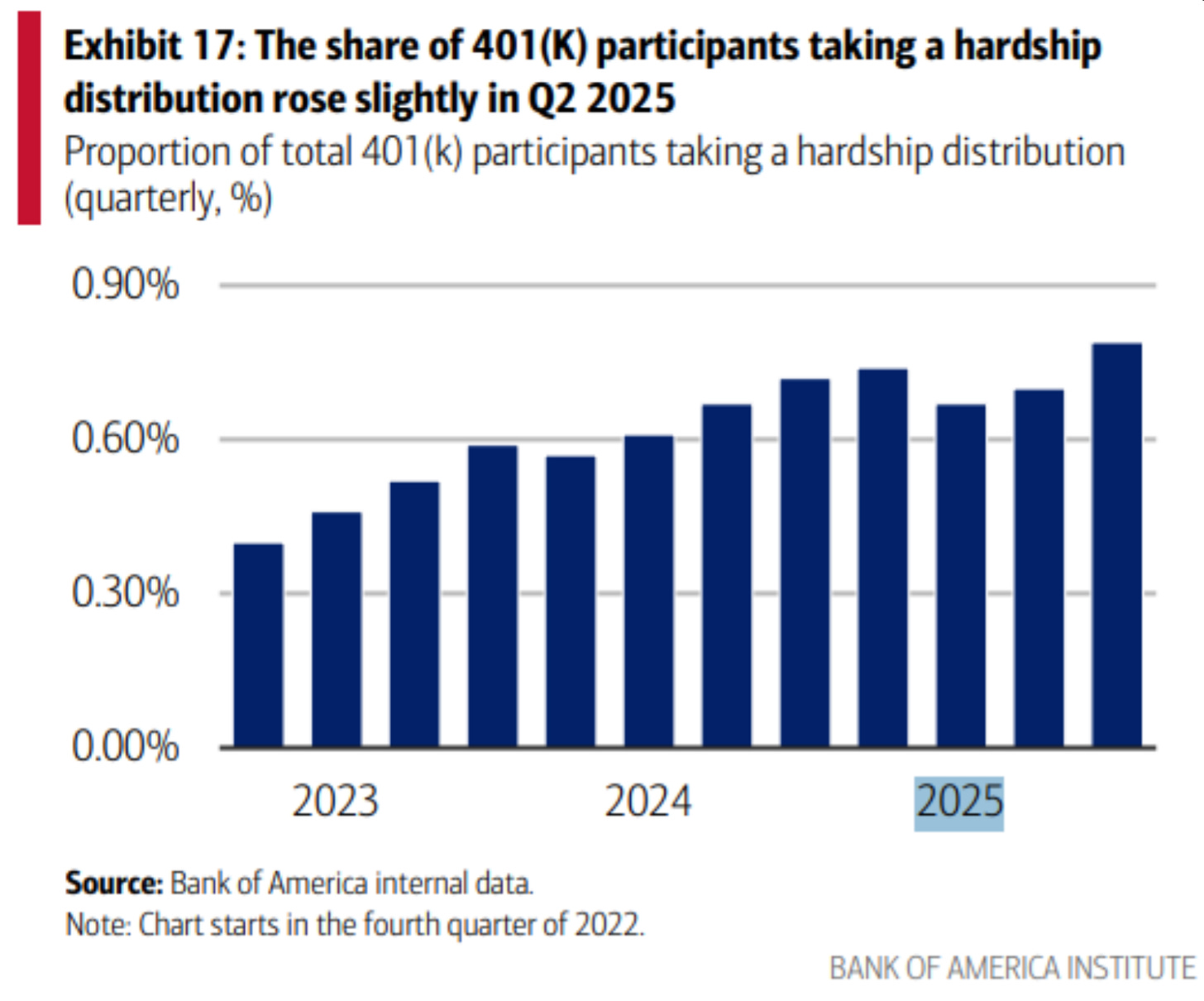

Not to mention that people are taking hardship distributions from 401(k)s at historic rates:

Yet, investors are taking unprecedented risk.

