Note: Please read our disclaimer at the bottom of the article.

#StrongHands 🙌 #BOP 🚀 Nation Update ️️️️️️️️️️️️️️️️️️️❤️️

Hi, I’m Paul Mampilly.

Welcome to my company's Substack, where we provide daily coverage of #OGI (opportunity, growth, and innovation) market trends, macro level analysis, and stock picks.

Like our name suggests, at ATG Digital, we go Against the Grain to support everyday people on their investing journeys.

ATG also represents seeing the world for what is abundantly clear to see — an opportunity for incredible growth and the BRIGHT and PROSPEROUS future that lies ahead.

To aid you on your journey to financial freedom, we have five paid plans starting at $9.99 for you to consider.

With a subscription you get:

Premium Content: Weekly market and stock updates via email.

Stock Picking Guidance: Flash (buy/sell) alerts.

Model Portfolio Access: Access to LIVE portfolios.

Webinars: Private events with the team selected by you.

Just visit atgdigital.media to see which plan is the best fit for your journey!

Substack 🥞 subscribers: 6,231

Dean: Is the AI Trade Over? 🤖

While many are wondering if the artificial intelligence (AI) trade is still on, we’ve identified the real winner of this trend.

That said, we’re still bullish on companies with business models that generate real revenues from AI technology.

The key is locating them amid all the chaos . . .

Just imagine how difficult it was to locate winners of the internet-boom when the market was in a dotcom stock buying frenzy!

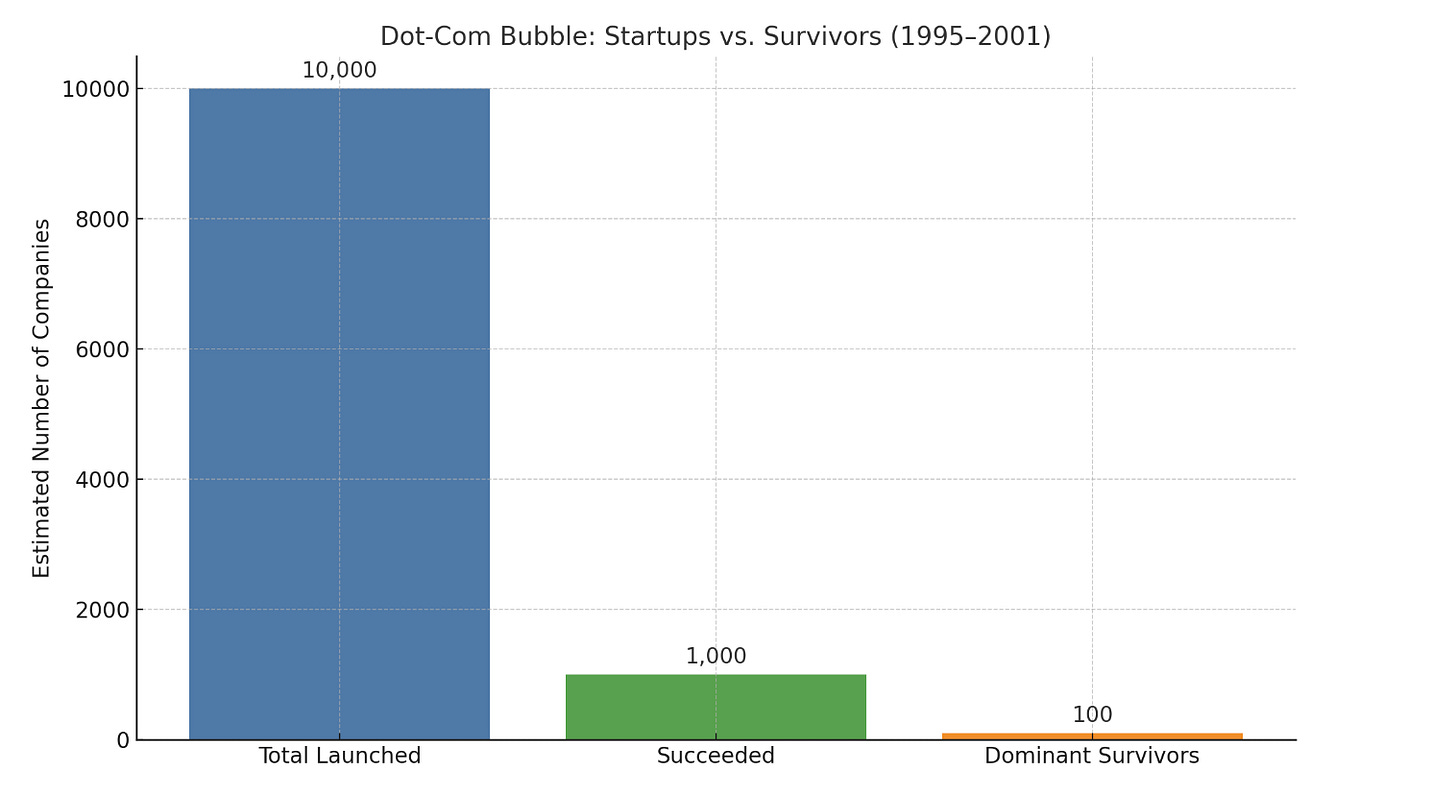

I was curious and asked my good friend, ChatGPT, to demonstrate how wild the dotcom boom was, and well . . .