While it sort of feels a little like . . .

But we have good news — there’s a bull market that will likely benefit from this chaos.

Read on to discover it! 👇

Back From the Dead 🪦

Just after gold reached new highs, investors counted it out along with precious metals in general.

Despite dipping below $4K per oz., gold is climbing toward its recent high of $4.3K:

In fact, we said this would happen in this recent Substack:

You’re now seeing the tailwinds we mentioned in updates, Substacks, and on YouTube play out in real time!

Undeniable Tailwinds 🌬️💹

Right now, everything’s lining up for gold.

Central banks worldwide are allocating more capital to gold — often viewed as a safe haven — due to the U.S.’s record $38.1 trillion debt and growing concerns about the strength of the dollar.

There’s also a historic number of wars unfolding globally, usually leading to a gold-buying frenzy by world governments.

And in 2026, President Trump plans to install a new Federal Reserve Chair who is expected to cut rates, causing more inflation and potentially eroding the buying power of the dollar.

But if that wasn’t enough to contend with, he’s also floating the idea of a $2K stimulus, which is inherently inflationary.

The natural alternative as a store of value?

Gold.

In this environment, we could see an uptick in Bitcoin USD (BTC-USD) buys for the same reasons I’ve laid out for gold.

The bottom line is that we’re investing during foggy and challenging times, to say the least.

But our ATG Digital members were prepared for this quick pivot, with over 15 precious metal positions across our portfolios in the green — some up as much as triple-digits!

But it’s not too late to get positioned.

Click the button below to discover a tier that fits your risk tolerance and taste in stocks.

#OGI100: Thursday, November 13, 2025

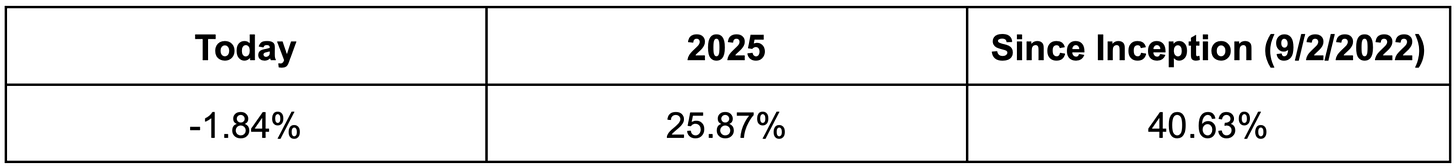

The #OGI100 is down 1.84% today.

Created on September 22, 2022, the #OGI100 is an index/portfolio composed of opportunity, growth, innovation, and crypto-related investments.

Our goals with the #OGI100 are twofold . . .

First, we want readers to get a sense of what our investments are doing in the market, because they can sometimes perform very differently than traditional indices (like the S&P 500 or Nasdaq 100).

Second, we’d like to eventually turn the #OGI100 into an exchange-traded fund (ETF).

That way, instead of owning hundreds of growth stocks, you can get exposure to ATG Digital thinking — in opportunity, growth, innovation, and crypto — all in one place.

To learn more or to express your support for the launch of an ETF (by completing a poll), click here.

Tomorrow: Dan covers a metal-related stock ready to explode. 🚀

Compounding Wisdom 🧠

Our analyst Dean recently shared a quote with the team that really stuck — and we had to pass it along to you:

Legendary investor and longtime partner to Warren Buffett was onto to something here . . .

Investing isn’t about predicting every market swing — it’s about showing up, learning, and improving bit by bit.

Over time, these small steps compound into big results — and that’s where the real growth happens!

That’s why we work hard to deliver expert insights to you every single day.

Because day by day, you keep learning until you start seeing the market through the eyes of a professional.

Consistency isn’t flashy, but it’s powerful.

So, we’re grateful you’re on this journey with us!

On Thursday, November 13, 2025, we’re playing the long game, one step at a time.

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It’s your money and your responsibility.

Bitcoin miners really got hit today along with everything else. But the miners really got clobbered. What's up with that ? Is the AI trade being reassessed and resting for awhile?