10,000 companies estimated to have launched.

But only 10% or 1,000 could create a sustainable business.

And just 1% or 100 survived — think companies like Facebook, Google, PayPal, and eBay.

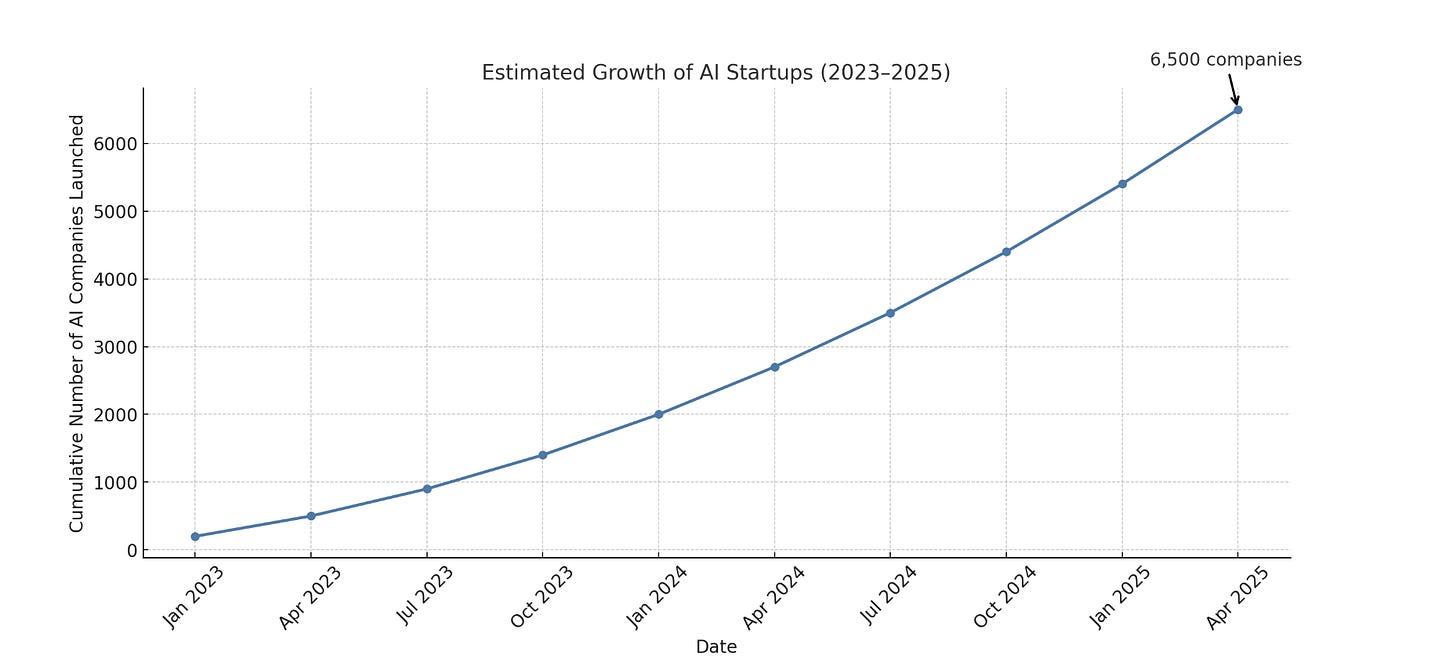

In just two years, ChatGPT estimated that about 6,500 AI companies have launched:

Now these are just estimates, but these staggering numbers demonstrate just how difficult pinpointing AI winners can be.

Which is why we use these three tips when picking AI stocks . . . 👇

The AI Checklist 🤖📝

For starters, an AI company on your radar should have proven revenue models.

It doesn’t really matter how flashy or popular the company is if you can’t foresee how it will generate revenue — and how much growth it’s expected to see in years to come.

But even if it’s generating some revenue, we must ask: Does the business have a strong value proposition?

Remember, out of the 10,000 dotcom boom companies, only 1,000 carved out a solid piece of the market.

Meanwhile, only 100 remained after the dust settled.

Lastly, avoid hype at all costs.

You want to invest in companies that are highly reliant on AI, not those who simply "integrate" AI on a webpage.

To recap, we’re watching for:

✅ Proven revenue models

✅ Robust value proposition

✅ Real AI at the core, no hype

With that in mind, we believe this company checks all of these boxes!

The Sweetest AI Company 🍋

I’m referring to Lemonade Inc. (NYSE: LMND), a tech-driven insurance company leveraging AI to disrupt the traditional insurance industry.

Its services include a variety of options, including renters, homeowners, pet, life, and car insurance.

Unlike legacy insurance companies, clients are quoted and insured in mere minutes, courtesy of its AI model.

That’s a huge difference compared to incumbents that take 24 hours, or more, to finalize policies.

The convenience that LMND 0.00%↑ offers is especially appealing to younger generations who aren’t thrilled to wait days for the underwriter to get back to the insurer to finalize the policy.

Its business model might not be as flashy as some companies touting AI capabilities, but investors are taking notice . . .

It Just Keeps Growing 💪

This quarter marks LMND 0.00%↑’s sixth consecutive quarter of growth with revenue ballooning to $1 billion, up 27% year over year (YoY).

Despite the California wildfires, which impacted many insurance companies this year, the company’s gross profit increased 11% YoY to $39 million.

With $1 billion in cash, it has 44% of its tiny $2.4 market cap in cash!

We’re currently holding LMND 0.00%↑ in our Gold Tier model portfolio at a gain of 71%.

But we’ll continue to hold it for a potential triple-digit gain!

For access to more stocks with real potential — not hype — check out our Gold Tier model portfolio by clicking below!

#OGI100: 🚨Not Your Ordinary Note 🚨

Dean here with a quick note!

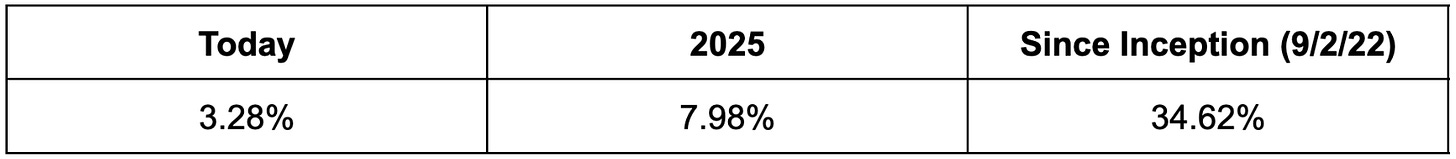

The #OGI100 is up 3.28% today.

We’re making some changes to the #OGI100 — Opportunity, Growth, & Innovation 100 — model portfolio to improve your investing experience.

Effective today, the #OGI100 will only reflect picks from our model portfolios at ATG Digital.

Our goal is to give you the most accurate snapshot of how our stocks are performing.

That said, we’ve removed access to this free portfolio from our website so we don’t undermine members who are paying for our portfolio picks and guidance.

But there is a silver lining: You can expect a quarterly Substack on the performance of the #OGI100, including its top and bottom performers.

Thank you for your support and we look forward to serving you!

Tomorrow: Dan will cover a stock in one of the fastest-growing sectors!

Have you heard?

Paul dropped his newest YouTube video this week . . .

In it, he revealed a tiny market expected to balloon to $2 trillion in market cap!

Check it out below:

If you enjoyed this video, make sure you subscribe to our YouTube channel for more content like it! 📺

On Thursday, May 8, 2025, we hope you enjoy our latest updates! 🤗

❤️ This Substack was made — by US, for YOU — with love. ❤️

Questions? Concerns? 🤔 Look Below 👇

Have questions or trouble accessing your account? Please reach out to us at info@atgdigital.media or schedule a call, and our Customer Support team will be happy to help.

You can also check our FAQ page on our website for an up-to-date list of questions and answers. Your question may have been addressed there.

*Please be advised that customer support calls are limited to 15 minutes and will strictly cover your membership subscription and billing needs only. Any calls that are disrespectful in nature may be subject to immediate termination.

Join us, be #BOP 🚀, be #StrongHands 🙌, #GoATG! ️️❤️️

Disclaimer/Legal Stuff Written in Plain English

What you read/watch/hear is OPINION, not financial/investment advice. Treat it no different than when you read/watch/hear your favorite author/YouTuber/podcaster. Despite our best efforts, we get things wrong and make mistakes. Investing is risky. There is no guarantee you will make money. Your investments may lose value. That’s RISK. Past performance is no guarantee of future results. Employees, contractors, and owners of ATG Digital, LLC own/trade/transact in the stocks, options, and crypto that are the subject of our trade alerts, updates, reports, and commentaries. We cannot give you personalized financial advice because we are NOT financial advisors. It’s on you to decide how much/when/what to buy/sell based on YOUR financial needs, plans, and risk preferences. There are no guarantees. Loss of your capital is an outcome that you should evaluate carefully with a financial advisor before you trade, speculate, or invest. It's your money and your responsibility.

Lemonade has a great future.